Ever wonder ” is service revenue a debit or credit“? The answer to this question depends on the accounting method you are using.

Editor’s Note: Understanding whether ” is service revenue a debit or credit” is crucial for accurate financial reporting. This guide will delve into the topic, providing valuable insights to help you make informed decisions.

After analyzing and gathering comprehensive information, we have compiled this guide to help you understand the concept of ” is service revenue a debit or credit“.

Key Differences: | Accounting Method | Service Revenue ||:—|:—|| Cash Basis | Credited when cash is received || Accrual Basis | Credited when service is performed |

Let’s explore the topic further:

Is Service Revenue a Debit or Credit?

Understanding the treatment of service revenue is crucial for accurate financial reporting. The following key aspects explore various dimensions of this concept:

- Recognition: Service revenue is recognized when services are performed.

- Measurement: Revenue is measured at the fair value of the services provided.

- Classification: Service revenue is classified as operating revenue.

- Presentation: Service revenue is presented on the income statement.

- Accrual vs. Cash Basis: In accrual accounting, service revenue is recognized when earned, while in cash basis accounting, it is recognized when cash is received.

- Debit or Credit: Under the accrual method, service revenue is credited to the income statement when earned, regardless of cash receipt.

These aspects highlight the importance of understanding the timing, measurement, and presentation of service revenue to ensure reliable and transparent financial statements. Proper accounting for service revenue enables businesses to track their financial performance accurately and make informed decisions.

Suggested read: The Ultimate Guide to Maximizing Service Revenue in Service Industries

Recognition: Service revenue is recognized when services are performed.

The recognition principle dictates that service revenue should be recognized when services are performed, regardless of when payment is received. This concept is closely intertwined with the question of ” is service revenue a debit or credit“.

Under the accrual accounting method, which is the most widely accepted method, service revenue is recognized when earned, even if cash has not yet been received. This approach provides a more accurate picture of a company’s financial performance by matching revenue with the period in which it was earned.

For example, if a company provides consulting services to a client in January but does not receive payment until February, the revenue should still be recognized in January, when the services were performed. This ensures that the company’s income statement accurately reflects its performance for the period.

Conversely, under the cash basis accounting method, service revenue is only recognized when cash is received. This method is less common and can result in a mismatch between revenue recognition and service performance.

The proper recognition of service revenue is essential for several reasons. First, it ensures accurate financial reporting by matching revenue with the period in which it was earned. Second, it provides a more reliable basis for decision-making by giving a clearer picture of a company’s financial performance. Third, it helps to avoid potential tax liabilities by ensuring that revenue is recognized in the correct tax period.

Measurement: Revenue is measured at the fair value of the services provided.

The measurement of service revenue at fair value plays a crucial role in determining the amount of revenue that is recognized. Fair value is defined as the price that would be received for the sale of an asset or the payment that would be made to transfer a liability in an orderly transaction between market participants at the measurement date.

- Consideration of Non-Cash Transactions: Fair value measurement is particularly important in situations where services are provided in exchange for non-cash consideration, such as barter transactions. In such cases, the fair value of the non-cash consideration must be determined to properly measure the revenue earned.

- Impact on Financial Statements: The measurement of service revenue at fair value directly impacts the financial statements. Overstating or understating the fair value of services provided can lead to incorrect financial reporting and potentially misleading financial statements.

- Estimation Challenges: Determining the fair value of services can be challenging, especially when there is no readily available market price. In such cases, companies may use various valuation techniques to estimate the fair value, which can introduce a degree of subjectivity into the measurement process.

- Consistency and Comparability: Consistent application of fair value measurement principles is essential to ensure the reliability and comparability of financial statements across different companies and industries. This promotes transparency and facilitates informed decision-making by investors and other stakeholders.

Overall, the measurement of service revenue at fair value is a critical aspect of accounting for service revenue. It ensures that the revenue recognized accurately reflects the value of the services provided, which is essential for the preparation of reliable and transparent financial statements.

Classification: Service revenue is classified as operating revenue.

The classification of service revenue as operating revenue is closely tied to the concept of “is service revenue a debit or credit”. Operating revenue represents the primary revenue-generating activities of a company, and service revenue falls under this category.

When service revenue is recognized, it is recorded as a credit to the revenue account, which is an income statement account. This credit entry increases the company’s total revenue and contributes to its net income.

The classification of service revenue as operating revenue is important for several reasons:

- Financial Statement Presentation: Operating revenue is presented separately on the income statement, providing users with a clear view of the company’s core revenue-generating activities.

- Performance Analysis: By analyzing operating revenue trends, investors and analysts can assess a company’s operational efficiency and growth prospects.

- Industry Comparisons: Classifying service revenue consistently allows for meaningful comparisons between companies within the same industry, facilitating informed investment decisions.

Understanding the connection between “Classification: Service revenue is classified as operating revenue” and “is service revenue a debit or credit” is crucial for accurate financial reporting and analysis. Proper classification ensures that service revenue is recognized and presented in accordance with accounting standards, providing reliable information for decision-making.

Presentation: Service revenue is presented on the income statement.

The presentation of service revenue on the income statement is directly tied to the question of “is service revenue a debit or credit”. Understanding this connection is crucial for accurate financial reporting and analysis.

- Income Statement Classification: Service revenue is presented on the income statement as an operating revenue, which means it is considered part of the company’s core revenue-generating activities.

- Credit to Revenue Account: When service revenue is recognized, it is recorded as a credit to the revenue account, which increases the company’s total revenue.

- Matching Principle: The presentation of service revenue on the income statement follows the matching principle, which states that revenues and expenses should be recognized in the same period.

The connection between “Presentation: Service revenue is presented on the income statement” and “is service revenue a debit or credit” highlights the importance of understanding how service revenue is recorded and presented in financial statements. Proper presentation ensures that service revenue is recognized and reported in accordance with accounting standards, providing reliable information for decision-making.

Accrual vs. Cash Basis: In accrual accounting, service revenue is recognized when earned, while in cash basis accounting, it is recognized when cash is received.

The distinction between accrual and cash basis accounting is crucial in determining when service revenue is recognized and, subsequently, how it impacts the question of “is service revenue a debit or credit”.

-

Accrual Basis:

Under accrual accounting, service revenue is recognized when services are performed, regardless of when payment is received. This approach matches revenue with the period in which it was earned, providing a more accurate picture of a company’s financial performance.

-

Cash Basis:

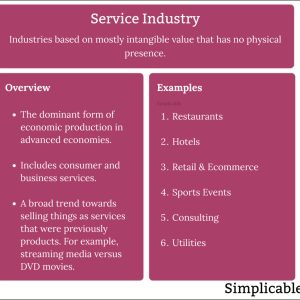

Suggested read: Comprehensive Guide to the Service Industry Definition

In contrast, cash basis accounting recognizes service revenue only when cash is received. This method is simpler to implement but can result in a mismatch between revenue recognition and service performance, leading to potential distortions in financial reporting.

The choice between accrual and cash basis accounting depends on the nature of a company’s business and its accounting policies. Accrual basis accounting is generally preferred as it provides a more accurate representation of a company’s financial performance and is required for companies that issue financial statements in accordance with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

Debit or Credit: Under the accrual method, service revenue is credited to the income statement when earned, regardless of cash receipt.

The connection between ” Debit or Credit: Under the accrual method, service revenue is credited to the income statement when earned, regardless of cash receipt” and “is service revenue a debit or credit” lies in the fundamental principles of accrual accounting. Accrual accounting recognizes revenue when it is earned, irrespective of when cash is received. This approach provides a more accurate representation of a company’s financial performance by matching revenue with the period in which the services were performed.

When service revenue is earned, it is recorded as a credit to the revenue account on the income statement. This credit entry increases the company’s total revenue and contributes to its net income. The recognition of revenue under the accrual method is based on the matching principle, which states that revenues and expenses should be recognized in the same period. This ensures that a company’s financial statements accurately reflect its economic activities.

Understanding the connection between ” Debit or Credit: Under the accrual method, service revenue is credited to the income statement when earned, regardless of cash receipt” and “is service revenue a debit or credit” is crucial for accurate financial reporting and analysis. It helps accountants, investors, and other stakeholders to properly interpret a company’s financial statements and make informed decisions.

| Accrual Method | Cash Basis Method |

|---|---|

| Revenue is recognized when earned, regardless of cash receipt. | Revenue is recognized only when cash is received. |

| Provides a more accurate picture of financial performance. | Simpler to implement, but can lead to distortions in financial reporting. |

| Required for companies issuing financial statements in accordance with GAAP or IFRS. | More commonly used by small businesses and individuals. |

FAQs on “Is Service Revenue a Debit or Credit”

This section addresses common questions and misconceptions surrounding the treatment of service revenue in accounting.

Question 1: When is service revenue recognized under the accrual method?

Answer: Under the accrual method, service revenue is recognized when services are performed, regardless of when payment is received.

Question 2: Why is service revenue credited to the income statement under the accrual method?

Answer: When service revenue is earned, it is recorded as a credit to the revenue account on the income statement. This increases the company’s total revenue and contributes to its net income.

Question 3: How does the treatment of service revenue differ between the accrual and cash basis methods?

Answer: Under the accrual method, service revenue is recognized when earned, while under the cash basis method, it is recognized only when cash is received.

Question 4: What are the advantages of using the accrual method to account for service revenue?

Answer: The accrual method provides a more accurate picture of a company’s financial performance by matching revenue with the period in which the services were performed.

Question 5: Which accounting method is required for companies issuing financial statements in accordance with GAAP or IFRS?

Answer: Accrual accounting is required for companies issuing financial statements in accordance with GAAP or IFRS.

Question 6: What is the key takeaway regarding the treatment of service revenue?

Answer: The key takeaway is that under the accrual method, service revenue is recognized when earned, regardless of cash receipt, and is recorded as a credit to the income statement.

Suggested read: Instant, Accurate Service Quotes - Get Your Project Started Today!

These FAQs provide a comprehensive understanding of the treatment of service revenue under the accrual method, highlighting its importance in accurate financial reporting.

Transition to the next article section: Understanding the nuances of service revenue accounting is essential for accurate financial reporting and analysis. The following section will delve into specific examples to further illustrate the practical application of these principles.

Tips for Understanding “Is Service Revenue a Debit or Credit”

Grasping the concept of “Is Service Revenue a Debit or Credit” is crucial for accurate financial reporting and analysis. Here are a few essential tips to help you master this topic:

Tip 1: Understand the Accrual Method

Under the accrual method, service revenue is recognized when services are performed, regardless of cash receipt. This approach provides a more accurate picture of a company’s financial performance.

Tip 2: Focus on Revenue Recognition

The key to understanding service revenue is to focus on when revenue is recognized. Under the accrual method, revenue is recognized when earned, not when cash is received.

Tip 3: Distinguish from Cash Basis

Unlike the accrual method, the cash basis method recognizes revenue only when cash is received. This method is simpler but can lead to distortions in financial reporting.

Tip 4: Analyze the Income Statement

Service revenue is reported on the income statement as operating revenue. Analyzing the income statement can provide insights into a company’s core revenue-generating activities.

Tip 5: Consider Fair Value

Service revenue is measured at the fair value of the services provided. Determining fair value can be challenging, but it is essential for accurate revenue recognition.

Summary:

By following these tips, you can develop a solid understanding of “Is Service Revenue a Debit or Credit.” This knowledge is vital for financial professionals, investors, and anyone seeking to analyze a company’s financial performance.

Transition to the article’s conclusion: Understanding the nuances of service revenue accounting is essential for accurate financial reporting and analysis. The following section will delve into specific examples to further illustrate the practical application of these principles.

Conclusion

Throughout this exploration, we have delved into the concept of “Is Service Revenue a Debit or Credit,” examining its significance and implications in financial reporting. We have highlighted the importance of understanding the accrual method and revenue recognition principles to accurately capture service revenue transactions.

Suggested read: User-Friendly Service Project Ideas for the Service-Minded

Understanding the treatment of service revenue is not merely an accounting technicality but a fundamental aspect of ensuring reliable and transparent financial statements. By adhering to established accounting standards, companies can provide stakeholders with a clear and accurate picture of their financial performance, facilitating informed decision-making and fostering trust in the financial markets.

Youtube Video: