Who services your student loan? It’s a question that many borrowers ask themselves, especially when they’re having trouble making payments or need to make changes to their loan terms.

Editor’s Note: “Who services my student loan” has published on today date to help target audience make the right decision.

Knowing who services your student loan is important for a number of reasons. First, it’s the company that you’ll need to contact if you have any questions about your loan or need to make changes to your payment plan. Second, your loan servicer is responsible for collecting your payments and applying them to your loan balance. Finally, your loan servicer can provide you with information about your loan status, such as your balance, interest rate, and payment due date.

There are a few different ways to find out who services your student loan. You can check your loan statement, which will typically list the name and contact information of your loan servicer. You can also log in to the National Student Loan Data System (NSLDS) at NSLDS.ed.gov and search for your loan information.

Once you know who services your student loan, you can contact them to get help with any questions or concerns you have about your loan.

Who services my student loan

Understanding who services your student loan is crucial for managing your loan effectively. Here are eight key aspects to consider:

- Loan servicer: The company responsible for handling your loan payments and providing customer service.

- Contact information: Easily accessible contact details for inquiries and support.

- Loan details: Access to up-to-date information on your loan balance, interest rate, and payment due dates.

- Payment options: Understanding the available payment options and their implications.

- Deferment and forbearance: Options for pausing or reducing loan payments during times of financial hardship.

- Loan forgiveness programs: Information on eligibility and application processes for loan forgiveness programs.

- Customer service: The quality and responsiveness of the loan servicer’s customer support.

- Online account access: Convenience of managing your loan online, making payments, and accessing loan information.

These aspects are interconnected and play a vital role in your student loan repayment journey. Knowing who services your student loan and understanding these key aspects will empower you to make informed decisions about your loan management, explore repayment options that align with your financial situation, and access support when needed.

Loan servicer

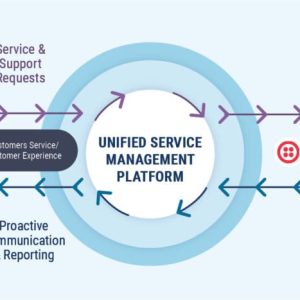

When it comes to student loans, understanding who services your loan is of utmost importance. Your loan servicer is the company responsible for handling your loan payments, providing customer service, and ensuring your loan is managed effectively. They act as the intermediary between you and the lender, playing a crucial role in your loan repayment journey.

The significance of your loan servicer cannot be overstated. They are the primary point of contact for all matters related to your loan, including payment processing, loan modifications, deferment or forbearance requests, and loan forgiveness applications. A reliable and responsive loan servicer can make a significant difference in your loan management experience.

Suggested read: Managed Equipment Services: Transform Your Business Operations with Strategic Asset Management

To determine who services your student loan, you can check your loan statement, log in to the National Student Loan Data System (NSLDS) at NSLDS.ed.gov, or contact your lender directly. Once you have identified your loan servicer, make sure to keep their contact information readily available for any inquiries or support you may need.

By understanding the role of your loan servicer and building a strong relationship with them, you can ensure that your student loan is managed efficiently, and you have access to the resources and support you need to successfully repay your loan.

Key Takeaways:

- Your loan servicer is responsible for handling your loan payments and providing customer service.

- They are the primary point of contact for all matters related to your loan.

- A reliable and responsive loan servicer can make a significant difference in your loan management experience.

Contact information

Having easily accessible contact information for your student loan servicer is crucial for effective loan management. When you have questions, need to make changes to your loan, or encounter any difficulties, being able to reach your loan servicer promptly and efficiently is essential.

Your loan servicer’s contact information should be readily available on your loan statement and online account. It should include a phone number, email address, and physical address. Make sure to keep this information organized and easily accessible, whether in a physical file or saved in your phone’s contacts.

The importance of accessible contact information cannot be overstated. If you have questions about your loan balance, payment due dates, or repayment options, you need to be able to contact your loan servicer quickly and easily. Additionally, if you experience any financial difficulties or need to request deferment or forbearance, having up-to-date contact information is vital.

Here are some practical examples of how easily accessible contact information can make a difference:

- You can quickly contact your loan servicer to report a change of address or phone number, ensuring that important loan correspondence reaches you.

- If you lose your job or experience a financial hardship, you can reach out to your loan servicer to discuss repayment options and explore programs like deferment or forbearance.

- You can get clarification on your loan terms, interest rates, and repayment schedule, helping you manage your loan effectively.

In conclusion, having easily accessible contact details for your student loan servicer is essential for effective loan management. It allows you to promptly address any questions or concerns, seek support when needed, and ensure that your loan is being handled efficiently. Make sure to keep your loan servicer’s contact information readily available and don’t hesitate to reach out if you need assistance.

Loan details

Understanding the connection between “Loan details: Access to up-to-date information on your loan balance, interest rate, and payment due dates” and “who services my student loan” is crucial for effective loan management. Your loan servicer is responsible for providing you with accurate and up-to-date information about your loan, including your loan balance, interest rate, and payment due dates. This information is essential for several reasons:

Firstly, it allows you to track your loan progress and ensure that your payments are being applied correctly. By monitoring your loan balance, you can see how much you have paid off and how much you still owe. This information can help you stay on track with your repayment plan and avoid any potential surprises down the road.

Secondly, knowing your interest rate is important for understanding how much you will pay in interest over the life of your loan. A higher interest rate means that you will pay more in interest, so it is important to be aware of your interest rate and factor it into your repayment plan.

Finally, knowing your payment due dates is essential for avoiding late payments and potential damage to your credit score. Late payments can also result in additional fees and penalties, so it is important to make sure that you know when your payments are due and that you have sufficient funds available to make those payments on time.

In conclusion, having access to up-to-date loan details is essential for effective loan management. By understanding your loan balance, interest rate, and payment due dates, you can track your progress, make informed decisions about your repayment plan, and avoid potential problems down the road.

Here is a table summarizing the key insights:

| Loan Detail | Importance |

|---|---|

| Loan balance | Track progress, avoid surprises |

| Interest rate | Understand cost of borrowing |

| Payment due dates | Avoid late payments, damage to credit score |

Payment options

When it comes to understanding “who services my student loan,” it is crucial to grasp the significance of “Payment options: Understanding the available payment options and their implications.” Your loan servicer plays a vital role in providing you with a range of payment options tailored to your financial situation and repayment goals.

The availability of various payment options empowers you to customize your repayment plan and align it with your financial circumstances. You can choose from options such as standard repayment, graduated repayment, extended repayment, and income-driven repayment plans. Each option has its unique terms, interest rates, and repayment periods, and understanding their implications is essential for making informed decisions.

For instance, if you are facing financial hardship, income-driven repayment plans may offer lower monthly payments based on your income and family size. On the other hand, if you prioritize paying off your loan faster, standard repayment may be a suitable option, potentially saving you money on interest in the long run.

Your loan servicer is responsible for explaining these payment options in detail, outlining their advantages and disadvantages, and assisting you in selecting the plan that best meets your needs. They can also provide guidance on adjusting your payment plan if your financial situation changes in the future.

In conclusion, understanding the available payment options and their implications is fundamental to effective loan management. By working closely with your loan servicer, you can explore these options, make informed choices, and tailor your repayment plan to achieve your financial goals.

Table summarizing key considerations:

Suggested read: Chain Link Services: Everything You Need to Know About Professional Chain Link Fencing Solutions

| Payment Option | Considerations |

|---|---|

| Standard Repayment | Fixed monthly payments, typically higher, shorter repayment period, potential interest savings |

| Graduated Repayment | Monthly payments increase gradually over time, lower initial payments, longer repayment period |

| Extended Repayment | Lower monthly payments, longer repayment period, may result in higher interest paid |

| Income-Driven Repayment Plans | Monthly payments based on income and family size, potential for loan forgiveness |

Deferment and forbearance

Understanding “Deferment and forbearance: Options for pausing or reducing loan payments during times of financial hardship” is crucial in the context of “who services my student loan.” Your loan servicer plays a critical role in providing these options and guiding you through the process.

-

Deferment:

Deferment allows you to temporarily pause your loan payments for a specific period, usually due to qualifying events such as enrollment in an eligible school program, military service, or economic hardship. During this period, interest may continue to accrue on your loan, but you are not required to make payments. Your loan servicer can provide detailed information on deferment eligibility criteria and the application process.

-

Forbearance:

Forbearance is another option that allows you to temporarily reduce or pause your loan payments for a specific period, typically due to financial hardship or other qualifying circumstances. Unlike deferment, interest continues to accrue on your loan during forbearance, and it is added to your loan balance. Your loan servicer can assist you in exploring forbearance options and determining if you qualify.

Deferment and forbearance can provide much-needed relief during challenging financial times, allowing you to focus on overcoming the hardship without the added burden of loan payments. Your loan servicer is responsible for evaluating your eligibility, processing your request, and providing guidance throughout the process. They can also help you explore other repayment options or loan forgiveness programs that may be available to you.

Loan forgiveness programs

Understanding the connection between “Loan forgiveness programs: Information on eligibility and application processes for loan forgiveness programs.” and “who services my student loan” is crucial for navigating the complexities of student loan repayment. Your loan servicer plays a vital role in providing information and assisting you with exploring loan forgiveness options.

-

Eligibility criteria:

Loan forgiveness programs have specific eligibility criteria that vary depending on the program. Your loan servicer can help you determine if you qualify based on factors such as your loan type, employment history, and financial situation. -

Application process:

Applying for loan forgiveness can involve submitting a detailed application and supporting documentation. Your loan servicer can guide you through the application process and ensure that your application is complete and accurate. -

Types of loan forgiveness:

There are various loan forgiveness programs available, each with its unique requirements and benefits. Your loan servicer can provide information on programs such as Public Service Loan Forgiveness, Teacher Loan Forgiveness, and Perkins Loan Cancellation. -

Repayment implications:

Loan forgiveness can have implications for your overall financial situation and tax liability. Your loan servicer can help you understand the potential impact of loan forgiveness on your taxes and other financial obligations.

By working closely with your loan servicer, you can gain valuable insights into loan forgiveness programs, determine your eligibility, and navigate the application process effectively. Their expertise and guidance can help you maximize your chances of obtaining loan forgiveness and achieving your financial goals.

Customer service

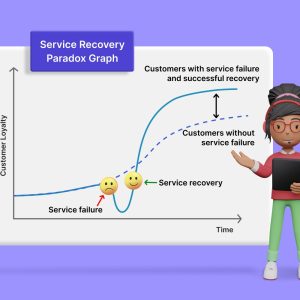

Understanding the connection between “Customer service: The quality and responsiveness of the loan servicer’s customer support.” and “who services my student loan” is crucial for effective loan management. Your loan servicer plays a vital role in providing accessible and reliable customer support, which directly impacts your loan repayment experience and satisfaction.

Quality customer service encompasses several key elements: prompt and courteous responses, knowledgeable and helpful staff, and a commitment to resolving issues efficiently. When dealing with student loans, you may encounter various questions, concerns, or unexpected situations. A responsive loan servicer can provide timely assistance, guiding you through the complexities of loan repayment and ensuring that your inquiries are addressed promptly.

For example, if you experience a job loss or financial hardship, reaching out to a responsive loan servicer can make a significant difference. They can provide information on available support programs, explore repayment options that align with your financial situation, and offer guidance on navigating the process. Conversely, poor customer service can lead to frustration, delays, and potential financial consequences.

The practical significance of understanding this connection lies in the impact it has on your overall loan management experience. A loan servicer with excellent customer service can provide peace of mind, knowing that you have access to support and assistance when needed. This can help you stay on track with your repayment plan, avoid unnecessary stress, and make informed decisions about your loan.

Table summarizing key insights:

| Quality Customer Service | Benefits |

|---|---|

| Prompt and courteous responses | Timely assistance and resolution of inquiries |

| Knowledgeable and helpful staff | Accurate information and guidance |

| Commitment to resolving issues efficiently | Positive loan management experience |

In conclusion, the quality and responsiveness of your loan servicer’s customer support play a crucial role in managing your student loans effectively. By understanding this connection, you can make informed decisions about who services your loan, ensuring that you have access to the support and guidance you need throughout your repayment journey.

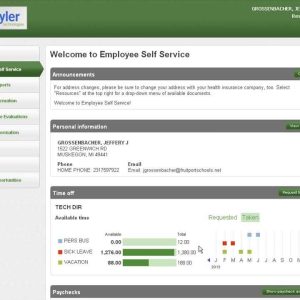

Online account access

Understanding the connection between “Online account access: Convenience of managing your loan online, making payments, and accessing loan information.” and “who services my student loan” is crucial for efficient loan management. Your loan servicer plays a significant role in providing a secure and user-friendly online platform that empowers you to manage your loan effectively.

-

24/7 Accessibility:

Online account access allows you to manage your loan anytime, anywhere. You can log in to your account to view your loan details, make payments, and update your personal information at your convenience. -

Simplified Loan Management:

Through your online account, you can easily track your loan balance, payment history, and upcoming due dates. This transparency helps you stay organized and avoid potential late payments. -

Convenient Payment Options:

Online account access enables you to set up automatic payments, schedule one-time payments, and make extra payments towards your loan. These options provide flexibility and control over your loan repayment. -

Secure Document Storage:

Your online account serves as a secure repository for important loan documents such as statements, payment confirmations, and tax forms. This eliminates the need for physical storage and ensures easy retrieval when needed.

The convenience and accessibility of online account access streamline the loan management process, allowing you to stay informed, make informed decisions, and avoid potential pitfalls. By choosing a loan servicer that offers a robust and user-friendly online platform, you can simplify your loan repayment journey and achieve your financial goals.

FAQs on “Who Services My Student Loan”

Understanding who services your student loan is crucial for effective loan management. Here are some frequently asked questions to provide further clarification:

Question 1: How do I find out who services my student loan?

You can find out who services your student loan by checking your loan statement, logging in to the National Student Loan Data System (NSLDS) at https://nslds.ed.gov/, or contacting your lender directly.

Question 2: What are the responsibilities of my loan servicer?

Suggested read: Salesforce Managed Services: Transform Your CRM Investment into Business Growth

Your loan servicer is responsible for handling your loan payments, providing customer service, and ensuring your loan is managed effectively. They serve as the intermediary between you and the lender.

Question 3: Why is it important to have easily accessible contact information for my loan servicer?

Having easily accessible contact information for your loan servicer is crucial for prompt responses to inquiries, support when needed, and to ensure that your loan is being handled efficiently.

Question 4: What types of payment options are available to me?

Your loan servicer can provide you with information on various payment options tailored to your financial situation and repayment goals. These may include standard repayment, graduated repayment, extended repayment, and income-driven repayment plans.

Question 5: What is the difference between deferment and forbearance?

Deferment allows you to temporarily pause your loan payments due to qualifying events such as enrollment in an eligible school program or military service. Forbearance also allows for temporary payment reduction or pause, typically due to financial hardship, but interest continues to accrue.

Question 6: How can I access my loan information online?

Many loan servicers offer online account access, allowing you to view your loan details, make payments, and update your personal information at your convenience.

Understanding the answers to these FAQs can empower you to effectively manage your student loans and make informed decisions about your repayment options.

If you have additional questions or concerns, do not hesitate to contact your loan servicer for personalized assistance.

Tips on Managing Your Student Loans

Understanding who services your student loan is crucial for effective loan management. Here are some practical tips to help you navigate the process:

Tip 1: Know Your Loan Servicer

Identify the company responsible for handling your loan payments and customer service. Check your loan statement, log in to NSLDS, or contact your lender directly.

Tip 2: Maintain Contact Information

Keep your contact information up-to-date with your loan servicer. This ensures timely responses to inquiries and efficient loan management.

Tip 3: Explore Payment Options

Discuss various payment options with your loan servicer, including standard repayment, graduated repayment, extended repayment, and income-driven repayment plans.

Suggested read: Professional Gutter Inspection Services: Protect Your Home from Water Damage in 2025

Tip 4: Utilize Online Account Access

Take advantage of online account access to view loan details, make payments, and update personal information conveniently.

Tip 5: Understand Deferment and Forbearance

Know the difference between deferment and forbearance, and explore these options if you face financial hardship or qualifying life events.

Tip 6: Seek Professional Advice

Consider consulting with a financial advisor or loan counselor if you have complex loan repayment situations or need personalized guidance.

Summary:

By following these tips, you can gain a clear understanding of your student loan servicer, explore repayment options, and effectively manage your loan. Remember to maintain open communication, explore available resources, and seek professional advice when needed to ensure a successful loan repayment journey.

Conclusion

Understanding “who services my student loan” is paramount for effective loan management. Throughout this exploration, we have emphasized the significance of identifying your loan servicer, maintaining contact information, exploring payment options, utilizing online account access, understanding deferment and forbearance, and seeking professional advice when needed.

Remember, your loan servicer plays a crucial role in handling your loan payments, providing customer support, and ensuring your loan is managed efficiently. By maintaining open communication and actively engaging with your loan servicer, you can navigate the loan repayment process with greater ease and achieve your financial goals.

Youtube Video: