The interactions and support provided to individuals or entities engaging with Blackstone, a global investment firm, constitute a critical aspect of its operational framework. This support encompasses various forms of communication, problem-solving, and information dissemination aimed at addressing inquiries and resolving issues that may arise during the course of the relationship. For example, a limited partner with questions about investment performance or a portfolio company seeking operational guidance would typically interact with representative channels designed to furnish relevant assistance.

Efficient and responsive support channels are vital for maintaining stakeholder trust and fostering long-term relationships. The firm’s reputation is significantly influenced by the perceived quality of its engagement with its diverse constituents. Historically, superior engagement has correlated with increased investor confidence and enhanced operational efficiencies within its portfolio companies. The ability to promptly and effectively address concerns can lead to a stronger brand image and a more favorable market perception.

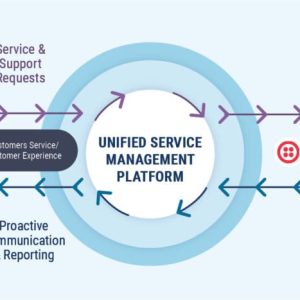

The following sections will delve into specific aspects of the support ecosystem, including available channels, common inquiries, and strategies for optimizing the interaction experience. Furthermore, it will examine methods to assess the effectiveness of these interactions and potential avenues for future enhancement.

1. Responsiveness

Responsiveness, in the context of interactions with Blackstone, is a critical determinant of client satisfaction and operational efficacy. It dictates the speed and efficacy with which the firm addresses inquiries, resolves issues, and provides essential information. A prompt and well-considered reply significantly contributes to stakeholders’ perceptions of the firm’s competence and dedication to its fiduciary duties.

-

Timely Acknowledgment of Inquiries

Suggested read: Top Unified Products & Services Customer Service Now!

The initial response time to an inquiry sets the tone for the entire interaction. A swift acknowledgment signals that the firm values the stakeholder’s time and concerns. Delays can lead to frustration and erode confidence. For example, an investor seeking clarification on a fund’s performance should receive a confirmation of receipt within a reasonable timeframe, even if a detailed answer requires further investigation. This demonstrates respect and professionalism.

-

Efficient Information Delivery

Beyond mere acknowledgment, the rapid provision of accurate and relevant information is crucial. Stakeholders rely on Blackstone to deliver timely insights to support their investment decisions or operational planning. Bottlenecks in information flow can hinder their ability to act decisively. For instance, a portfolio company awaiting guidance on a strategic initiative needs the information promptly to capitalize on market opportunities.

-

Expeditious Problem Resolution

The speed and effectiveness of problem resolution directly impacts stakeholder confidence and potential financial outcomes. Unresolved issues can escalate and lead to significant disruptions. The firm’s ability to quickly diagnose problems, implement solutions, and communicate progress is paramount. Consider a scenario where a technical glitch prevents an investor from accessing their account statements; a prompt and effective resolution is essential to maintain their trust and prevent potential losses.

-

Availability and Accessibility

Responsiveness is also dependent on the accessibility of support channels. If clients find it difficult to reach the relevant teams or obtain immediate assistance, their engagement erodes. Offering various communication channels, from phone support to email and online portals, can improve responsiveness. Availability during critical periods such as quarterly reporting or market volatility is equally vital.

The facets of timely acknowledgment, efficient information delivery, expeditious problem resolution, and availability collectively define Blackstone’s commitment to engaging its stakeholders. It’s evident that the speed of response and the efficiency of solutions contribute significantly to the stakeholder’s perception of value and reliability.

2. Information Accuracy

Information accuracy is a cornerstone of effective stakeholder engagement and a vital component of support frameworks. In the context of Blackstone’s operations, the provision of precise, verified, and up-to-date data directly influences stakeholder trust and informed decision-making. The dissemination of inaccurate information, whether intentional or unintentional, can lead to significant financial repercussions and erode confidence in the firm’s capabilities. For example, if an investor receives erroneous data regarding the net asset value of a fund, it could result in flawed investment strategies and potential financial losses. The consequence underscores the critical importance of verifiable and precise details.

The significance of this aspect extends beyond immediate financial implications. Accurate information is essential for regulatory compliance, risk management, and the overall stability of Blackstone’s operations. Misreporting or inaccuracies in financial statements can lead to legal challenges and reputational damage. Internal processes must be designed to ensure that all data disseminated to investors, portfolio companies, and other stakeholders is subject to rigorous verification and validation procedures. Systems should be in place to promptly identify and rectify any discrepancies to mitigate the risk of cascading errors. Consider the due diligence process when acquiring a new asset; the integrity of financial data is paramount for assessing the true value and potential risks associated with the investment.

In summation, information accuracy constitutes an essential element of Blackstone’s engagement framework. Its impact reverberates across the organization, influencing stakeholder confidence, regulatory compliance, and overall operational integrity. Maintaining rigorous standards for data validation and ensuring the reliability of information dissemination are vital for safeguarding the firm’s reputation and fostering long-term relationships with its diverse constituents. Failure to prioritize information accuracy can lead to cascading errors with significant financial consequences.

3. Problem Resolution

Effective problem resolution is intrinsically linked to the quality and perception of interactions with Blackstone. The firm’s capacity to address and resolve issues encountered by investors, portfolio companies, and other stakeholders directly influences their level of satisfaction and confidence. Delays or failures in problem resolution can erode trust, damage relationships, and potentially lead to financial losses for all parties involved. For instance, if a portfolio company faces an operational challenge hindering its growth, Blackstone’s ability to provide timely and effective guidance becomes critical. A swift response and implementation of appropriate solutions can mitigate the adverse impact and preserve the company’s value. Conversely, prolonged inaction can exacerbate the issue, leading to irreversible damage and diminished returns.

The structure of Blackstone’s support infrastructure and its capacity for thorough analysis are central to effective problem resolution. Access to experienced professionals, relevant data, and efficient communication channels are essential for promptly identifying the root cause of issues and devising tailored solutions. Consider the scenario where an investor experiences difficulties accessing their account or receiving timely reports. The support structure’s ability to quickly diagnose the problem, identify the appropriate resources, and communicate progress to the investor is paramount. Transparent communication throughout the problem-solving process fosters trust and reinforces the commitment to addressing stakeholder concerns. A systematic approach to analyzing feedback and learning from past experiences enables continuous improvement in the firm’s capacity to prevent and resolve future challenges. Continuous improvement to service delivery mechanisms also enhance the ability to resolve problems quicker.

In conclusion, problem resolution serves as a key differentiator in the landscape of interactions with Blackstone. It is a tangible manifestation of the firm’s commitment to its stakeholders and a critical driver of long-term value creation. By prioritizing efficient and effective problem-solving, Blackstone reinforces its reputation for reliability and strengthens its relationships with investors and portfolio companies. The ability to anticipate potential challenges, proactively address emerging issues, and learn from past experiences positions the firm for sustained success in a dynamic and competitive environment.

Suggested read: Top Spark Delivery Customer Service + Support

4. Relationship Management

Relationship management forms a critical intersection with support structures, shaping stakeholder experiences and influencing the long-term success of Blackstone’s engagements. Proactive and personalized relationship management practices serve as the foundation for building trust, fostering collaboration, and ensuring that stakeholder needs are consistently met. Its effective implementation directly impacts perceptions of value and loyalty.

-

Proactive Communication

Proactive communication involves anticipating stakeholder needs and providing relevant information before it is explicitly requested. This includes regular updates on portfolio performance, market insights, and strategic initiatives. For example, instead of waiting for an investor to inquire about a fund’s performance, proactively providing a quarterly report with detailed analysis demonstrates a commitment to transparency and builds trust. This proactive approach can mitigate potential misunderstandings and foster a stronger relationship.

-

Personalized Engagement

Personalized engagement recognizes that each stakeholder has unique needs and preferences. Tailoring interactions to suit these individual requirements demonstrates a commitment to understanding and valuing the relationship. For instance, a dedicated relationship manager who understands an investor’s specific investment goals and risk tolerance can provide more relevant and targeted advice. This personalized approach fosters a sense of connection and strengthens the overall experience.

-

Feedback Mechanisms

Effective relationship management incorporates feedback mechanisms to solicit input from stakeholders and identify areas for improvement. Regularly seeking feedback through surveys, interviews, or informal discussions demonstrates a commitment to continuous improvement and ensures that the firm remains responsive to evolving needs. For instance, conducting post-interaction surveys to gauge stakeholder satisfaction and identify pain points can provide valuable insights for optimizing service delivery. Addressing negative feedback promptly and effectively reinforces the commitment to stakeholder satisfaction.

-

Long-Term Perspective

Relationship management emphasizes building long-term relationships based on mutual trust and shared goals. This involves taking a holistic view of the stakeholder’s needs and working collaboratively to achieve mutually beneficial outcomes. For example, providing ongoing support and guidance to a portfolio company as it navigates market challenges demonstrates a commitment to its long-term success. A long-term perspective fosters loyalty and strengthens the overall relationship.

These facets, when implemented effectively, create a holistic approach that underscores Blackstone’s dedication to its constituents. The result can be elevated levels of stakeholder satisfaction, increased retention, and a stronger reputation for building mutually beneficial partnerships.

5. Communication Clarity

Communication clarity serves as a foundational pillar underpinning successful support interactions. Ambiguous, convoluted, or technically dense information can impede understanding, leading to frustration and inefficiencies. In the context of Blackstones interactions, clarity ensures that stakeholders accurately comprehend information related to investments, portfolio performance, regulatory compliance, and strategic initiatives. Poor communication can directly impact investment decisions, potentially resulting in suboptimal outcomes. For example, if a limited partner misinterprets a financial report due to unclear terminology, they may make ill-advised investment adjustments. The causal relationship between communication clarity and positive stakeholder experiences is evident; clear communication reduces the likelihood of misunderstandings and fosters confidence in the firm’s capabilities. The ability to distill complex financial data into accessible formats is therefore, paramount.

Effective communication clarity encompasses several key elements. Firstly, the use of plain language, avoiding jargon and technical terms unless absolutely necessary and appropriately defined, is crucial. Secondly, a well-structured message with clear headings and concise paragraphs enhances readability. Thirdly, visual aids such as charts and graphs can effectively convey complex data in an accessible format. For instance, providing a graphical representation of fund performance over time alongside a written summary can significantly improve comprehension. Moreover, active listening and the ability to anticipate potential points of confusion are essential skills for representatives. Addressing questions proactively and tailoring communication to the specific needs of the stakeholder further enhances the interaction. Consider the importance of readily understandable explanations of investment risks; clear communication in this area is essential for ensuring informed consent and mitigating potential legal liabilities. Clear communication is about building a trust relationship and fostering client/stakeholder satisfaction.

In summation, the practical significance of communication clarity cannot be overstated. It minimizes ambiguity, fosters understanding, and reinforces stakeholder confidence. Blackstones commitment to clear and concise communication strengthens relationships, reduces operational inefficiencies, and contributes to long-term success. While challenges exist in translating complex financial information into readily accessible formats, the benefits of prioritizing communication clarity far outweigh the effort required. A commitment to ongoing training in communication skills, coupled with a focus on simplification and transparency, ensures that Blackstone continues to excel in its engagement with stakeholders.

Suggested read: Lycatel Customer Service: Fast Help & Support

Frequently Asked Questions

This section addresses frequently asked questions pertaining to interactions with Blackstone’s support framework. The objective is to provide clarity on common inquiries and concerns.

Question 1: What channels are available for accessing support?

Support channels include telephone, email, and online portals. The specific channels available may vary depending on the nature of the inquiry and the stakeholder’s relationship with the firm. Contact details for each channel are typically provided on the firm’s website or through direct communication with relationship managers.

Question 2: What is the typical response time for inquiries submitted through these channels?

Response times may vary depending on the complexity of the inquiry and the volume of requests. The firm strives to acknowledge all inquiries promptly. More complex issues may require additional investigation and may therefore take longer to resolve. Stakeholders can expect to receive an initial acknowledgment within a reasonable timeframe, followed by regular updates on the progress of their inquiry.

Question 3: How does Blackstone ensure the accuracy of information provided through these channels?

The firm employs rigorous verification and validation procedures to ensure the accuracy of information disseminated. Data sources are carefully vetted, and information is reviewed by subject matter experts before being communicated to stakeholders. Regular audits are conducted to identify and rectify any discrepancies. The organization aims to minimize the risk of disseminating inaccurate information.

Question 4: What recourse is available if there is dissatisfaction with the provided interaction or resolution?

Stakeholders who are dissatisfied with the interaction or resolution of an issue are encouraged to escalate their concerns through established channels. This may involve contacting a relationship manager, submitting a formal complaint, or engaging with a designated ombudsman. Concerns are reviewed impartially and appropriate action is taken to address any shortcomings. Stakeholders are to provide specific details regarding the nature of the complaint and any supporting documentation.

Suggested read: Chain Link Services: Everything You Need to Know About Professional Chain Link Fencing Solutions

Question 5: How does Blackstone protect confidential information shared during support interactions?

The firm adheres to strict confidentiality protocols to protect sensitive information. Access to confidential data is restricted to authorized personnel, and secure communication channels are utilized to prevent unauthorized access. All employees are trained on data privacy and security policies. The organization is committed to safeguarding the confidentiality of its stakeholders.

Question 6: Are interaction channels available in multiple languages?

The availability of support in multiple languages may vary depending on the region and the specific service being offered. The firm strives to provide support in languages that are commonly spoken by its stakeholders. Translation services may be available for inquiries submitted in less common languages. Stakeholders are encouraged to inquire about language support options when contacting representatives.

These FAQs provide a foundation for understanding the operational aspects of engaging with Blackstone. For specific or nuanced inquiries, direct engagement with their channels is always recommended.

The subsequent section will explore strategies for optimizing the support experience and maximizing its value.

Optimizing Interaction with Blackstone

The following guidelines serve to optimize the experience when seeking support, ensuring efficient and effective resolution of inquiries.

Tip 1: Clearly Define the Inquiry. Prior to initiating contact, articulate the inquiry in a concise and specific manner. Vague or ambiguous requests may delay resolution due to the need for clarification. For example, instead of asking “What is the status of my investment?”, specify “What is the current net asset value of my investment in Fund X as of [Date]?”

Tip 2: Gather Relevant Documentation. Assemble any supporting documentation that may facilitate the resolution process. This could include account statements, transaction records, or previous correspondence related to the inquiry. Providing readily available documentation can expedite the investigation and prevent unnecessary delays.

Tip 3: Utilize Appropriate Communication Channels. Select the most appropriate communication channel based on the nature of the inquiry. For urgent matters, telephone contact may be preferable, while less time-sensitive inquiries can be addressed via email. Consult the firm’s website or relationship manager for guidance on selecting the optimal channel.

Tip 4: Be Prepared to Provide Verification. Upon initiating contact, anticipate the need to verify identity and authorization. This is necessary to protect confidential information and ensure that only authorized individuals have access to account details. Have relevant identification documents readily available.

Tip 5: Maintain a Record of Communications. Keep a detailed record of all interactions, including dates, times, names of representatives contacted, and summaries of the conversations. This documentation can serve as a valuable reference point in case of discrepancies or unresolved issues. It will also help should there be any follow up.

Suggested read: Integrated Service Solutions: Transforming Business Operations Through Unified Management

Tip 6: Escalate Issues Appropriately. If an inquiry remains unresolved after a reasonable period, escalate the issue through the designated channels. Escalate any issues to a supervisor if you feel you are not getting the service required. Adhere to the firm’s established escalation process to ensure that the concern is addressed at the appropriate level.

Tip 7: Provide Constructive Feedback. Share feedback on the interaction experience. Constructive feedback, both positive and negative, helps the firm identify areas for improvement and enhance support frameworks. The sharing of feedback is part of continuous improvement.

Adhering to these guidelines fosters a more efficient and productive interaction, maximizing the value derived from the support ecosystem. Efficient and faster service can only happen if there is an understanding of how best to access it.

The concluding section will provide a summary of key concepts.

Conclusion

This exposition has analyzed the multifaceted nature of blackstone customer service, underscoring its critical role in fostering stakeholder trust and ensuring operational efficiency. Key tenets, including responsiveness, information accuracy, problem resolution, relationship management, and communication clarity, directly influence the perceived value and overall success of interactions. These elements collectively contribute to a robust support ecosystem that is essential for maintaining the firm’s reputation and driving long-term value creation.

As the financial landscape evolves, a continued commitment to optimizing support structures and enhancing stakeholder engagement will remain paramount. By prioritizing accessibility, transparency, and proactive communication, Blackstone can solidify its position as a trusted partner and reinforce its dedication to delivering exceptional service in an increasingly competitive environment. The continuous improvement and adaptation to client needs will continue to increase engagement and value creation.