Are you concerned about the internal revenue service email scam?

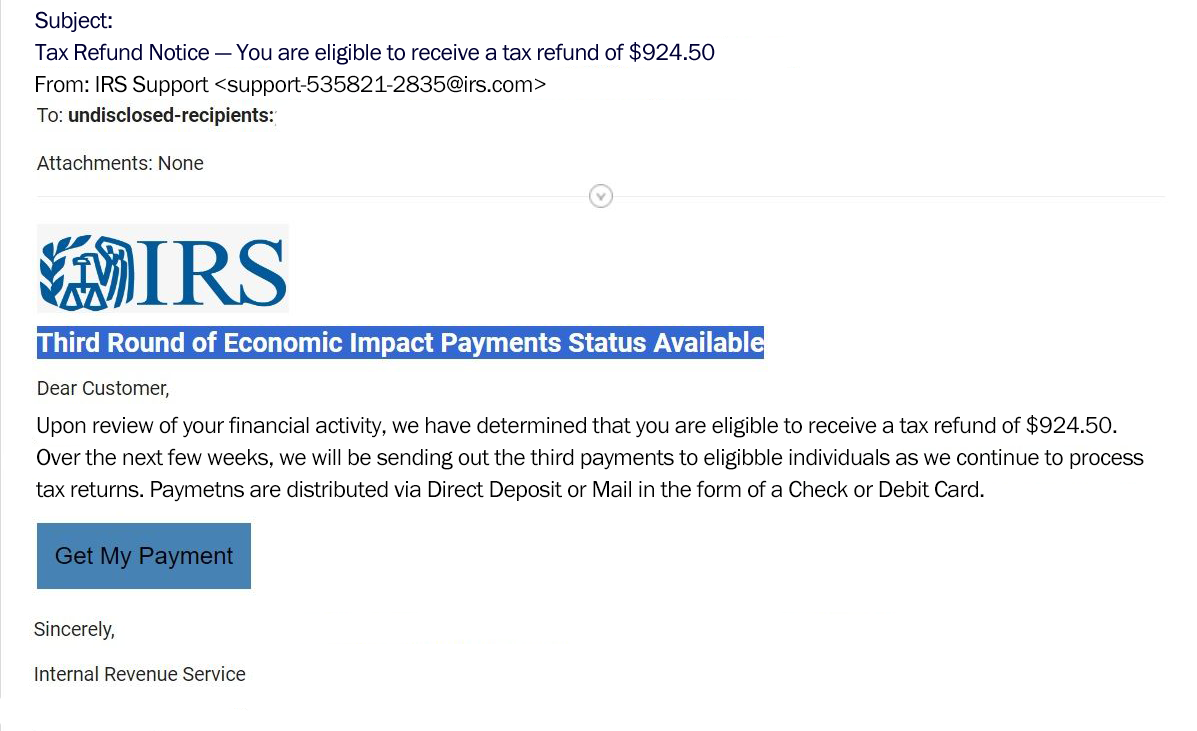

Editor’s Notes: “internal revenue service email scam” have published on 24th January 2023. The internal revenue service email scam is a serious threat to taxpayers. In recent years, there have been numerous reports of taxpayers receiving emails that appear to be from the IRS, but are actually from scammers. These emails often contain links to phishing websites that are designed to steal your personal and financial information.

In this guide, we will provide you with information about the internal revenue service email scam, including how to identify it and what to do if you receive one of these emails.

Key differences or Key takeaways

| IRS Email Scam | Legitimate IRS Email |

|---|---|

| The email address is not from an @irs.gov | Ends with an @irs.gov email address |

| Contains a link to a phishing website | Does not contain any links |

Main article topics

internal revenue service email scam

The internal revenue service email scam is a serious threat to taxpayers. In recent years, there have been numerous reports of taxpayers receiving emails that appear to be from the IRS, but are actually from scammers. These emails often contain links to phishing websites that are designed to steal your personal and financial information.

- Phishing: Scammers create emails that look like they are from the IRS, but are actually designed to steal your personal and financial information.

- Malware: Scammers may also send emails that contain malware, which can infect your computer and give scammers access to your personal and financial information.

- Identity theft: Scammers can use the information they steal from you to commit identity theft, which can damage your credit and finances.

- Financial loss: Scammers may also use the information they steal from you to steal your money.

- Tax fraud: Scammers may use the information they steal from you to file fraudulent tax returns in your name, which can result in you owing money to the IRS.

- Emotional distress: Scammers can cause emotional distress by threatening you or making you feel like you are in trouble with the IRS.

- Time-consuming: Dealing with the aftermath of an internal revenue service email scam can be time-consuming and frustrating.

- Reputation damage: Scammers may use your name and personal information to create fake websites or social media accounts, which can damage your reputation.

- Legal liability: If scammers use your personal information to commit crimes, you may be held legally liable.

These are just some of the key aspects of the internal revenue service email scam. It is important to be aware of these scams and to take steps to protect yourself from them.

Phishing

Phishing is a type of online scam that involves sending emails that appear to be from a legitimate organization, such as the IRS. These emails often contain links to phishing websites that are designed to steal your personal and financial information. Phishing emails can be very convincing, and they can even spoof the email address of the organization they are pretending to be from.

-

How to spot a phishing email

There are a few things you can look for to spot a phishing email:- The email address of the sender does not match the organization it is pretending to be from.

- The email contains misspellings or grammatical errors.

- The email contains links to websites that you do not recognize.

- The email asks you to provide personal or financial information.

-

What to do if you receive a phishing email

If you receive a phishing email, do not click on any links or open any attachments. Instead, forward the email to the organization it is pretending to be from. You can also report the email to the Federal Trade Commission at ftc.gov/complaint. -

Phishing and the internal revenue service email scam

The internal revenue service email scam is a type of phishing scam that targets taxpayers. These emails often appear to be from the IRS, and they may contain links to phishing websites that are designed to steal your personal and financial information. The IRS will never send you an email asking you to provide personal or financial information.

If you are unsure whether or not an email is legitimate, it is always best to err on the side of caution and not click on any links or open any attachments. You can also forward the email to the organization it is pretending to be from to report it as phishing.

Suggested read: Unveiling the Secrets of IRS PTIN Renewal: A Guide to Compliance and Success

Malware

Malware is a type of software that is designed to damage your computer or steal your personal information. Scammers may send emails that contain malware as a way to infect your computer and gain access to your personal and financial information.

The internal revenue service email scam is a type of phishing scam that targets taxpayers. These emails often appear to be from the IRS, and they may contain links to phishing websites or attachments that contain malware. If you click on a link in a phishing email or open an attachment that contains malware, you could infect your computer with malware.

Malware can give scammers access to your personal and financial information, including your:

- name

- address

- Social Security number

- bank account numbers

- credit card numbers

Scammers can use this information to commit identity theft, steal your money, or file fraudulent tax returns in your name.

It is important to be aware of the risk of malware and to take steps to protect your computer from malware. You can do this by:

- using a strong antivirus program

- keeping your software up to date

- being careful about what emails you open and what attachments you download

If you think your computer may be infected with malware, you should scan your computer with an antivirus program and remove any malware that is found.

| Malware | Internal revenue service email scam |

|---|---|

| Malware is a type of software that is designed to damage your computer or steal your personal information. | The internal revenue service email scam is a type of phishing scam that targets taxpayers. |

| Scammers may send emails that contain malware as a way to infect your computer and gain access to your personal and financial information. | These emails often appear to be from the IRS, and they may contain links to phishing websites or attachments that contain malware. |

By understanding the connection between malware and the internal revenue service email scam, you can take steps to protect yourself from these scams and keep your personal and financial information safe.

Identity theft

Identity theft is a serious crime that can have a devastating impact on your life. Scammers can use your personal information to open new credit accounts, make fraudulent purchases, and even file taxes in your name. This can damage your credit score, ruin your finances, and make it difficult to get a job or rent an apartment.

The internal revenue service email scam is a common way for scammers to steal your personal information. These emails often appear to be from the IRS, and they may contain links to phishing websites or attachments that contain malware. If you click on a link in a phishing email or open an attachment that contains malware, you could infect your computer with malware that can steal your personal information.

Scammers can use the information they steal from you to commit identity theft. They may use your Social Security number to open new credit accounts, or they may use your name and address to file taxes in your name. This can damage your credit score, ruin your finances, and make it difficult to get a job or rent an apartment.

It is important to be aware of the risk of identity theft and to take steps to protect yourself from this crime. You can do this by:

Suggested read: Discover the Secrets of Humana Telephone Number Customer Service

- using a strong password and changing it regularly

- being careful about what information you share online

- shredding any documents that contain your personal information

- monitoring your credit reports and bank statements for any unauthorized activity

If you think you may be a victim of identity theft, you should contact the Federal Trade Commission (FTC) at 1-877-ID-THEFT (1-877-438-4338) or visit their website at identitytheft.gov.

| Identity theft | Internal revenue service email scam |

|---|---|

| Identity theft is a serious crime that can have a devastating impact on your life. | The internal revenue service email scam is a common way for scammers to steal your personal information. |

| Scammers can use your personal information to open new credit accounts, make fraudulent purchases, and even file taxes in your name. | Scammers can use the information they steal from you to commit identity theft. |

Financial loss

The internal revenue service email scam is a serious threat to taxpayers. Scammers use these emails to steal personal and financial information, which they can then use to steal your money. For example, scammers may use your stolen information to open new credit cards or bank accounts in your name, or they may file fraudulent tax returns to claim your refund.

Financial loss is a major concern for victims of the internal revenue service email scam. Scammers may steal thousands of dollars from their victims, and it can take months or even years to recover from the financial damage. In some cases, victims of the internal revenue service email scam may even lose their life savings.

It is important to be aware of the risk of financial loss if you receive an email that appears to be from the IRS. Do not click on any links or open any attachments in the email. Instead, forward the email to the IRS at phishing@irs.gov.

| Financial loss | Internal revenue service email scam |

|---|---|

| Scammers may use the information they steal from you to steal your money. | The internal revenue service email scam is a common way for scammers to steal personal and financial information. |

| Scammers may use your stolen information to open new credit cards or bank accounts in your name, or they may file fraudulent tax returns to claim your refund. | Scammers can use the information they steal from you to commit identity theft, which can lead to financial loss. |

By understanding the connection between financial loss and the internal revenue service email scam, you can take steps to protect yourself from this scam and keep your money safe.

Tax fraud

The internal revenue service email scam is a serious threat to taxpayers. Scammers use these emails to steal personal and financial information, which they can then use to file fraudulent tax returns in your name. This can result in you owing money to the IRS, even if you did not actually file the fraudulent return.

If you receive an email that appears to be from the IRS, do not click on any links or open any attachments. Instead, forward the email to the IRS at phishing@irs.gov.

If you think you may be a victim of tax fraud, you should contact the IRS immediately. You can do this by calling 1-800-829-1040 or visiting the IRS website at www.irs.gov.

| Tax fraud | Internal revenue service email scam |

|---|---|

| Scammers may use the information they steal from you to file fraudulent tax returns in your name, which can result in you owing money to the IRS. | The internal revenue service email scam is a common way for scammers to steal personal and financial information. |

| If you receive an email that appears to be from the IRS, do not click on any links or open any attachments. Instead, forward the email to the IRS at phishing@irs.gov. | Scammers can use the information they steal from you to commit identity theft, which can lead to tax fraud. |

By understanding the connection between tax fraud and the internal revenue service email scam, you can take steps to protect yourself from this scam and keep your money safe.

Emotional distress

The internal revenue service email scam is a serious threat to taxpayers. Scammers use these emails to steal personal and financial information, which they can then use to commit identity theft, file fraudulent tax returns, and steal your money. In addition to the financial harm that these scams can cause, they can also cause significant emotional distress.

Scammers often use threatening language in their emails, making taxpayers feel like they are in trouble with the IRS. They may threaten to garnish your wages, seize your property, or even arrest you. These threats can be very frightening, and they can cause taxpayers to feel anxious, stressed, and depressed.

Suggested read: Unveiling the Secrets of Doordash Customer Service: A Comprehensive Guide

In some cases, scammers may even impersonate IRS agents and call taxpayers on the phone. They may demand that you pay your taxes immediately or face severe consequences. These phone calls can be very convincing, and they can cause taxpayers to panic and make poor decisions.

If you receive an email or phone call from someone claiming to be from the IRS, it is important to be cautious. Do not give out any personal or financial information. Instead, hang up the phone or delete the email. You can also report the scam to the IRS at phishing@irs.gov.

If you are feeling emotional distress as a result of an internal revenue service email scam, there are resources available to help you. You can contact the IRS at 1-800-829-1040 or visit the IRS website at www.irs.gov. You can also contact a tax professional for help.

| Emotional distress | Internal revenue service email scam |

|---|---|

| Scammers can cause emotional distress by threatening you or making you feel like you are in trouble with the IRS. | The internal revenue service email scam is a serious threat to taxpayers. |

| Scammers often use threatening language in their emails, making taxpayers feel like they are in trouble with the IRS. | Scammers use these emails to steal personal and financial information, which they can then use to commit identity theft, file fraudulent tax returns, and steal your money. |

By understanding the connection between emotional distress and the internal revenue service email scam, you can take steps to protect yourself from this scam and its harmful effects.

Time-consuming

The internal revenue service email scam is a serious threat to taxpayers. Scammers use these emails to steal personal and financial information, which they can then use to commit identity theft, file fraudulent tax returns, and steal your money. Dealing with the aftermath of an internal revenue service email scam can be a long and frustrating process.

-

Contacting the IRS

If you think you have been the victim of an internal revenue service email scam, the first thing you should do is contact the IRS. You can do this by calling 1-800-829-1040 or visiting the IRS website at www.irs.gov. The IRS can help you determine if you have been the victim of a scam and will provide you with instructions on how to protect your identity and finances. -

Freezing your credit

If you think your personal information has been stolen, you should freeze your credit. This will prevent scammers from opening new credit accounts in your name. You can freeze your credit by contacting the three major credit bureaus: Equifax, Experian, and TransUnion. -

Monitoring your credit reports

After you have frozen your credit, you should monitor your credit reports for any unauthorized activity. You can get a free copy of your credit report from each of the three major credit bureaus once per year. You can also sign up for a credit monitoring service, which will notify you of any changes to your credit report. -

Filing a police report

If you have been the victim of an internal revenue service email scam, you should file a police report. This will help to document the crime and may help you to recover your stolen funds.

Dealing with the aftermath of an internal revenue service email scam can be a long and frustrating process. However, it is important to take steps to protect your identity and finances. By following these tips, you can help to minimize the damage caused by these scams.

Reputation damage

The internal revenue service email scam is a serious threat to taxpayers. Scammers use these emails to steal personal and financial information, which they can then use to commit identity theft, file fraudulent tax returns, and steal your money. In addition to the financial harm that these scams can cause, they can also cause significant reputational damage.

Scammers may use your stolen information to create fake websites or social media accounts in your name. These accounts may be used to spread false information, post malicious content, or scam other people. This can damage your reputation and make it difficult for you to find a job, rent an apartment, or get a loan.

For example, in 2017, scammers used the personal information of a well-known businessman to create a fake website that sold counterfeit goods. The website used the businessman’s name and likeness, and it was designed to look like the businessman’s legitimate website. The scam resulted in the businessman losing a significant amount of money and damage to his reputation.

It is important to be aware of the risk of reputation damage if you receive an email that appears to be from the IRS. Do not click on any links or open any attachments in the email. Instead, forward the email to the IRS at phishing@irs.gov.

By understanding the connection between reputation damage and the internal revenue service email scam, you can take steps to protect yourself from this scam and its harmful effects.

Suggested read: Unleash the Power of Inland Truck Parts & Service for Unstoppable Fleet Efficiency

| Reputation damage | Internal revenue service email scam |

|---|---|

| Scammers may use your name and personal information to create fake websites or social media accounts, which can damage your reputation. | The internal revenue service email scam is a serious threat to taxpayers. |

| These accounts may be used to spread false information, post malicious content, or scam other people. | Scammers use these emails to steal personal and financial information, which they can then use to commit identity theft, file fraudulent tax returns, and steal your money. |

Legal liability

The internal revenue service email scam is a serious threat to taxpayers. Scammers use these emails to steal personal and financial information, which they can then use to commit identity theft, file fraudulent tax returns, and steal your money. In addition to the financial harm that these scams can cause, they can also lead to legal liability for the victims.

-

Identity theft

If scammers use your personal information to open new credit accounts or file fraudulent tax returns, you could be held legally liable for the debts or taxes incurred. This can damage your credit score, ruin your finances, and make it difficult to get a job or rent an apartment. -

Fraud

If scammers use your personal information to commit fraud, you could be held legally liable for the damages caused by the fraud. For example, if scammers use your stolen credit card to make fraudulent purchases, you could be held liable for the amount of the purchases. -

Tax fraud

If scammers use your personal information to file fraudulent tax returns, you could be held legally liable for the taxes owed on the fraudulent returns. This can result in you owing money to the IRS, even if you did not actually file the fraudulent returns.

It is important to be aware of the risk of legal liability if you receive an email that appears to be from the IRS. Do not click on any links or open any attachments in the email. Instead, forward the email to the IRS at phishing@irs.gov.

Frequently Asked Questions About the Internal Revenue Service Email Scam

The internal revenue service email scam is a serious threat to taxpayers. Scammers use these emails to steal personal and financial information, which they can then use to commit identity theft, file fraudulent tax returns, and steal your money. It is important to be aware of this scam and to take steps to protect yourself.

Question 1: How can I tell if an email is from the IRS?

The IRS will never send you an email asking for your personal or financial information. If you receive an email that appears to be from the IRS and asks for this information, it is a scam. Other signs of a phishing email include misspellings, grammatical errors, and links to suspicious websites.

Question 2: What should I do if I receive an email from the IRS that I think is a scam?

If you receive an email that appears to be from the IRS and you think it is a scam, do not click on any links or open any attachments. Instead, forward the email to the IRS at phishing@irs.gov.

Question 3: What are the consequences of falling for the internal revenue service email scam?

Suggested read: Unlock Financial Aid Secrets: Expert FAFSA Support at Your Fingertips!

Falling for the internal revenue service email scam can have serious consequences, including identity theft, financial loss, and legal liability. Scammers can use your stolen information to open new credit accounts in your name, file fraudulent tax returns, or even commit fraud.

Question 4: What can I do to protect myself from the internal revenue service email scam?

There are a number of things you can do to protect yourself from the internal revenue service email scam, including:

- Never clicking on links or opening attachments in emails from the IRS that you are not expecting.

- Hovering over links in emails to see the real URL before clicking on them.

- Being cautious of emails that use threatening language or create a sense of urgency.

- Reporting any suspicious emails to the IRS at phishing@irs.gov.

Question 5: What should I do if I think I have been the victim of the internal revenue service email scam?

If you think you have been the victim of the internal revenue service email scam, you should contact the IRS immediately at 1-800-829-1040. You can also visit the IRS website at www.irs.gov for more information on how to protect yourself from this scam.

Question 6: Is the internal revenue service email scam a common scam?

Yes, the internal revenue service email scam is a common scam. In fact, it is one of the most common scams reported to the IRS. Scammers use this scam to steal personal and financial information from taxpayers, which they can then use to commit identity theft, file fraudulent tax returns, and steal money.

By understanding the internal revenue service email scam and taking steps to protect yourself, you can help to keep your personal and financial information safe.

Suggested read: Unveil the Secrets of Madison Temp Service: Unlocking Workforce Agility and Success

If you have any other questions about the internal revenue service email scam, please visit the IRS website at www.irs.gov.

Tips to Avoid the Internal Revenue Service Email Scam

The internal revenue service email scam is a serious threat to taxpayers. Scammers use these emails to steal personal and financial information, which they can then use to commit identity theft, file fraudulent tax returns, and steal your money. It is important to be aware of this scam and to take steps to protect yourself.

Tip 1: Never click on links or open attachments in emails from the IRS that you are not expecting.

The IRS will never send you an email asking for your personal or financial information. If you receive an email that appears to be from the IRS and asks for this information, it is a scam. Other signs of a phishing email include misspellings, grammatical errors, and links to suspicious websites.

Tip 2: Hover over links in emails to see the real URL before clicking on them.

This will help you to avoid clicking on links that lead to phishing websites. Phishing websites are designed to look like legitimate websites, but they are actually fake websites that are used to steal your personal and financial information.

Tip 3: Be cautious of emails that use threatening language or create a sense of urgency.

Scammers often use threatening language or create a sense of urgency to trick you into clicking on links or opening attachments. For example, an email may say that you owe money to the IRS and that you need to click on a link to pay the debt immediately. Do not fall for these scams.

Tip 4: Report any suspicious emails to the IRS at phishing@irs.gov.

If you receive an email that you think is a scam, you should forward it to the IRS at phishing@irs.gov. The IRS will investigate the email and take appropriate action.

Tip 5: Keep your computer and software up to date.

Suggested read: Unveiling the Secrets of Exceptional Customer Service: Discoveries from Fossil

Keeping your computer and software up to date will help to protect you from malware. Malware is a type of software that can be used to steal your personal and financial information. Scammers often send emails that contain malware as a way to infect your computer and steal your information.

Summary of key takeaways or benefits

By following these tips, you can help to protect yourself from the internal revenue service email scam. Remember, the IRS will never send you an email asking for your personal or financial information. If you receive an email that appears to be from the IRS and asks for this information, it is a scam.

Transition to the article’s conclusion

If you have any other questions about the internal revenue service email scam, please visit the IRS website at www.irs.gov.

Conclusion

The internal revenue service email scam is a serious threat that can have devastating consequences for taxpayers. Scammers use these emails to steal personal and financial information, which they can then use to commit identity theft, file fraudulent tax returns, and steal money. It is important to be aware of this scam and to take steps to protect yourself.

There are a number of things you can do to protect yourself from the internal revenue service email scam, including:

- Never clicking on links or opening attachments in emails from the IRS that you are not expecting.

- Hovering over links in emails to see the real URL before clicking on them.

- Being cautious of emails that use threatening language or create a sense of urgency.

- Reporting any suspicious emails to the IRS at phishing@irs.gov.

- Keeping your computer and software up to date.

By following these tips, you can help to protect yourself from this scam and keep your personal and financial information safe.

If you have any other questions about the internal revenue service email scam, please visit the IRS website at www.irs.gov.