What is the Department of the Treasury Bureau of the Fiscal Service?

The Department of the Treasury Bureau of the Fiscal Service represents one of the most crucial yet often overlooked components of the United States federal government’s financial infrastructure. This essential bureau operates as the federal government’s financial manager, handling everything from collecting revenue to distributing payments and managing debt. Established to streamline and consolidate various fiscal operations, the Bureau of the Fiscal Service plays an instrumental role in maintaining the financial stability and operational efficiency of the entire U.S. government system.

The Fiscal Service was created on October 7, 2012, through the merger of two previously separate entities: the Financial Management Service (FMS) and the Bureau of the Public Debt (BPD). This consolidation aimed to eliminate redundancies, improve efficiency, and create a more unified approach to managing the government’s financial operations. Today, the bureau employs thousands of dedicated professionals across multiple locations and manages trillions of dollars in transactions annually.

Understanding the Department of the Treasury’s Bureau of the Fiscal Service is essential for anyone dealing with federal payments, tax refunds, savings bonds, or government debt. Whether you’re a taxpayer expecting a refund, a federal employee receiving your paycheck, or simply a citizen interested in how your government manages its finances, the Fiscal Service directly impacts your financial interactions with the federal government.

Core Responsibilities of the Bureau of the Fiscal Service

Revenue Collection and Management

The Bureau of the Fiscal Service serves as the primary collection agent for the federal government, processing hundreds of billions of dollars in revenue annually. Through its sophisticated systems and partnerships with financial institutions, the bureau collects taxes, fees, fines, and other payments owed to various government agencies. This revenue collection function extends far beyond simple tax processing—it encompasses every dollar that flows into the federal treasury from countless sources.

The bureau operates the Treasury Offset Program (TOP), which intercepts federal payments to individuals who owe delinquent debts to federal agencies or state governments. This program ensures that outstanding obligations like unpaid taxes, defaulted student loans, child support arrearages, and other debts are collected efficiently. In fiscal year 2022 alone, TOP collected over $4.5 billion in delinquent debts by offsetting federal payments including tax refunds and Social Security benefits.

Key revenue collection statistics include:

- Over $3.7 trillion in federal revenue collected annually

- More than 400 million transactions processed each year

- Collection services provided to over 180 federal agencies

- 99.9% accuracy rate in payment processing

Federal Payment Distribution

One of the most visible functions of the Department of the Treasury Bureau of the Fiscal Service involves distributing payments on behalf of federal agencies. Every month, the Fiscal Service disburses billions of dollars to millions of recipients including Social Security beneficiaries, veterans, federal employees, tax refund recipients, and government contractors. This massive payment operation requires precision, security, and efficiency to ensure that Americans receive their entitled benefits and payments on time.

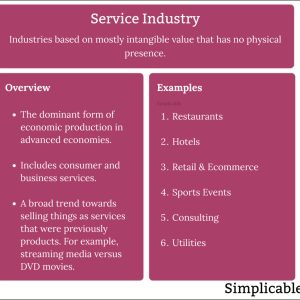

Suggested read: Comprehensive Guide to the Service Industry Definition

The bureau has been instrumental in transitioning federal payments from paper checks to electronic methods, significantly reducing costs and fraud. Through the Go Direct initiative and its successor programs, the Fiscal Service has promoted direct deposit and prepaid debit cards as safer, faster alternatives to paper checks. This shift has saved taxpayers hundreds of millions of dollars in processing costs while simultaneously reducing payment theft and fraud.

The Direct Express debit card program, managed by the Fiscal Service, provides a secure electronic payment option for individuals without bank accounts. More than 4 million Americans currently receive their federal benefits via Direct Express cards, ensuring that even unbanked individuals can access their payments safely without the risks associated with check cashing services or carrying large amounts of cash.

Managing the Federal Debt

Public Debt Accounting and Reporting

The Bureau of the Fiscal Service bears the enormous responsibility of accounting for and reporting on the entire public debt of the United States, which currently exceeds $34 trillion. This function requires meticulous record-keeping, sophisticated financial systems, and transparent reporting to Congress, government agencies, and the American public. The bureau publishes daily updates on the national debt, providing unprecedented transparency into the government’s borrowing and financial obligations.

Through its comprehensive debt management programs, the Fiscal Service tracks every Treasury security issued, from short-term bills to long-term bonds. This includes maintaining records of ownership, processing interest payments, handling redemptions, and managing the reissuance of lost or stolen securities. The bureau’s systems must accommodate millions of investors ranging from individual savers holding Series EE bonds to foreign governments holding billions in Treasury notes.

Federal debt management metrics:

| Debt Category | Approximate Amount | Percentage of Total |

|---|---|---|

| Debt Held by Public | $27 trillion | 79% |

| Intragovernmental Holdings | $7 trillion | 21% |

| Foreign Holdings | $7.6 trillion | 28% of public debt |

| Domestic Holdings | $19.4 trillion | 72% of public debt |

Treasury Securities and Savings Bonds

The Department of the Treasury Bureau of the Fiscal Service administers all U.S. savings bonds and Treasury securities programs, making it possible for individuals, institutions, and foreign governments to invest in U.S. government debt. The bureau operates TreasuryDirect, an online platform that allows investors to purchase, manage, and redeem Treasury securities directly without going through banks or brokers. This system has democratized access to government securities, enabling anyone with an internet connection to invest directly in Treasury bills, notes, bonds, and savings bonds.

Savings bonds represent a particularly important retail investment product managed by the Fiscal Service. Series I bonds have gained tremendous popularity recently due to their inflation-protected returns, with interest rates reaching historical highs in 2022 and 2023. The bureau has processed record numbers of savings bond purchases through TreasuryDirect, reflecting Americans’ renewed interest in these safe, government-backed investments during periods of economic uncertainty and inflation.

The Fiscal Service also manages the redemption of billions of dollars in matured savings bonds annually. Many Americans hold old paper bonds inherited from family members or purchased decades ago. The bureau’s online tools help bondholders determine current values, track maturity dates, and process redemptions through financial institutions or by mail. This service ensures that Americans can access the value of their long-term savings when needed.

Payment Integrity and Fraud Prevention

Do Not Pay Program

The Bureau of the Fiscal Service operates the groundbreaking Do Not Pay (DNP) Business Center, a comprehensive solution designed to prevent improper payments before they occur. Improper payments—including payments to deceased individuals, duplicate payments, and payments to ineligible recipients—cost the federal government tens of billions of dollars annually. The DNP system provides federal agencies with pre-payment screening tools that check potential recipients against multiple databases to identify and prevent improper payments.

The Do Not Pay program integrates data from numerous sources including the Death Master File, the System for Award Management exclusions database, debt and bankruptcy records, prisoner databases, and employment verification systems. By screening payments against these authoritative data sources before disbursement, agencies can stop fraudulent or improper payments before taxpayer money leaves the Treasury. This proactive approach has saved billions of dollars and continues to expand as more agencies adopt the system.

Since its inception, the DNP program has helped prevent over $6 billion in improper payments across federal agencies. The program analyzes more than 150 million records daily, providing real-time screening capabilities that integrate seamlessly with agency payment systems. This represents a fundamental shift from reactive recovery of improper payments to proactive prevention—a far more cost-effective approach to protecting taxpayer dollars.

Anti-Fraud Initiatives and Security Measures

The Department of the Treasury Bureau of the Fiscal Service employs sophisticated security measures and fraud detection systems to protect federal payments and financial data. With cybercrime and payment fraud evolving constantly, the bureau invests heavily in advanced technologies including artificial intelligence, machine learning, and behavioral analytics to identify suspicious patterns and prevent fraudulent transactions. These systems monitor millions of transactions daily, flagging anomalies that might indicate fraud, identity theft, or other criminal activity.

The bureau collaborates extensively with law enforcement agencies, financial institutions, and other government entities to combat payment fraud. When fraudulent schemes are detected, the Fiscal Service works with the Department of Justice, Secret Service, and FBI to investigate and prosecute perpetrators. This coordinated approach has led to numerous successful prosecutions of individuals and organized crime rings attempting to defraud federal payment systems.

Notable anti-fraud achievements include:

Suggested read: Instant, Accurate Service Quotes - Get Your Project Started Today!

- Detection and prevention of over $2 billion in fraudulent tax refund attempts annually

- Implementation of multi-factor authentication for TreasuryDirect accounts

- Enhanced identity verification procedures for high-value transactions

- Real-time transaction monitoring using advanced analytics

- Partnership with over 10,000 financial institutions to verify account ownership

Digital Innovation and Modernization

TreasuryDirect Platform

The TreasuryDirect platform represents the Fiscal Service’s commitment to providing accessible, secure, and user-friendly digital services to American investors and savers. This web-based system allows individuals to purchase and manage Treasury securities entirely online, eliminating the need for paper certificates and reducing administrative costs. The platform hosts accounts for millions of Americans who have collectively invested hundreds of billions of dollars in Treasury securities through this convenient digital channel.

TreasuryDirect offers numerous advantages over traditional brokerage accounts for Treasury security purchases. There are no fees or commissions charged, investments are backed by the full faith and credit of the U.S. government, and users maintain direct control over their holdings. The system automatically reinvests matured securities if desired, tracks all transactions for tax reporting purposes, and provides tools to calculate values and interest earnings. These features make TreasuryDirect particularly attractive for long-term savers and conservative investors seeking safety and simplicity.

The Bureau of the Fiscal Service continually enhances TreasuryDirect with new features and security measures. Recent improvements include enhanced mobile accessibility, simplified account recovery procedures, expanded customer service options, and integration with modern authentication methods. These updates reflect the bureau’s understanding that user experience directly impacts public participation in government securities programs and overall financial literacy.

Payment Modernization Initiatives

The Fiscal Service leads the federal government’s transition to modern payment technologies and standards. Through initiatives like same-day ACH processing, real-time payment capabilities, and enhanced electronic payment options, the bureau works to ensure that federal payments arrive faster, more securely, and more conveniently than ever before. This modernization extends beyond simply updating technology—it involves reimagining how government interacts financially with citizens, businesses, and other entities in the digital age.

The bureau has implemented Fedwire improvements that enable more efficient high-value payment processing, critical for major government expenditures and debt service payments. For lower-value, high-volume payments like Social Security benefits and tax refunds, the Fiscal Service has pioneered the adoption of faster ACH settlement, reducing the time between payment initiation and recipient access to funds. These improvements benefit millions of Americans who depend on timely receipt of federal payments for their financial stability.

Mobile payment options represent another frontier for the Department of the Treasury Bureau of the Fiscal Service. As smartphone adoption continues to grow and younger generations increasingly prefer mobile-first financial services, the bureau explores how to deliver federal payment services through mobile applications and digital wallets. These efforts aim to meet citizens where they are, providing government services through the devices and platforms people use daily.

Fiscal Service Organizational Structure

Bureau Leadership and Governance

The Bureau of the Fiscal Service operates under the leadership of the Commissioner of the Fiscal Service, who reports directly to the Treasury Department’s Under Secretary for Domestic Finance. This organizational placement reflects the bureau’s critical importance to the Treasury’s mission and the broader federal government’s financial operations. The Commissioner oversees a workforce of approximately 5,000 employees spread across multiple locations, with major operations centers in Parkersburg, West Virginia; Austin, Texas; Philadelphia, Pennsylvania; and Birmingham, Alabama.

The bureau’s organizational structure divides responsibilities among several key offices and divisions, each focusing on specific aspects of fiscal operations. The Office of Payments handles federal payment disbursement and the promotion of electronic payment methods. The Office of Revenue Collections Management oversees the collection of government revenue and the operation of the Treasury Offset Program. The Office of Public Debt Accounting manages the accounting, reporting, and servicing of the public debt. The Office of Fiscal Accounting and Shared Services provides financial management services to federal agencies.

Key leadership positions within the Fiscal Service include:

- Commissioner of the Fiscal Service (Chief Executive)

- Deputy Commissioner for Operations

- Deputy Commissioner for Finance and Administration

- Assistant Commissioner for Debt Management Services

- Assistant Commissioner for Payment Management

- Assistant Commissioner for Government-wide Accounting

Regional Operations and Service Centers

The Department of the Treasury Bureau of the Fiscal Service maintains several strategically located service centers that handle different aspects of its mission. The largest facility in Parkersburg, West Virginia, serves as the primary center for savings bond operations and debt management services. This location processes millions of savings bond transactions annually, maintains historical records dating back decades, and provides customer service to bondholders nationwide. The Parkersburg center’s expertise in legacy systems and historical financial instruments makes it indispensable to the bureau’s operations.

Austin, Texas hosts the Fiscal Service’s primary payment operations center, processing millions of federal payments daily. This facility handles everything from Social Security direct deposits to vendor payments, tax refunds to federal employee salaries. The Austin center’s state-of-the-art payment processing systems and redundant backup capabilities ensure that critical federal payments continue uninterrupted even during natural disasters, cyberattacks, or other disruptions. The center employs advanced security measures and 24/7 monitoring to protect payment systems and data.

Philadelphia and Birmingham support various specialized functions including revenue collection, debt collection, and agency financial services. These distributed operations provide resilience and redundancy, ensuring that no single point of failure can disrupt critical government financial operations. The geographic distribution also provides employment opportunities across multiple regions and allows the bureau to tap into diverse talent pools with different skills and experiences.

Services for Federal Agencies

Government-wide Accounting Services

The Fiscal Service provides comprehensive accounting services to federal agencies through its Government-wide Accounting (GWA) division. This office maintains the official financial records of the United States government, consolidating financial data from hundreds of agencies into unified reports that present the government’s overall financial position. These consolidated financial statements undergo rigorous audits and are published annually, providing transparency into how taxpayer dollars are collected, spent, and accounted for across the entire federal enterprise.

GWA services include operating the Governmentwide Treasury Account Symbol Adjusted Trial Balance System (GTAS), which collects and validates financial data from federal agencies. This system serves as the primary source of data for the Financial Report of the United States Government, a comprehensive annual document that presents the federal government’s financial condition similar to how a corporation reports to shareholders. The system’s standardized data formats and validation rules ensure consistency and accuracy across agency reports.

The division also operates the Central Accounting and Reporting System (CARS), which processes millions of accounting transactions daily and maintains the official record of the federal government’s cash position. CARS tracks every dollar that flows in and out of the Treasury, providing real-time visibility into the government’s available cash and helping manage daily borrowing needs. This system’s accuracy and reliability are essential for maintaining the government’s ability to meet its financial obligations on time.

Suggested read: User-Friendly Service Project Ideas for the Service-Minded

Federal Payment Solutions for Agencies

Federal agencies rely on the Bureau of the Fiscal Service to handle their payment operations through several comprehensive service offerings. The Invoice Processing Platform (IPP) provides a centralized solution for agencies to receive, validate, and process vendor invoices electronically. This system reduces paper-based processes, accelerates payment cycles, and improves accuracy by automating invoice matching and validation. Agencies using IPP report significant reductions in processing costs and payment errors compared to traditional manual systems.

The Secure Payment System (SPS) offers agencies a flexible platform for disbursing payments through multiple channels including direct deposit, prepaid cards, and checks. SPS handles payments for diverse purposes ranging from disaster relief to grant disbursements, adapting to each agency’s specific requirements while maintaining security and compliance standards. The system’s versatility makes it suitable for both routine recurring payments and one-time emergency disbursements, as demonstrated during the COVID-19 pandemic when it processed Economic Impact Payments to millions of Americans.

Agency benefits from Fiscal Service payment solutions:

- Reduced payment processing costs averaging 40% compared to agency-operated systems

- Improved payment accuracy with error rates below 0.1%

- Enhanced fraud prevention through integrated screening

- Standardized processes reducing compliance risks

- Access to payment expertise and best practices

- Scalability to handle volume fluctuations

- Disaster recovery and business continuity capabilities

Working with the Bureau of the Fiscal Service

For Individual Citizens and Taxpayers

Individual citizens interact with the Department of the Treasury Bureau of the Fiscal Service more frequently than they might realize. Tax refunds, Social Security benefits, veterans’ benefits, federal employee salaries, and numerous other payments all flow through Fiscal Service systems. Understanding how to effectively interact with the bureau can help individuals resolve payment issues, access their funds more quickly, and protect themselves from fraud. The bureau maintains robust customer service channels including phone support, online resources, and written correspondence options.

Citizens can visit fiscal.treasury.gov to access a wealth of information about federal payments, savings bonds, debt collection, and other services. The website provides tools to track payments, report problems, update direct deposit information, and learn about various programs. For savings bond holders, the TreasuryDirect.gov portal offers account management, purchase capabilities, and educational resources about different security types and investment strategies. These online resources are designed to be accessible and user-friendly, allowing citizens to self-serve for many common needs.

When issues arise—such as missing payments, incorrect amounts, or suspected fraud—the Fiscal Service provides multiple contact methods. The bureau’s customer service representatives can research payment status, initiate traces for missing funds, and coordinate with other agencies to resolve discrepancies. For debt collection issues, the bureau’s TOP call center helps individuals understand why offsets occurred and how to dispute them if they believe an error was made. These customer service functions handle millions of inquiries annually, reflecting the bureau’s massive impact on everyday Americans’ finances.

For Businesses and Government Contractors

Businesses that contract with the federal government rely heavily on the Bureau of the Fiscal Service for timely and accurate payment. The bureau processes billions of dollars in vendor payments annually, from small businesses providing local services to major defense contractors delivering complex systems. Understanding the federal payment process, including registration requirements, payment timelines, and troubleshooting procedures, is essential for businesses that derive significant revenue from government contracts.

All businesses seeking federal contracts must register in the System for Award Management (SAM), which the Fiscal Service uses to validate vendor information and routing details before disbursing payments. This registration includes providing tax identification numbers, banking information, and business certifications. The bureau cross-references SAM data with other databases to prevent payments to suspended or debarred entities and to ensure compliance with various federal requirements. Keeping SAM registration current is critical—outdated information often causes payment delays that frustrate contractors and slow project progress.

The Invoice Processing Platform and various agency-specific payment systems allow contractors to submit invoices electronically and track payment status. Electronic invoicing accelerates payment cycles compared to paper-based processes, often reducing the time from invoice submission to payment receipt by several weeks. The Fiscal Service encourages contractors to use electronic payment methods, which provide faster access to funds, better security, and improved record-keeping compared to paper checks.

Best practices for government contractors working with Fiscal Service systems:

- Maintain accurate and current SAM registration information

- Use electronic invoicing systems whenever available

- Enroll in electronic payment methods (ACH direct deposit)

- Keep detailed records of all invoices and payment confirmations

- Understand payment timelines and follow up proactively

- Report any payment discrepancies immediately

- Attend vendor outreach events and webinars hosted by agencies

Recent Developments and Future Initiatives

Response to COVID-19 Pandemic

The Department of the Treasury Bureau of the Fiscal Service played a pivotal role in the federal government’s financial response to the COVID-19 pandemic. The bureau rapidly scaled its operations to disburse unprecedented volumes of Economic Impact Payments (stimulus checks) to over 160 million Americans, totaling hundreds of billions of dollars across multiple payment rounds. This massive undertaking required the Fiscal Service to quickly develop new systems, coordinate with the IRS on eligibility determinations, and implement multiple payment channels to reach diverse populations including those without bank accounts or fixed addresses.

The pandemic response demonstrated both the bureau’s operational capabilities and the importance of payment modernization efforts. Electronic payment methods proved far faster and more efficient than paper checks, with direct deposits arriving within days while many paper checks took weeks to reach recipients. The Get My Payment web tool, developed jointly by the Fiscal Service and IRS, allowed Americans to track their payment status and update direct deposit information, handling billions of web sessions without major outages despite unprecedented traffic volumes.

Beyond stimulus payments, the Fiscal Service supported numerous other pandemic relief programs including Paycheck Protection Program loan disbursements, enhanced unemployment benefits, and various grant programs. The bureau’s infrastructure and expertise proved essential for rapidly delivering emergency funds to individuals and businesses nationwide. Lessons learned from the pandemic response continue to inform the bureau’s modernization efforts and emergency preparedness planning.

Ongoing Modernization Projects

The Bureau of the Fiscal Service continues investing heavily in technology modernization to improve efficiency, security, and user experience. Current initiatives include migrating legacy systems to cloud-based platforms, implementing artificial intelligence and machine learning for fraud detection and process automation, and enhancing cybersecurity defenses against evolving threats. These modernization efforts aim to transform the bureau from a traditional transaction processor into a digital-first financial services provider capable of meeting 21st-century expectations.

Suggested read: Ultimate Guide to Service Marks: Protecting Your Brand Identity

One significant ongoing project involves redesigning the TreasuryDirect platform with modern web technologies, improved mobile compatibility, and enhanced security features. The current system, while functional, relies on older technologies that limit flexibility and user experience. The redesigned platform will provide a more intuitive interface, better performance, and expanded capabilities while maintaining the security and reliability that users depend on for their investments. This multi-year effort reflects the bureau’s commitment to continuous improvement and customer service excellence.

The Fiscal Service also explores emerging payment technologies including real-time payments, blockchain applications for certain use cases, and integration with innovative identity verification methods. While the bureau must balance innovation with security and reliability—mistakes in federal payment systems can have severe consequences—it recognizes that staying current with technology trends is essential for serving modern citizens and agencies effectively. These explorations often involve partnerships with fintech companies, academic institutions, and other government agencies.

Connecting Federal Financial Services

Integration with Healthcare Financial Systems

The Department of the Treasury Bureau of the Fiscal Service plays an important role in processing payments for various federal healthcare programs and facilities. Federal healthcare facilities like the martin luther king jr multi service ambulatory care center and similar institutions rely on Fiscal Service payment systems to receive operational funding, disburse employee salaries, and pay vendors. This integration ensures that critical healthcare services continue uninterrupted, with reliable funding flows supporting everything from routine appointments to emergency care for veterans and other beneficiaries.

Healthcare-related federal payments represent billions of dollars annually, including Medicare provider payments, Veterans Health Administration expenses, Indian Health Service funding, and numerous grant programs supporting public health initiatives. The Fiscal Service ensures these payments flow efficiently and accurately, recognizing that delays or errors in healthcare payments can have direct impacts on patient care. The bureau’s payment systems accommodate the complex requirements of healthcare billing, including coordination with medical coding systems, insurance verification, and compliance with healthcare-specific regulations.

The connection between fiscal operations and healthcare extends to revenue collection as well. The Fiscal Service collects Medicare premiums, health insurance penalties, and various healthcare-related fees on behalf of federal health agencies. This collection function helps fund healthcare programs and ensures that individuals and entities meet their financial obligations to support public health systems. The bureau’s debt collection capabilities also apply to delinquent healthcare-related debts, though with appropriate protections and procedures recognizing the sensitive nature of medical financial issues.

Call to Action: Engage with the Bureau of the Fiscal Service

Understanding how the Department of the Treasury Bureau of the Fiscal Service operates empowers you to better manage your interactions with federal financial systems. Whether you’re expecting a tax refund, holding savings bonds, contracting with federal agencies, or simply interested in government financial management, staying informed about Fiscal Service operations helps you navigate these systems more effectively.

Take these actions to engage with the Bureau of the Fiscal Service:

- Visit the official website at fiscal.treasury.gov to explore resources and learn about services relevant to your situation

- Check your savings bonds using the Treasury Hunt tool to find any unredeemed or matured bonds you may have forgotten

- Enroll in direct deposit for any federal payments you receive to ensure faster, safer delivery of your funds

- Register on TreasuryDirect if you’re interested in investing directly in U.S. Treasury securities without broker fees

- Update your information in SAM if you’re a government contractor to prevent payment delays

- Report suspected fraud if you encounter suspicious communications claiming to be from the Fiscal Service

- Subscribe to updates to receive notifications about important changes to payment systems or new services

The Bureau of the Fiscal Service welcomes feedback and questions from the public. If you have concerns about a payment, questions about debt collection, or need assistance with savings bonds or Treasury securities, don’t hesitate to reach out through appropriate channels. The bureau’s customer service teams are trained to assist with a wide range of issues and can help resolve problems efficiently.

Frequently Asked Questions About the Department of the Treasury Bureau of the Fiscal Service

What does the Department of the Treasury Bureau of the Fiscal Service do?

The Department of the Treasury Bureau of the Fiscal Service serves as the federal government’s financial manager, handling revenue collection, payment disbursement, debt management, and government-wide accounting. The bureau collects taxes and fees, distributes federal payments like Social Security benefits and tax refunds, manages U.S. savings bonds and Treasury securities, and maintains the official accounting records of the federal government. Essentially, almost every financial transaction involving the federal government flows through systems operated or managed by the Fiscal Service.

How do I contact the Bureau of the Fiscal Service about a missing payment?

To inquire about a missing federal payment, first determine which agency authorized the payment (such as the IRS for tax refunds or the Social Security Administration for benefits). Then contact that agency’s customer service line, as they maintain payment records and can initiate traces. For general payment inquiries, you can call the Bureau of the Fiscal Service at their toll-free number 1-855-868-0151 or visit fiscal.treasury.gov for online resources. Have your Social Security number, payment type, and expected payment amount ready when contacting them to expedite assistance.

What is the Treasury Offset Program and why was my payment reduced?

The Treasury Offset Program (TOP) is administered by the Bureau of the Fiscal Service to collect delinquent debts owed to federal agencies or state governments. If you have unpaid debts such as back taxes, defaulted student loans, child support arrearages, or other obligations, TOP can intercept federal payments you’re expecting (like tax refunds) to satisfy those debts. You should receive a notice explaining the offset before or shortly after it occurs. If you believe an offset was made in error, you can contact TOP at 1-800-304-3107 to dispute it and request a review.

How do I cash or redeem my old savings bonds?

To redeem paper savings bonds, you can visit most financial institutions where you have an account, as many banks and credit unions offer this service. Bring valid identification and your Social Security number along with the bonds. For electronic bonds held in TreasuryDirect, simply log into your account and follow the redemption instructions—funds typically transfer to your linked bank account within one business day. If you have questions about bond values, maturity dates, or eligibility for redemption, the Bureau of the Fiscal Service provides a Savings Bond Calculator at treasurydirect.gov that helps determine current values.

Can I buy Treasury securities without going through a broker?

Yes, the Department of the Treasury Bureau of the Fiscal Service operates TreasuryDirect, an online platform specifically designed to let individuals purchase Treasury securities directly from the government without paying broker fees or commissions. You can buy Treasury bills, notes, bonds, TIPS (Treasury Inflation-Protected Securities), and savings bonds through TreasuryDirect. To get started, visit treasurydirect.gov and open a free account using your Social Security number, bank account information, and email address. The platform provides educational resources to help you understand different security types and make informed investment decisions.

What should I do if I receive a suspicious call claiming to be from the Fiscal Service?

The Bureau of the Fiscal Service does not make unsolicited phone calls demanding immediate payment or threatening arrest. If you receive such a call, it’s likely a scam. Do not provide personal information, financial details, or make any payments. Legitimate communications from the Fiscal Service typically come through official mail correspondence or through secure channels when you’ve initiated contact. Report suspicious calls to the Treasury Inspector General’s fraud hotline at 1-800-359-3898 or online at treasury.gov/tigta. You can verify the legitimacy of any communication by contacting the Fiscal Service directly through official numbers listed on fiscal.treasury.gov.

Suggested read: The Essential Guide to Finding a Top-Notch Service Professor

How long does it take to receive a federal payment after it’s issued?

Payment delivery times vary by payment method. Direct deposits typically arrive within one to three business days after the Fiscal Service releases the payment from the originating agency. Paper checks sent through mail generally take seven to ten business days, though delivery times can vary based on postal service efficiency and your location. For urgent payments, agencies sometimes use expedited delivery services. You can check payment status through the issuing agency’s systems—for example, the IRS provides a “Where’s My Refund” tool for tax refunds. Setting up direct deposit significantly reduces wait times compared to paper checks.

What is the role of the Bureau of the Fiscal Service in managing the national debt?

The Bureau of the Fiscal Service serves as the accountant and bookkeeper for the entire U.S. public debt, which includes tracking every Treasury security issued, processing interest payments, handling security redemptions, and publishing daily debt reports. The bureau maintains precise records of who owns government debt instruments, when they mature, and how much interest is owed. Through the TreasuryDirect platform and partnerships with financial institutions, the Fiscal Service enables investors worldwide to purchase Treasury securities, providing the government with necessary borrowing capacity. The bureau also publishes transparent debt data at fiscaldata.treasury.gov, allowing citizens, researchers, and policymakers to understand the government’s borrowing and fiscal position.

Conclusion: The Foundation of Federal Financial Operations

The Department of the Treasury Bureau of the Fiscal Service operates largely behind the scenes, yet its work touches virtually every American and forms the foundation of federal financial operations. From the Social Security check deposited monthly to elderly beneficiaries, to the savings bond purchased for a newborn grandchild, to the tax refund credited to millions of accounts each spring, the Fiscal Service makes these transactions possible with remarkable efficiency and reliability. The bureau’s sophisticated systems process trillions of dollars annually while maintaining accuracy rates that exceed 99.9%, a testament to the dedication and expertise of its workforce.

As government services continue evolving toward digital delivery, the Bureau of the Fiscal Service stands at the forefront of financial innovation within the federal government. The bureau’s modernization efforts, fraud prevention initiatives, and commitment to customer service reflect an understanding that citizens expect government financial services to match the convenience and security they experience in the private sector. While challenges remain—particularly around cybersecurity, legacy system migration, and serving diverse populations with varying technology access—the Fiscal Service’s track record inspires confidence in its ability to adapt and improve.

Understanding the Department of the Treasury Bureau of the Fiscal Service and its role in government financial management benefits every citizen. Whether you’re a taxpayer, investor, federal employee, government contractor, or beneficiary of federal programs, knowing how to interact effectively with Fiscal Service systems helps you receive payments promptly, invest safely, and resolve issues efficiently. The bureau welcomes public engagement and provides extensive resources to help Americans understand and access its services.

For the most current information, official announcements, and access to various services, visit the Bureau of the Fiscal Service official website at fiscal.treasury.gov. There you’ll find detailed guides, contact information, online tools, and resources covering every aspect of the bureau’s mission. By staying informed and engaging proactively with these systems, you can ensure smooth financial interactions with your federal government and better understand how public funds are collected, managed, and distributed for the benefit of all Americans.

Sources and Citations:

- U.S. Department of the Treasury, Bureau of the Fiscal Service. “About Us.” https://fiscal.treasury.gov/about/

- U.S. Department of the Treasury. “Treasury Offset Program.” https://fiscal.treasury.ov/top/

- TreasuryDirect. “Treasury Securities & Programs.” https://www.treasurydirect.gov

- U.S. Department of the Treasury. “Do Not Pay Business Center.” https://fiscal.treasury.gov/dnp/

- U.S. Government Accountability Office. “Fiscal Service Operations and Programs” (Various reports and audits)