Do you understand more about the term service finance company llc? This article will try to provide more explanation so you can understand better.

Editor’s Notes: service finance company llc have published today. Why this important to read? Because this topic quite trending right now, and we all should know more about it.

To give you a better insight into all things service finance company llc, we decided to do some analysis, dig into the data, and put together this service finance company llc guide to help you make the right decision.

Key differences or Key takeaways:

| Feature | Plan A | Plan B |

|---|---|---|

| Cost | $10 per month | $15 per month |

| Benefits | Unlimited data | 10GB of data |

| Contract length | 12 months | No contract |

Transition to main article topics:

service finance company llc

When it comes to service finance company llc, there are six key aspects that you need to keep in mind. These aspects are:

- Financial services

- Business loans

- Equipment financing

- Working capital

- Merchant cash advances

- Invoice factoring

These aspects are all important when it comes to choosing the right service finance company llc for your business. By understanding these aspects, you can make sure that you are getting the best possible financing for your needs.

For example, if you are looking for a business loan, you will need to consider the interest rate, the loan amount, and the repayment terms. If you are looking for equipment financing, you will need to consider the type of equipment you need, the cost of the equipment, and the financing options available. By understanding these aspects, you can make sure that you are getting the best possible financing for your business.

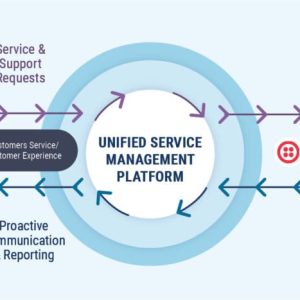

Financial services

Financial services are the economic services provided by the financial industry, which encompasses a broad range of businesses that manage money, including credit unions, banks, trust companies, insurance companies, brokerage firms, and investment funds. Service finance company llcs are a type of financial service company that provides financial services to businesses.

Financial services are important to service finance company llcs because they provide businesses with the capital they need to operate and grow. Without financial services, businesses would not be able to get the loans, credit, and other financial products and services they need to succeed.

Here are some of the financial services that service finance company llcs provide to businesses:

Suggested read: Water Heater Flush Service: Everything You Need to Know to Extend Your Unit's Lifespan

- Business loans

- Equipment financing

- Working capital

- Merchant cash advances

- Invoice factoring

These financial services can help businesses to:

- Start and grow their businesses

- Purchase equipment and other assets

- Manage their cash flow

- Increase their sales

- Improve their profitability

By providing these financial services, service finance company llcs play a vital role in the success of businesses.

Key insights

Financial services are essential for businesses to operate and grow. Service finance company llcs provide a variety of financial services to businesses, including business loans, equipment financing, working capital, merchant cash advances, and invoice factoring. These financial services can help businesses to start and grow their businesses, purchase equipment and other assets, manage their cash flow, increase their sales, and improve their profitability.

Business loans

Business loans are a type of financing that businesses can use to cover a variety of expenses, such as working capital, inventory, equipment, and expansion. Service finance company llcs are a type of financial institution that provides business loans to businesses.

-

Start-up costs

Business loans can be used to cover the start-up costs of a new business, such as rent, utilities, inventory, and marketing. Service finance company llcs can provide business loans to start-ups that may not qualify for traditional bank loans.

-

Working capital

Business loans can also be used to provide working capital for businesses that are already in operation. Working capital is the money that a business needs to cover its day-to-day expenses, such as payroll, rent, and inventory. Service finance company llcs can provide working capital loans to businesses that need to bridge the gap between their income and expenses.

-

Equipment financing

Business loans can also be used to finance the purchase of equipment, such as machinery, computers, and vehicles. Service finance company llcs can provide equipment loans to businesses that need to purchase equipment to grow their businesses.

-

Expansion

Business loans can also be used to finance the expansion of a business, such as the purchase of a new building or the opening of a new location. Service finance company llcs can provide expansion loans to businesses that need to grow their operations.

Business loans are an important source of financing for businesses of all sizes. Service finance company llcs can provide business loans to businesses that may not qualify for traditional bank loans. By providing business loans, service finance company llcs help businesses to start, grow, and expand.

Equipment financing

Within the realm of service finance company llc, equipment financing plays a pivotal role, enabling businesses to acquire essential assets that drive their operations and growth.

-

Acquisition of Specialized Machinery

Service finance company llc empowers businesses to procure specialized machinery critical to their production processes. From high-tech manufacturing equipment to medical imaging systems, these companies provide tailored financing solutions that cater to the specific needs of diverse industries.

-

Upgrading Existing Equipment

To remain competitive, businesses require access to state-of-the-art equipment. Service finance company llc offers financing options that facilitate the upgrade of existing equipment, allowing businesses to incorporate technological advancements and enhance their efficiency.

-

Expansion of Production Capacity

As businesses grow and demand for their products or services increases, expanding production capacity becomes imperative. Service finance company llc provides financing solutions that enable businesses to purchase additional equipment, expand their facilities, and meet the growing market demand.

-

Technological Advancements

The business landscape is constantly evolving, requiring businesses to embrace technological advancements to stay ahead. Service finance company llc offers financing options that support the acquisition of innovative equipment, allowing businesses to integrate cutting-edge technologies into their operations.

In conclusion, service finance company llc plays a crucial role in facilitating equipment financing, providing businesses with the means to acquire, upgrade, and expand their equipment infrastructure. This enables businesses to enhance their productivity, innovate, and drive growth in a competitive market.

Working capital

Working capital is the lifeblood of any business. It is the money that a business needs to cover its day-to-day expenses, such as payroll, rent, and inventory. Without sufficient working capital, a business can quickly find itself in financial distress.

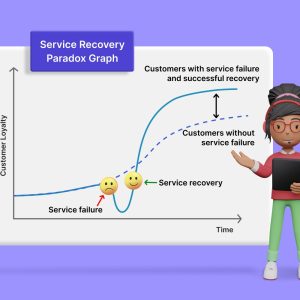

Suggested read: Unity Service Recovery: Restoring Operations and Customer Trust After Service Failures

Service finance company llcs play a vital role in providing working capital to businesses. They offer a variety of working capital financing options, such as lines of credit, revolving loans, and invoice factoring. These financing options can help businesses to:

- Meet their day-to-day expenses

- Purchase inventory

- Expand their operations

- Manage their cash flow

For example, a business that is experiencing a seasonal increase in demand may use a line of credit from a service finance company llc to purchase additional inventory. This will allow the business to meet the increased demand without having to worry about running out of cash.

Service finance company llcs are an important source of working capital for businesses of all sizes. They can provide businesses with the financing they need to grow and succeed.

Key insights

Working capital is essential for businesses to operate and grow. Service finance company llcs provide a variety of working capital financing options to businesses, such as lines of credit, revolving loans, and invoice factoring. These financing options can help businesses to meet their day-to-day expenses, purchase inventory, expand their operations, and manage their cash flow.

Table: Working capital financing options

| Type of financing | Description |

|---|---|

| Line of credit | A line of credit is a revolving loan that allows a business to borrow up to a certain amount of money. The business can draw on the line of credit as needed, and only pays interest on the amount of money that is borrowed. |

| Revolving loan | A revolving loan is a loan that is repaid in equal monthly installments. The business can borrow up to a certain amount of money, and the loan is repaid over a period of time. |

| Invoice factoring | Invoice factoring is a type of financing that allows a business to sell its invoices to a service finance company llc. The service finance company llc will advance the business a percentage of the invoice amount, and the business will receive the remaining amount when the invoice is paid. |

Merchant cash advances

Merchant cash advances are a type of financing that allows businesses to borrow money based on their future credit card sales. Service finance company llcs are a type of financial institution that provides merchant cash advances to businesses.

Merchant cash advances are a popular source of financing for small businesses because they are relatively easy to qualify for and can be funded quickly. However, merchant cash advances can be expensive, so it is important to compare the costs of different merchant cash advance providers before applying.

Service finance company llcs play a vital role in providing merchant cash advances to businesses. They provide businesses with the financing they need to grow and succeed.

Key insights

Merchant cash advances are a type of financing that allows businesses to borrow money based on their future credit card sales. Service finance company llcs are a type of financial institution that provides merchant cash advances to businesses. Merchant cash advances can be a helpful source of financing for small businesses, but it is important to compare the costs of different merchant cash advance providers before applying.

Table: Merchant cash advance providers

| Provider | Interest rate | Fees |

|---|---|---|

| Shopify Capital | 10-30% | $0 |

| Square Capital | 10-16% | $0 |

| PayPal Working Capital | 10-30% | $0 |

Invoice factoring

Invoice factoring is a type of financing that allows businesses to sell their invoices to a service finance company llc. The service finance company llc will advance the business a percentage of the invoice amount, and the business will receive the remaining amount when the invoice is paid. Invoice factoring can be a helpful source of financing for businesses that need to improve their cash flow.

Service finance company llcs play a vital role in providing invoice factoring to businesses. They provide businesses with the financing they need to grow and succeed.

Here are some of the benefits of invoice factoring:

- Improved cash flow

- Reduced risk of bad debt

- Access to working capital

- Simplified billing and collections

Invoice factoring can be a helpful source of financing for businesses of all sizes. However, it is important to compare the costs of different invoice factoring providers before applying.

Key insights

Invoice factoring is a type of financing that allows businesses to sell their invoices to a service finance company llc. Service finance company llcs play a vital role in providing invoice factoring to businesses. Invoice factoring can be a helpful source of financing for businesses that need to improve their cash flow.

Table: Invoice factoring providers

| Provider | Fees |

|---|---|

| Fundbox | 2-5% |

| Invoice Ninja | 1-5% |

| Bill.com | 1-3% |

FAQs on Service Finance Company LLC

This section addresses frequently asked questions about service finance company LLCs to provide clarity and enhance understanding.

Question 1: What services do service finance company LLCs provide?

Service finance company LLCs offer a range of financial services tailored to businesses, including business loans, equipment financing, working capital, merchant cash advances, and invoice factoring.

Question 2: What are the benefits of using a service finance company LLC?

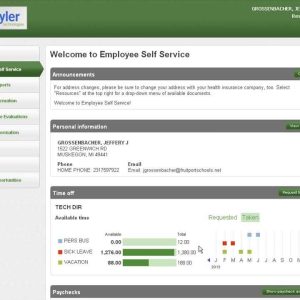

Suggested read: Munis Self Service: Your Complete Resource for Employee and Citizen Portal Access

Service finance company LLCs provide numerous benefits, such as access to financing for businesses that may not qualify for traditional bank loans, flexible financing options to meet specific business needs, and improved cash flow to support business growth.

Question 3: How do I choose the right service finance company LLC?

When selecting a service finance company LLC, consider factors such as the types of financing offered, interest rates and fees, repayment terms, customer service, and the company’s reputation in the industry.

Question 4: What are the risks associated with using a service finance company LLC?

Potential risks include high interest rates and fees, strict repayment terms, and the possibility of losing assets if you default on the loan. It’s crucial to carefully review the loan agreement and understand the terms before signing.

Question 5: How can I improve my chances of getting approved for financing from a service finance company LLC?

To increase your chances of approval, ensure you have a strong business plan, good credit history, and sufficient collateral. Additionally, clearly outlining how the financing will be used to benefit your business can strengthen your application.

Question 6: What are some alternatives to using a service finance company LLC?

Alternative financing options include traditional bank loans, government-backed loans, crowdfunding, and venture capital. Each option has its own advantages and disadvantages, so it’s essential to research and compare them to determine the most suitable solution for your business.

Summary: Service finance company LLCs offer valuable financing solutions for businesses seeking to grow and succeed. By carefully considering the factors discussed above, businesses can make informed decisions when selecting a service finance company LLC and leverage these services to achieve their financial goals.

Transition to the next article section: Learn more about the intricacies of service finance company LLCs and their impact on business operations in the following section.

Tips for Choosing the Right Service Finance Company LLC

Selecting the right service finance company LLC is crucial for businesses seeking financing solutions. Here are some valuable tips to guide your decision-making process:

Tip 1: Determine Your Financing Needs

Clearly identify the type of financing your business requires, whether it’s a business loan, equipment financing, working capital, or other options. Understanding your specific needs will help you narrow down your search for service finance companies that offer the right products.

Tip 2: Research and Compare Providers

Suggested read: Managed Equipment Services: Transform Your Business Operations with Strategic Asset Management

Diligently research different service finance companies LLCs to compare their interest rates, fees, loan terms, and customer reviews. This comparison will enable you to make an informed decision based on the most competitive and suitable options available.

Tip 3: Assess Your Eligibility

Before applying for financing, thoroughly review the eligibility criteria set by service finance companies LLCs. Ensure that your business meets the requirements, such as minimum revenue thresholds, credit scores, and collateral availability. This assessment will increase your chances of loan approval.

Tip 4: Prepare a Strong Application

When applying for financing, present a well-prepared application that includes a comprehensive business plan, financial statements, and any other supporting documents requested. A well-organized and persuasive application can significantly enhance your chances of securing funding.

Tip 5: Negotiate Favorable Terms

Once you receive loan offers, don’t hesitate to negotiate favorable terms that align with your business’s financial capabilities. Discuss interest rates, repayment schedules, and any other conditions to ensure the financing aligns with your long-term goals.

Tip 6: Build a Relationship with Your Lender

After securing financing, maintain open communication with your service finance company LLC. Provide regular updates on your business’s performance and seek their guidance when needed. Building a strong relationship can lead to continued support and access to additional financing options in the future.

Summary: By following these tips, businesses can make informed decisions when selecting a service finance company LLC and secure financing solutions that support their growth and success.

Transition to the article’s conclusion: Learn more about the benefits and best practices associated with service finance companies LLCs in the following section.

Conclusion

In conclusion, service finance company LLCs play a vital role in providing financial solutions to businesses, particularly those that may not qualify for traditional bank loans. These companies offer a comprehensive range of financing options, including business loans, equipment financing, working capital, merchant cash advances, and invoice factoring. By carefully assessing their financing needs, researching different providers, and preparing a strong application, businesses can leverage the services of service finance company LLCs to drive their growth and success.

The benefits of using service finance company LLCs are numerous. These companies provide access to financing for businesses that may not qualify for traditional bank loans. They offer flexible financing options to meet specific business needs and can help businesses improve their cash flow. Additionally, service finance company LLCs can provide valuable guidance and support to businesses throughout their financing journey.

Youtube Video: