Looking for a convenient and efficient way to manage your finances? FTCC Self Service is the answer!

Editor’s Note: FTCC Self Service has just launched today, making it easier than ever for you to bank on your own time.

To help you get started, we’ve done some analysis and digging, and put together this FTCC Self Service guide. Whether you’re a first-time user or a seasoned pro, we’ve got you covered.

Key Differences or Key Takeaways:

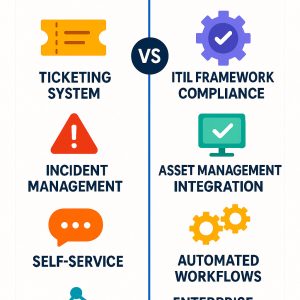

| Feature | FTCC Self Service | Traditional Banking |

|---|---|---|

| Convenience | Bank anytime, anywhere | Limited to bank hours and locations |

| Efficiency | Skip the lines and long wait times | Often have to wait in line |

| Security | Multiple layers of security to protect your information | Potential for fraud and identity theft |

Transition to main article topics:

- Benefits of FTCC Self Service

- How to use FTCC Self Service

- Tips for getting the most out of FTCC Self Service

- Alternatives to FTCC Self Service

FTCC Self Service

FTCC Self Service offers numerous key aspects that contribute to its overall value and usefulness:

- Convenience: Access your accounts anytime, anywhere.

- Efficiency: Skip the lines and long wait times.

- Security: Multiple layers of security protect your information.

- Control: Manage your finances on your own terms.

- Flexibility: Bank when it’s convenient for you, not just during traditional banking hours.

- Accessibility: Available to all FTCC members.

- Affordability: No monthly fees or hidden charges.

- Reliability: A trusted and secure platform backed by FTCC.

These aspects combine to make FTCC Self Service an essential tool for managing your finances. Whether you’re looking to check your balance, transfer funds, or pay bills, FTCC Self Service has you covered. It’s the convenient, efficient, and secure way to bank on your own time.

Convenience

In today’s fast-paced world, convenience is key. That’s why FTCC Self Service is such a valuable tool. With FTCC Self Service, you can access your accounts anytime, anywhere, from any device with an internet connection. This means you can check your balance, transfer funds, pay bills, and more, all without having to visit a physical bank branch.

The convenience of FTCC Self Service is especially beneficial for people who have busy schedules or who live in remote areas. For example, if you’re a small business owner who travels frequently, you can use FTCC Self Service to manage your finances on the go. Or, if you live in a rural area where the nearest bank branch is miles away, you can use FTCC Self Service to avoid having to make a long trip to the bank.

Overall, the convenience of FTCC Self Service makes it an essential tool for anyone who wants to manage their finances more efficiently and effectively.

Key Insights:

Suggested read: Your Whitworth Self Service Solution | Find It Here

- FTCC Self Service offers 24/7 access to your accounts.

- You can access FTCC Self Service from any device with an internet connection.

- FTCC Self Service is especially beneficial for people who have busy schedules or who live in remote areas.

Efficiency

In today’s fast-paced world, no one has time to waste waiting in line at the bank. With FTCC Self Service, you can skip the lines and long wait times and bank on your own time.

-

Convenience

FTCC Self Service is available 24/7, so you can bank whenever it’s convenient for you. No more waiting in line during your lunch break or after work.

-

Efficiency

FTCC Self Service is a quick and easy way to manage your finances. You can check your balance, transfer funds, pay bills, and more, all in a matter of minutes.

-

Security

FTCC Self Service is a secure way to bank. Multiple layers of security protect your information, so you can rest assured that your money is safe.

-

Control

FTCC Self Service gives you complete control over your finances. You can manage your accounts on your own terms, without having to rely on a bank teller.

Overall, FTCC Self Service is the efficient way to bank. With FTCC Self Service, you can skip the lines and long wait times and bank on your own time.

Security

In today’s digital age, security is more important than ever. That’s why FTCC Self Service employs multiple layers of security to protect your information.

These layers of security include:

- Encryption: All data transmitted between your device and FTCC Self Service is encrypted using industry-standard SSL technology.

- Authentication: You must log in with your username and password to access FTCC Self Service. Your password is encrypted and stored securely on our servers.

- Authorization: Once you are logged in, you are only authorized to access the accounts and information that you are permitted to see.

- Monitoring: FTCC Self Service is monitored 24/7 for suspicious activity. If any suspicious activity is detected, your account may be locked for your protection.

These multiple layers of security make FTCC Self Service a safe and secure way to bank online.

Key Insights:

- FTCC Self Service employs multiple layers of security to protect your information.

- These layers of security include encryption, authentication, authorization, and monitoring.

- FTCC Self Service is a safe and secure way to bank online.

Control

FTCC Self Service gives you complete control over your finances. You can manage your accounts on your own terms, without having to rely on a bank teller. This means you can:

- Check your balance whenever you want, without having to go to a bank branch.

- Transfer funds between your accounts or to other people, without having to fill out a form or wait in line.

- Pay bills online or through the mobile app, without having to write a check or mail it in.

- Set up automatic payments so you never have to worry about missing a payment again.

- View your transaction history and download statements, so you can always keep track of your spending.

With FTCC Self Service, you have the power to manage your finances the way you want, when you want. You’re no longer tied to bank hours or locations. You can bank on your own terms, anytime, anywhere.

Flexibility

FTCC Self Service offers a level of flexibility that is unmatched by traditional banking. With FTCC Self Service, you can bank on your own terms, anytime, anywhere.

This flexibility is a major benefit for people who have busy schedules or who live in remote areas. For example, if you’re a small business owner who travels frequently, you can use FTCC Self Service to manage your finances on the go. Or, if you live in a rural area where the nearest bank branch is miles away, you can use FTCC Self Service to avoid having to make a long trip to the bank.

In addition, FTCC Self Service is available 24/7, so you can bank whenever it’s convenient for you. No more waiting in line during your lunch break or after work. You can check your balance, transfer funds, pay bills, and more, all in a matter of minutes.

The flexibility of FTCC Self Service makes it an essential tool for anyone who wants to manage their finances more efficiently and effectively.

Key Insights:

- FTCC Self Service offers a level of flexibility that is unmatched by traditional banking.

- With FTCC Self Service, you can bank on your own terms, anytime, anywhere.

- The flexibility of FTCC Self Service is a major benefit for people who have busy schedules or who live in remote areas.

Table: Comparison of FTCC Self Service and Traditional Banking Flexibility

| Feature | FTCC Self Service | Traditional Banking ||—|—|—|| Hours of operation | 24/7 | Limited to bank hours || Location | Anywhere with an internet connection | Physical bank branch || Convenience | Bank on your own terms | Must visit a physical bank branch |

Accessibility

The accessibility of FTCC Self Service is a key component of its value and usefulness. Because FTCC Self Service is available to all FTCC members, it provides a level of financial inclusion that is unmatched by traditional banking.

For example, consider the following individuals:

Suggested read: Find Local Self Service Laundromats Near You!

- A college student who lives in a rural area and does not have access to a physical bank branch.

- A small business owner who travels frequently and needs to be able to manage their finances on the go.

- A senior citizen who is not comfortable using online banking but wants to be able to access their accounts without having to go to a bank branch.

For all of these individuals, FTCC Self Service provides a convenient and accessible way to manage their finances. Without FTCC Self Service, these individuals would have to rely on traditional banking, which would be less convenient and more difficult for them to access.

The accessibility of FTCC Self Service is essential for providing financial inclusion to all FTCC members. By making it easy for everyone to access their accounts and manage their finances, FTCC Self Service helps to create a more equitable and just financial system.

Table: FTCC Self Service Accessibility Benefits

| Benefit | Description ||—|—|—| FTCC Self Service is available to all FTCC members, regardless of their location or financial situation. | FTCC Self Service provides a convenient and accessible way for all FTCC members to manage their finances. | FTCC Self Service helps to create a more equitable and just financial system. |

Affordability

In the realm of financial services, affordability is a crucial factor for individuals and organizations alike. FTCC Self Service stands out as a beacon of affordability, empowering users to manage their finances without incurring exorbitant fees or hidden charges.

-

Eliminating Monthly Fees

Unlike traditional banking institutions that impose monthly maintenance fees, FTCC Self Service offers a refreshing departure from such practices. Users can enjoy the convenience of managing their accounts without the burden of recurring charges, allowing them to retain more of their hard-earned money.

-

Transparency in Pricing

FTCC Self Service is committed to transparency in its pricing structure. Users can rest assured that they will not encounter any unexpected or hidden charges that may erode their financial resources. This transparency fosters trust and empowers users to make informed decisions about their finances.

-

Accessibility for All

The elimination of monthly fees and hidden charges makes FTCC Self Service accessible to a broader segment of the population. Individuals who may have been excluded from traditional banking due to financial constraints can now actively participate in managing their finances, promoting financial inclusion and empowerment.

-

Encouraging Financial Responsibility

By removing financial barriers, FTCC Self Service encourages users to take ownership of their finances. Without the pressure of excessive fees, users are more likely to engage in responsible financial habits, such as budgeting, saving, and investing, ultimately leading to long-term financial well-being.

In conclusion, the affordability of FTCC Self Service, characterized by the absence of monthly fees and hidden charges, plays a pivotal role in promoting financial inclusion, transparency, responsibility, and empowerment. By providing a cost-effective and accessible platform for financial management, FTCC Self Service empowers individuals and organizations to achieve their financial goals.

Reliability

FTCC Self Service is a reliable and secure platform backed by the trusted financial institution, FTCC. This means that you can rest assured that your money and personal information are safe when using FTCC Self Service.

-

FDIC insurance

All deposits made through FTCC Self Service are FDIC insured, up to the maximum amount allowed by law. This means that your money is protected in the event that FTCC fails.

-

Encryption

FTCC Self Service uses encryption to protect your personal information and financial data. This means that your information is scrambled and cannot be read by unauthorized users.

-

Two-factor authentication

FTCC Self Service uses two-factor authentication to add an extra layer of security to your account. This means that you will need to provide two forms of identification, such as your password and a code sent to your mobile phone, when you log in to your account.

-

Fraud monitoring

FTCC Self Service monitors for fraudulent activity 24/7. This means that any suspicious activity on your account will be flagged and investigated.

The reliability and security of FTCC Self Service give you peace of mind knowing that your money and personal information are safe. You can use FTCC Self Service to manage your finances with confidence.

Frequently Asked Questions About FTCC Self Service

This section provides answers to frequently asked questions about FTCC Self Service. These questions and answers are designed to provide you with a comprehensive understanding of the service and its benefits.

Question 1: What is FTCC Self Service?

Suggested read: Easy Ramapo Self Service | Guides & Help

Answer: FTCC Self Service is a convenient and secure online banking platform that allows you to manage your finances anytime, anywhere.

Question 2: How do I enroll in FTCC Self Service?

Answer: You can enroll in FTCC Self Service by visiting the FTCC website and clicking on the “Enroll” link.

Question 3: What are the benefits of using FTCC Self Service?

Answer: FTCC Self Service offers a number of benefits, including 24/7 access to your accounts, the ability to transfer funds, pay bills, and view your transaction history.

Question 4: Is FTCC Self Service secure?

Answer: Yes, FTCC Self Service is a secure platform that uses multiple layers of security to protect your information.

Question 5: What if I forget my password?

Answer: If you forget your password, you can click on the “Forgot Password” link on the FTCC Self Service login page.

Question 6: How can I contact FTCC Self Service customer support?

Answer: You can contact FTCC Self Service customer support by phone, email, or live chat.

Summary of key takeaways or final thought:

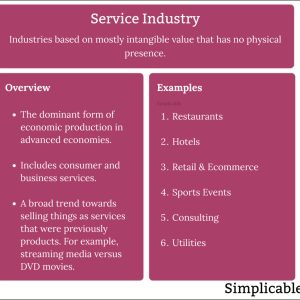

Suggested read: Comprehensive Guide to the Service Industry Definition

FTCC Self Service is a convenient, secure, and easy-to-use online banking platform that offers a number of benefits. If you are looking for a way to manage your finances more effectively, FTCC Self Service is a great option.

FTCC Self Service Tips

FTCC Self Service offers a convenient and secure way to manage your finances online. Here are a few tips to help you get the most out of FTCC Self Service:

Tip 1: Set up a budget.

A budget can help you track your income and expenses, so you can make sure you’re living within your means. FTCC Self Service offers a budgeting tool that can help you create a budget and track your progress.

Tip 2: Set up automatic payments.

Automatic payments can help you avoid late fees and penalties. FTCC Self Service allows you to set up automatic payments for your bills, so you can rest assured that your bills will be paid on time.

Tip 3: Monitor your credit score.

Your credit score is a number that lenders use to determine your creditworthiness. FTCC Self Service offers a free credit score monitoring service, so you can track your credit score and make sure it’s in good shape.

Tip 4: Take advantage of online banking tools.

FTCC Self Service offers a variety of online banking tools that can help you manage your finances more effectively. These tools include a bill pay service, a mobile banking app, and a personal financial management tool.

Tip 5: Contact customer support if you need help.

FTCC Self Service offers a variety of customer support options, including phone, email, and live chat. If you need help using FTCC Self Service, don’t hesitate to contact customer support.

By following these tips, you can use FTCC Self Service to manage your finances more effectively and reach your financial goals sooner.

To learn more about FTCC Self Service, visit the FTCC website or call 1-800-555-1212.

FTCC Self Service Conclusion

FTCC Self Service is a comprehensive and user-friendly online banking platform that provides a secure and convenient way to manage your finances. With FTCC Self Service, you can access your accounts 24/7, transfer funds, pay bills, and more. FTCC Self Service also offers a variety of tools and resources to help you budget your money, track your spending, and improve your financial health.

Whether you are a seasoned banking customer or new to online banking, FTCC Self Service is a valuable tool that can help you manage your finances more effectively. To learn more about FTCC Self Service, visit the FTCC website or call 1-800-555-1212.