What credit score is needed to rent an apartment? A credit score is a number that lenders use to assess your creditworthiness. It is based on your credit history, which includes factors such as your payment history, the amount of debt you have, and the length of your credit history.

Editor’s Note: “What credit score is needed to rent an apartment” have published on date to help who interest to rent a apartment to make decision base on credit score.

We analyzed and dug into the topic and put together this “what credit score is needed to rent an apartment” guide to help you make the right decision.

Key Differences

Main Article Topics

What Credit Score Is Needed to Rent an Apartment

A credit score is a number that lenders use to assess your creditworthiness. It is based on your credit history, which includes factors such as your payment history, the amount of debt you have, and the length of your credit history. A good credit score can help you qualify for a loan or credit card with a lower interest rate. It can also make it easier to rent an apartment.

- Credit score range: Most landlords will look for a credit score in the range of 620 to 650.

- Payment history: Your payment history is one of the most important factors in your credit score. Late payments can have a negative impact on your score.

- Amount of debt: The amount of debt you have relative to your income is another important factor in your credit score. A high debt-to-income ratio can make it difficult to qualify for a loan or apartment.

- Length of credit history: The length of your credit history is also a factor in your credit score. Lenders like to see a long and stable credit history.

- Type of credit: The type of credit you have can also affect your credit score. For example, having a mix of credit cards, installment loans, and mortgages can help you build a good credit score.

- Inquiries: Hard inquiries, which occur when you apply for new credit, can temporarily lower your credit score.

- Public records: Public records, such as bankruptcies and foreclosures, can also have a negative impact on your credit score.

- Credit utilization ratio: Your credit utilization ratio is the amount of credit you are using compared to your total available credit. A high credit utilization ratio can lower your credit score.

- Age of accounts: The age of your credit accounts is also a factor in your credit score. Older accounts can help you build a good credit history.

- Negative information: Negative information, such as late payments and collections, can stay on your credit report for seven years. This can make it difficult to qualify for a loan or apartment.

By understanding the factors that affect your credit score, you can take steps to improve your score and make it easier to rent an apartment.

Credit Score Range

In the realm of apartment hunting, a credit score is a crucial factor that can significantly impact your chances of securing your desired rental property. Landlords often utilize credit scores as a means of assessing a prospective tenant’s financial responsibility and trustworthiness. A higher credit score indicates a history of timely payments, responsible credit management, and a lower risk of default, making you a more attractive candidate in the eyes of landlords.

-

Understanding Credit Score Ranges

Credit scores typically fall within a range of 300 to 850. A score in the range of 620 to 650 is generally considered “fair” or “good” by most landlords. This range suggests that you have a history of mostly on-time payments, a manageable level of debt, and a reasonable credit utilization ratio. While it may not be the most exceptional score, it is sufficient to meet the requirements of many landlords.

-

Impact on Rental Applications

When submitting a rental application, your credit score will be a key factor in the landlord’s decision-making process. A score within the 620 to 650 range will likely increase your chances of approval, as it demonstrates your financial stability and reliability. Landlords are more likely to rent to tenants who they perceive as responsible and low-risk.

-

Variations in Landlord Requirements

Suggested read: Uncover the Hidden Truths: Explore the Surefire Signs of a Needed Root Canal

It is important to note that credit score requirements may vary from landlord to landlord. Some landlords may have stricter requirements, seeking tenants with scores in the “good” or “very good” range (670-739 or higher). Conversely, some landlords may be more lenient, accepting applicants with scores in the “fair” range (580-669). Researching the specific requirements of potential landlords can help you determine if your credit score meets their criteria.

-

Improving Your Credit Score

If your credit score falls below the 620 to 650 range, there are steps you can take to improve it. Paying your bills on time, reducing your debt, and limiting your credit utilization can all contribute to a higher credit score over time. Building a positive credit history by using a credit card responsibly and making consistent payments can also boost your score.

In conclusion, understanding the connection between “Credit score range: Most landlords will look for a credit score in the range of 620 to 650.” and “what credit score is needed to rent an apartment” is essential for navigating the rental market successfully. By maintaining a credit score within this range, you can increase your chances of securing your desired rental property and demonstrate your financial responsibility to potential landlords.

Payment history

When considering “what credit score is needed to rent an apartment,” your payment history plays a crucial role. Landlords often rely on credit scores to assess a prospective tenant’s financial responsibility, and payment history is a key component of that assessment. A consistent record of timely rent payments is essential for maintaining a good credit score.

Late payments, on the other hand, can significantly damage your credit score. Even a single missed or delayed payment can have a negative impact. This is because payment history accounts for 35% of your FICO Score, the most commonly used credit scoring model. A history of late payments can lower your score, making it more difficult to qualify for an apartment rental.

For example, let’s say you have a credit score of 650. If you make a late payment on your rent, your score could drop by 20 points or more. This could push your score below the 620 to 650 range that is typically required by most landlords. As a result, you may face challenges in securing an apartment rental.

Conversely, a strong payment history can positively impact your credit score. Consistently making rent payments on time demonstrates your financial reliability and responsibility. This can help you build a good credit score, making you a more attractive candidate for landlords.

It is important to note that the impact of late payments on your credit score can vary depending on your overall credit history. If you have a history of consistently making payments on time, a single late payment may not have a significant impact on your score. However, if you have a history of late payments, even a single additional late payment can further damage your score.

To maintain a good payment history and improve your credit score, it is essential to prioritize rent payments and make them on time, every time. You can also set up automatic payments to avoid missing due dates. By managing your payment history responsibly, you can increase your chances of securing an apartment rental and building a strong credit score.

Amount of debt

The amount of debt you have relative to your income is another important factor that landlords consider when evaluating your credit score for an apartment rental. Your debt-to-income ratio (DTI) is calculated by dividing your monthly debt payments by your monthly gross income. A high DTI can make it difficult to qualify for a loan or apartment because it indicates that a significant portion of your income is already being used to pay off debt.

-

Understanding Debt-to-Income Ratio

A DTI of 36% or less is generally considered to be a good ratio. This means that you are spending no more than 36% of your monthly income on debt payments. However, some landlords may be willing to accept a DTI of up to 43%, depending on your other financial factors, such as your credit score and rental history.

-

Impact on Rental Applications

If your DTI is too high, it can make it difficult to qualify for an apartment rental. Landlords are concerned that if you have a high DTI, you may not have enough money left over each month to cover your rent and other expenses. This can increase the risk of you falling behind on your rent payments.

-

Managing Your DTI

If your DTI is too high, there are steps you can take to lower it. One way is to increase your income. This can be done by getting a raise, getting a second job, or starting a side hustle. Another way to lower your DTI is to reduce your debt. This can be done by paying down your debt faster, consolidating your debt, or getting a debt consolidation loan.

By understanding the connection between “Amount of debt: The amount of debt you have relative to your income is another important factor in your credit score. A high debt-to-income ratio can make it difficult to qualify for a loan or apartment.” and “what credit score is needed to rent an apartment,” you can take steps to improve your financial situation and increase your chances of securing an apartment rental.

Length of credit history

The length of your credit history is an important factor in your credit score. Lenders like to see a long and stable credit history because it indicates that you have been managing credit responsibly for an extended period of time. A long credit history also provides more data for lenders to assess, which can help them make a more accurate assessment of your creditworthiness.

When it comes to renting an apartment, a longer credit history can be beneficial. Landlords often use credit scores to screen tenants, and a longer credit history can help you qualify for a better interest rate on a security deposit or even get approved for an apartment that you might not otherwise be eligible for.

Here are some tips for building a long and stable credit history:

- Open a credit card or loan account as soon as you are eligible.

- Use your credit card regularly and pay your bills on time, every time.

- Don’t close old credit accounts, even if you don’t use them anymore.

- Avoid opening too many new credit accounts in a short period of time.

By following these tips, you can build a long and stable credit history that will help you qualify for the best possible interest rates and terms on loans and apartments.

Key Insights

- The length of your credit history is a factor in your credit score.

- A longer credit history can help you qualify for a better interest rate on a security deposit or even get approved for an apartment that you might not otherwise be eligible for.

- You can build a long and stable credit history by opening a credit card or loan account as soon as you are eligible, using your credit card regularly and paying your bills on time, every time, not closing old credit accounts, even if you don’t use them anymore, and avoiding opening too many new credit accounts in a short period of time.

Type of credit

In the context of renting an apartment, the type of credit you have can play a role in determining your eligibility and the terms of your lease. Landlords often use credit scores to assess a prospective tenant’s financial responsibility and trustworthiness. A good credit score can indicate that you have a history of managing credit responsibly, which can make you a more attractive candidate for an apartment rental.

-

Facet 1: Mix of credit types

Having a mix of credit types, such as credit cards, installment loans, and mortgages, can help you build a good credit score. This demonstrates to lenders that you are capable of managing different types of credit responsibly. For example, if you have a credit card that you use for everyday purchases and an installment loan that you use to finance a car, this shows that you can handle both revolving and installment credit.

By understanding the connection between “Type of credit: The type of credit you have can also affect your credit score. For example, having a mix of credit cards, installment loans, and mortgages can help you build a good credit score.” and “what credit score is needed to rent an apartment,” you can take steps to improve your credit score and increase your chances of securing a desired rental property.

Inquiries

When exploring “what credit score is needed to rent an apartment,” it is essential to understand the impact of credit inquiries on your credit score. Hard inquiries, which occur when you apply for new credit, can temporarily lower your credit score.

-

Facet 1: Impact on Credit Score

Suggested read: Uncover Hidden Truths: Symptoms of an Impending Root Canal Unveiled

Hard inquiries can lower your credit score by a few points, typically ranging from 5 to 10 points. This is because hard inquiries indicate that you are actively seeking new credit, which can be seen as a sign of financial distress. However, the impact of hard inquiries is usually temporary and will disappear from your credit report after two years.

-

Facet 2: Multiple Inquiries

Applying for multiple lines of credit in a short period of time can result in multiple hard inquiries on your credit report. This can have a cumulative effect on your credit score, lowering it more significantly. It is important to avoid applying for too much new credit at once, especially if you are close to the credit score threshold required to rent an apartment.

-

Facet 3: Shopping for Loans

When shopping for loans, such as a mortgage or auto loan, it is important to be mindful of the number of credit inquiries you are generating. While it is acceptable to compare rates from different lenders, applying for multiple loans within a short time frame can negatively impact your credit score.

-

Facet 4: Apartment Hunting

When applying for apartments, it is common for landlords to run credit checks on prospective tenants. These credit checks typically result in hard inquiries on your credit report. However, most landlords understand that apartment hunting involves applying for multiple rentals, and they will usually consider the context of your inquiries when evaluating your credit score.

By understanding the connection between “Inquiries: Hard inquiries, which occur when you apply for new credit, can temporarily lower your credit score.” and “what credit score is needed to rent an apartment,” you can take steps to minimize the impact of credit inquiries on your score and increase your chances of securing your desired rental property.

Public records

When considering “what credit score is needed to rent an apartment,” it is essential to understand the impact of public records on your credit score. Public records are legal documents that contain information about an individual’s financial history, including bankruptcies and foreclosures. These records can have a significant negative impact on your credit score, making it more difficult to qualify for an apartment rental.

Bankruptcies and foreclosures are particularly damaging to your credit score because they indicate that you have failed to meet your financial obligations. When a bankruptcy or foreclosure is reported on your credit report, it can stay there for up to 10 years. This can make it difficult to rebuild your credit and qualify for an apartment rental, even if you have a good payment history since the bankruptcy or foreclosure.

If you have public records on your credit report, it is important to take steps to improve your credit score. This may include paying down debt, making on-time payments, and disputing any errors on your credit report. You may also consider getting a credit counseling or debt management plan to help you improve your financial situation.

By understanding the connection between “Public records: Public records, such as bankruptcies and foreclosures, can also have a negative impact on your credit score.” and “what credit score is needed to rent an apartment,” you can take steps to protect your credit score and increase your chances of securing an apartment rental.

Key Insights:

- Public records, such as bankruptcies and foreclosures, can have a significant negative impact on your credit score.

- Bankruptcies and foreclosures can stay on your credit report for up to 10 years, making it difficult to rebuild your credit and qualify for an apartment rental.

- If you have public records on your credit report, it is important to take steps to improve your credit score by paying down debt, making on-time payments, and disputing any errors on your credit report.

Credit utilization ratio

In the context of “what credit score is needed to rent an apartment,” understanding your credit utilization ratio is crucial. Landlords often use credit scores to assess a prospective tenant’s financial responsibility and stability. A high credit utilization ratio can negatively impact your credit score and potentially affect your chances of securing an apartment rental.

-

Facet 1: Impact on Credit Score

Your credit utilization ratio is a key factor in calculating your credit score. It measures the amount of credit you are using relative to your total available credit limits. A high credit utilization ratio indicates that you are using a significant portion of your available credit, which can be seen as a sign of financial strain. This can lower your credit score and make it more difficult to qualify for an apartment rental.

-

Facet 2: Ideal Credit Utilization Ratio

To maintain a good credit score, it is recommended to keep your credit utilization ratio below 30%. This means that you should not be using more than 30% of your total available credit. For example, if you have a credit card with a limit of $1,000, you should aim to keep your balance below $300.

-

Facet 3: Multiple Credit Accounts

If you have multiple credit accounts, it is important to manage your credit utilization ratio across all of them. Using too much credit on any one account, even if your overall credit utilization ratio is low, can still negatively impact your credit score.

-

Facet 4: Landlords’ Perspective

When evaluating a prospective tenant’s creditworthiness, landlords may consider the applicant’s credit utilization ratio. A high credit utilization ratio can raise concerns about the applicant’s ability to manage debt responsibly, which may affect their chances of being approved for an apartment rental.

By understanding the connection between “Credit utilization ratio: Your credit utilization ratio is the amount of credit you are using compared to your total available credit. A high credit utilization ratio can lower your credit score.” and “what credit score is needed to rent an apartment,” you can take steps to improve your credit utilization ratio and increase your chances of securing your desired rental property.

Age of accounts

The age of your credit accounts is an important factor in your credit score. Older accounts can help you build a good credit history, demonstrating your responsible credit management over an extended period of time. This can be especially beneficial when applying for an apartment, as landlords often use credit scores to assess a prospective tenant’s financial stability and reliability.

-

Facet 1: Length of Credit History

The length of your credit history is a key component of your credit score. Lenders like to see a long and stable credit history, as it indicates that you have been managing credit responsibly for an extended period of time. Older credit accounts contribute to the length of your credit history and can help you build a good credit score.

-

Facet 2: Payment History on Older Accounts

Your payment history on older accounts is also important. Consistent on-time payments on older credit accounts demonstrate your reliability and responsibility in managing debt. This can positively impact your credit score and make you a more attractive candidate for an apartment rental.

-

Facet 3: Credit Mix

Suggested read: Unveiling the Secrets: Your Ultimate Guide to a Perfect US Visa Photo

Having a mix of credit accounts, including older accounts, can also help you build a good credit score. This shows lenders that you are capable of managing different types of credit responsibly. For example, having a credit card that you have had for several years, along with a student loan or auto loan, can demonstrate your ability to handle both revolving and installment credit.

-

Facet 4: Landlords’ Perspective

When evaluating a prospective tenant’s creditworthiness, landlords may consider the age of their credit accounts. Older credit accounts can indicate a longer history of responsible credit management, which can increase your chances of being approved for an apartment rental.

By understanding the connection between “Age of accounts: The age of your credit accounts is also a factor in your credit score. Older accounts can help you build a good credit history.” and “what credit score is needed to rent an apartment,” you can take steps to manage your credit wisely and increase your chances of securing your desired rental property.

Negative information

When exploring “what credit score is needed to rent an apartment,” it is important to understand the impact of negative information on your credit report. Negative information, such as late payments and collections, can significantly lower your credit score and make it difficult to qualify for a loan or apartment.

-

Facet 1: Late Payments

Late payments are one of the most common types of negative information that can appear on your credit report. Even a single late payment can have a negative impact on your score, and multiple late payments can significantly lower it. Landlords often use credit scores to assess a prospective tenant’s financial responsibility, and a history of late payments can raise concerns about your ability to meet your rent payments on time.

-

Facet 2: Collections

Collections occur when a creditor sells your debt to a collection agency. This can happen if you have missed several payments on your debt. Collections can severely damage your credit score and make it difficult to qualify for credit in the future, including an apartment rental.

-

Facet 3: Length of Time

Negative information can stay on your credit report for up to seven years. This means that even if you have made significant improvements to your creditworthiness since a negative event, it may still be visible on your credit report and impact your ability to rent an apartment.

-

Facet 4: Impact on Rental Applications

When applying for an apartment, landlords will typically run a credit check on you. If your credit report contains negative information, it may make it more difficult to get approved for an apartment or you may have to pay a higher security deposit. In some cases, a landlord may even deny your application based on your credit history.

By understanding the connection between “Negative information: Negative information, such as late payments and collections, can stay on your credit report for seven years. This can make it difficult to qualify for a loan or apartment.” and “what credit score is needed to rent an apartment,” you can take steps to minimize the impact of negative information on your credit score and increase your chances of securing your desired rental property.

FAQs about “what credit score is needed to rent an apartment”

Renting an apartment often requires a credit check, and a good credit score can make the process easier and more affordable. Here are some frequently asked questions about credit scores and apartment rentals:

Question 1: What credit score do I need to rent an apartment?

Answer: Most landlords look for a credit score in the range of 620 to 650. However, requirements may vary depending on the specific landlord and property.

Question 2: What factors affect my credit score?

Answer: Payment history, amount of debt, length of credit history, type of credit, inquiries, and public records all impact your credit score.

Question 3: How can I improve my credit score?

Answer: Pay your bills on time, keep your credit utilization low, and limit new credit applications.

Question 4: What if I have negative information on my credit report?

Answer: Negative information can stay on your credit report for seven years. You can dispute errors on your credit report and take steps to improve your credit score over time.

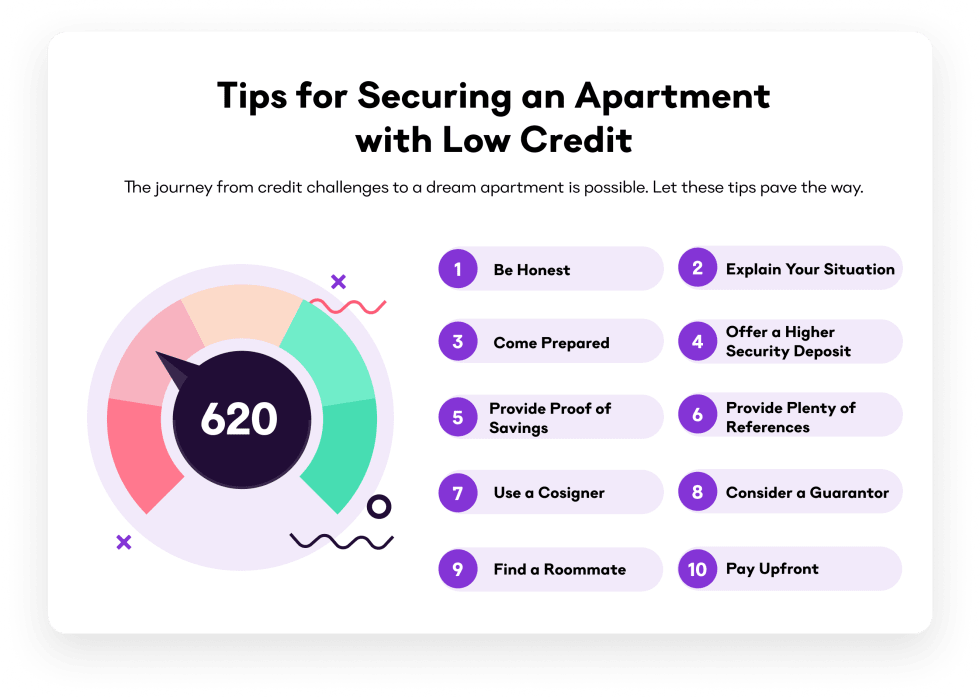

Question 5: Can I rent an apartment with a low credit score?

Suggested read: Unveiling the Secrets to College Success: "Penn State Grades Needed" Decoded

Answer: It is possible to rent an apartment with a low credit score, but you may have to pay a higher security deposit or find a landlord who is willing to work with you.

Question 6: What should I do if I’m denied an apartment due to my credit score?

Answer: Request a copy of your credit report to review for errors. You can also contact the landlord to discuss your situation and see if there are any other options.

Summary: Understanding the connection between “what credit score is needed to rent an apartment” and credit score factors can help you prepare for the rental process. By maintaining a good credit score and addressing any negative information on your credit report, you can increase your chances of securing your desired rental property.

Transition to the next article section: Understanding credit scores and their impact on apartment rentals is a crucial step in the apartment hunting process. With careful planning and responsible credit management, you can improve your chances of finding a suitable apartment and building a strong financial foundation.

Tips for Renting an Apartment

Securing an apartment rental often involves a credit check. By understanding the connection between “what credit score is needed to rent an apartment” and responsible credit management, you can increase your chances of success.

Tip 1: Check Your Credit Score

Obtain a copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) to review your credit history and identify any potential issues.

Tip 2: Dispute Errors

If you find any errors or outdated information on your credit report, dispute them with the credit bureaus. Correcting these errors can improve your credit score.

Tip 3: Pay Bills on Time

Timely payments are crucial for maintaining a good credit score. Set up reminders or automatic payments to avoid missed due dates.

Tip 4: Reduce Debt

High levels of debt can negatively impact your credit score. Make a plan to pay down your debt and keep your credit utilization ratio low.

Tip 5: Limit New Credit Applications

Applying for multiple lines of credit in a short period can result in multiple hard inquiries on your credit report. Limit new credit applications to avoid potential damage to your score.

Tip 6: Build a Positive Credit History

If you have a limited credit history, consider getting a secured credit card or becoming an authorized user on someone else’s credit card to establish a positive payment history.

Tip 7: Seek Landlord Flexibility

If your credit score is below the landlord’s requirements, be prepared to provide additional documentation, such as proof of income or a letter of explanation. Some landlords may be willing to work with tenants who have lower credit scores.

Tip 8: Be Patient and Persistent

Improving your credit score takes time. Don’t get discouraged if you don’t see immediate results. By consistently following these tips, you can gradually improve your credit score and increase your chances of renting your desired apartment.

Key Takeaways:

- Understanding the connection between “what credit score is needed to rent an apartment” and credit management is essential for successful apartment hunting.

- By implementing these tips, you can improve your credit score, increase your chances of being approved for an apartment, and potentially secure better rental terms.

- Remember that building a strong credit score is an ongoing process that requires discipline and responsible financial habits.

By following these tips, you can navigate the apartment rental process with confidence, knowing that you have taken the necessary steps to present a strong credit profile to potential landlords.

Conclusion

Understanding the connection between “what credit score is needed to rent an apartment” and responsible credit management is a crucial step in the apartment hunting process. By maintaining a good credit score and addressing any negative information on your credit report, you can increase your chances of securing your desired rental property.

Remember that building a strong credit score is an ongoing process that requires discipline and responsible financial habits. By consistently following these tips, you can gradually improve your credit score and increase your chances of being approved for an apartment, potentially securing better rental terms.

Youtube Video: