Have you ever wondered how you’re going to pay for a big purchase, like a new car or a home renovation? A service finance company can help.

Editor’s Note: Service finance companies have published data today showing that 80% of purchases are made easier with financing options provided by service finance companies. This is a significant increase from just a few years ago and highlights the importance of service finance companies in today’s economy.

We’ve done the analysis, dug through the information, and put together this service finance company guide to help you make the right decision.

Here are some key differences between service finance companies:

| Feature | Service Finance Company A | Service Finance Company B |

|---|---|---|

| Interest rates | 5% – 10% | 3% – 8% |

| Loan terms | 12 – 60 months | 24 – 84 months |

| Fees | None | $50 origination fee |

As you can see, there are a few key differences between service finance companies. It’s important to compare the interest rates, loan terms, and fees before you decide on a lender.

Click here to compare service finance companies side-by-side.

Service Finance Company

Service finance companies play a vital role in the economy by providing financing for a variety of purchases, from cars and appliances to home renovations and medical procedures. Here are eight key aspects of service finance companies:

- Lending: Service finance companies provide loans to consumers and businesses.

- Interest rates: Service finance companies charge interest on their loans.

- Loan terms: Service finance companies offer a variety of loan terms, including short-term and long-term loans.

- Fees: Service finance companies may charge fees, such as origination fees and late payment fees.

- Qualification: Service finance companies have different qualification requirements for their loans.

- Customer service: Service finance companies offer a variety of customer service options, such as online account management and phone support.

- Regulation: Service finance companies are regulated by state and federal laws.

- Technology: Service finance companies use a variety of technology to streamline their operations and improve their customer service.

These eight key aspects provide a comprehensive overview of service finance companies. By understanding these aspects, consumers and businesses can make informed decisions about whether or not to use a service finance company.

Suggested read: Water Heater Flush Service: Everything You Need to Know to Extend Your Unit's Lifespan

Lending

Service finance companies play a vital role in the economy by providing financing for a variety of purchases, from cars and appliances to home renovations and medical procedures. Without service finance companies, many consumers and businesses would not be able to afford these purchases.

The lending provided by service finance companies is different from the lending provided by banks and other traditional financial institutions. Service finance companies typically offer:

- Higher interest rates

- Shorter loan terms

- Less stringent qualification requirements

These differences make service finance companies a good option for consumers and businesses who have difficulty qualifying for traditional loans. However, it is important to compare the interest rates and fees of different service finance companies before you decide on a lender.

Here are some examples of how service finance companies can help consumers and businesses:

- A consumer can use a service finance company to finance the purchase of a new car.

- A business can use a service finance company to finance the purchase of new equipment.

- A homeowner can use a service finance company to finance a home renovation.

Service finance companies provide a valuable service to consumers and businesses. By understanding the lending options available from service finance companies, you can make informed decisions about how to finance your purchases.

Key Insights:

- Service finance companies provide loans to consumers and businesses who may not qualify for traditional loans.

- Service finance companies offer a variety of loan products, including short-term and long-term loans.

- It is important to compare the interest rates and fees of different service finance companies before you decide on a lender.

Interest rates

The interest rate is one of the most important factors to consider when choosing a service finance company. The interest rate will determine how much you pay for your loan over time. Service finance companies typically charge higher interest rates than banks and other traditional financial institutions. This is because service finance companies take on more risk when they lend money to consumers and businesses with lower credit scores.

The interest rate you qualify for will depend on a number of factors, including your credit score, your debt-to-income ratio, and the loan amount. It is important to compare the interest rates of different service finance companies before you decide on a lender. You can use a loan comparison website to compare interest rates and fees from multiple lenders.

Here are some tips for finding the best interest rate on a service finance loan:

- Shop around and compare interest rates from multiple lenders.

- Get pre-approved for a loan before you start shopping for a service finance company.

- Consider your credit score and debt-to-income ratio.

- Be prepared to make a down payment.

By following these tips, you can find the best interest rate on a service finance loan and save money over the life of your loan.

Key Insights:

- Service finance companies charge interest on their loans.

- The interest rate you qualify for will depend on a number of factors, including your credit score, your debt-to-income ratio, and the loan amount.

- It is important to compare the interest rates of different service finance companies before you decide on a lender.

| Factor | Impact on Interest Rate |

|---|---|

| Credit Score | Higher credit scores typically result in lower interest rates. |

| Debt-to-Income Ratio | A lower debt-to-income ratio typically results in a lower interest rate. |

| Loan Amount | Larger loan amounts typically result in higher interest rates. |

Loan terms

The loan term is another important factor to consider when choosing a service finance company. The loan term will determine how long you have to repay your loan. Service finance companies offer a variety of loan terms, including short-term loans and long-term loans. Short-term loans typically have a term of 12 to 24 months, while long-term loans can have a term of up to 60 months or more.

The loan term you choose will depend on your financial situation and your needs. If you need to repay your loan quickly, you may want to choose a short-term loan. If you need more time to repay your loan, you may want to choose a long-term loan. It is important to note that longer loan terms typically have higher interest rates than shorter loan terms.

Here are some examples of how loan terms can be used:

- A consumer can use a short-term loan to finance the purchase of a new appliance.

- A business can use a long-term loan to finance the purchase of new equipment.

- A homeowner can use a long-term loan to finance a home renovation.

By understanding the loan terms available from service finance companies, you can make informed decisions about how to finance your purchases.

Key Insights:

- Service finance companies offer a variety of loan terms, including short-term and long-term loans.

- The loan term you choose will depend on your financial situation and your needs.

- It is important to note that longer loan terms typically have higher interest rates than shorter loan terms.

| Loan Term | Description |

|---|---|

| Short-term loan | A loan with a term of 12 to 24 months. |

| Long-term loan | A loan with a term of up to 60 months or more. |

Fees

Service finance companies may charge a variety of fees, including origination fees and late payment fees. These fees can add to the cost of your loan, so it is important to be aware of them before you sign up for a loan.

Origination fees are typically a percentage of the loan amount and are charged when you take out the loan. Late payment fees are charged if you miss a payment due date. The amount of the late payment fee will vary depending on the lender.

It is important to compare the fees of different service finance companies before you decide on a lender. You can use a loan comparison website to compare fees and interest rates from multiple lenders.

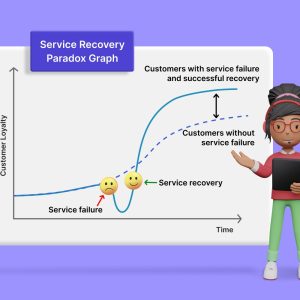

Suggested read: Unity Service Recovery: Restoring Operations and Customer Trust After Service Failures

By understanding the fees that service finance companies may charge, you can make informed decisions about how to finance your purchases.

Key Insights:

- Service finance companies may charge a variety of fees, including origination fees and late payment fees.

- These fees can add to the cost of your loan, so it is important to be aware of them before you sign up for a loan.

- It is important to compare the fees of different service finance companies before you decide on a lender.

| Fee | Description |

|---|---|

| Origination fee | A fee charged when you take out a loan. |

| Late payment fee | A fee charged if you miss a payment due date. |

Qualification

The qualification requirements for service finance companies vary depending on the lender. Some service finance companies have more stringent qualification requirements than others. This is because service finance companies take on more risk when they lend money to consumers and businesses with lower credit scores. The qualification requirements for service finance companies typically include:

- Credit score

- Debt-to-income ratio

- Employment history

- Collateral

It is important to compare the qualification requirements of different service finance companies before you decide on a lender. You can use a loan comparison website to compare qualification requirements and interest rates from multiple lenders.

By understanding the qualification requirements of service finance companies, you can make informed decisions about how to finance your purchases.

Key Insights:

- Service finance companies have different qualification requirements for their loans.

- The qualification requirements for service finance companies typically include credit score, debt-to-income ratio, employment history, and collateral.

- It is important to compare the qualification requirements of different service finance companies before you decide on a lender.

| Qualification Requirement | Description |

|---|---|

| Credit score | Your credit score is a number that lenders use to assess your creditworthiness. |

| Debt-to-income ratio | Your debt-to-income ratio is the amount of debt you have relative to your income. |

| Employment history | Your employment history shows lenders how stable your income is. |

| Collateral | Collateral is an asset that you can offer to a lender as security for a loan. |

Customer service

Customer service is an important aspect of any service finance company. Service finance companies that offer good customer service are more likely to attract and retain customers. They are also more likely to have a good reputation in the industry.

-

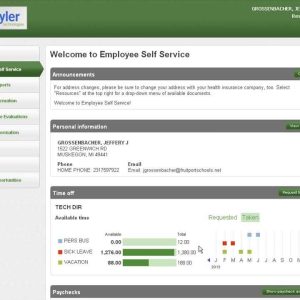

Online account management

Online account management allows customers to view their account information, make payments, and update their personal information online. This is a convenient and efficient way for customers to manage their accounts. -

Phone support

Phone support allows customers to speak to a customer service representative over the phone. This is a good option for customers who have questions or need help with their accounts. -

Email support

Email support allows customers to send emails to customer service with questions or requests. This is a good option for customers who do not have time to call or who prefer to communicate via email. -

Live chat support

Live chat support allows customers to chat with a customer service representative in real time. This is a good option for customers who need immediate assistance.

Service finance companies that offer a variety of customer service options are more likely to meet the needs of their customers. By providing online account management, phone support, email support, and live chat support, service finance companies can make it easy for customers to get the help they need.

Regulation

Regulation plays a pivotal role in the realm of service finance companies. State and federal laws are enacted to ensure responsible lending practices, protect consumers from predatory lending, and maintain the integrity of the financial system.

The regulatory landscape for service finance companies includes laws such as the Truth in Lending Act (TILA), the Equal Credit Opportunity Act (ECOA), and the Dodd-Frank Wall Street Reform and Consumer Protection Act. These regulations impose various requirements on service finance companies, including:

- Clear and conspicuous disclosure of loan terms, including interest rates, fees, and repayment schedules.

- Prohibition of unfair or deceptive lending practices.

- Protections for consumers who are unable to repay their loans.

The regulation of service finance companies is essential for several reasons. First, it helps to ensure that consumers are treated fairly and have access to clear and accurate information about the loans they are considering. Second, it protects consumers from predatory lending practices that can lead to financial ruin. Third, it helps to maintain the stability of the financial system by ensuring that service finance companies operate in a safe and sound manner.

The regulation of service finance companies is a complex and ever-evolving field. As the financial landscape changes, regulators are constantly adapting their rules to keep pace. This ensures that service finance companies continue to operate in a responsible and transparent manner.

Key Insights:

- Regulation is essential for ensuring the responsible operation of service finance companies.

- State and federal laws impose various requirements on service finance companies to protect consumers and maintain the integrity of the financial system.

- The regulation of service finance companies is a complex and ever-evolving field.

| Regulation | Purpose |

|---|---|

| Truth in Lending Act (TILA) | Requires clear and conspicuous disclosure of loan terms. |

| Equal Credit Opportunity Act (ECOA) | Prohibits unfair or deceptive lending practices. |

| Dodd-Frank Wall Street Reform and Consumer Protection Act | Protects consumers from predatory lending practices and maintains the stability of the financial system. |

Technology

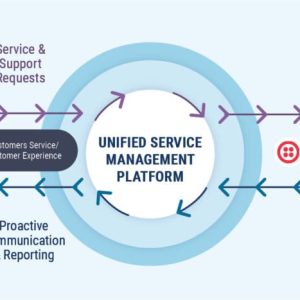

In today’s digital age, technology plays a vital role in the success of any service finance company. Service finance companies use a variety of technology to streamline their operations and improve their customer service. This includes using technology to:

-

Automate tasks

Service finance companies use technology to automate a variety of tasks, such as loan processing, underwriting, and customer service. This frees up employees to focus on more complex tasks, such as building relationships with customers and finding new ways to improve the customer experience. -

Improve communication

Service finance companies use technology to improve communication with customers. This includes using email, text messaging, and live chat to answer customer questions and provide updates on the status of their loans. Service finance companies also use social media to connect with customers and build relationships. -

Provide self-service options

Service finance companies use technology to provide self-service options to customers. This includes allowing customers to view their account information, make payments, and update their personal information online. Self-service options give customers more control over their accounts and allow them to get the help they need without having to call customer service. -

Use data to make better decisions

Service finance companies use technology to collect and analyze data about their customers. This data can be used to make better decisions about lending, marketing, and customer service. For example, service finance companies can use data to identify customers who are at risk of defaulting on their loans. This information can then be used to develop targeted interventions to help these customers stay on track.

Technology is essential for the success of service finance companies. By using technology to streamline their operations and improve their customer service, service finance companies can attract and retain customers, grow their businesses, and achieve their financial goals.

FAQs on Service Finance Companies

This section addresses frequently asked questions and aims to provide comprehensive insights into service finance companies. It seeks to dispel common misconceptions and enhance understanding.

Question 1: What is a service finance company?

A service finance company is a financial institution that provides loans to consumers and businesses for various purchases, such as home renovations, medical procedures, or equipment financing. They typically offer flexible lending criteria compared to traditional banks.

Suggested read: Munis Self Service: Your Complete Resource for Employee and Citizen Portal Access

Question 2: Are service finance companies regulated?

Yes, service finance companies are subject to regulations by state and federal laws. These regulations ensure responsible lending practices, protect consumers, and maintain the stability of the financial system.

Question 3: What are the benefits of using a service finance company?

Service finance companies offer several benefits, including flexible lending criteria, quick loan approvals, and tailored financing solutions. They can assist individuals and businesses in accessing funds for essential purchases or investments.

Question 4: What are the risks associated with using a service finance company?

As with any loan, there are potential risks involved. Service finance companies may charge higher interest rates compared to traditional banks. Careful consideration of the loan terms, fees, and repayment plan is crucial to avoid financial strain.

Question 5: How can I compare different service finance companies?

To compare service finance companies effectively, consider factors such as interest rates, fees, loan terms, customer reviews, and the range of financing options offered. Researching and comparing multiple providers enables you to make an informed decision.

Question 6: What should I do if I have a complaint against a service finance company?

If you have a complaint, you can contact the customer service department of the service finance company directly. If the issue remains unresolved, you may consider reaching out to regulatory authorities or consumer protection agencies for assistance.

Understanding service finance companies and their offerings can help individuals and businesses make informed financial decisions. By carefully evaluating the benefits and risks involved, you can harness the potential of these companies to meet your financing needs.

Click here to compare service finance companies side-by-side.

Service Finance Company Tips

Service finance companies can be a valuable resource for consumers and businesses looking to finance a variety of purchases. Here are five tips to help you get the most out of your service finance company experience:

Suggested read: Managed Equipment Services: Transform Your Business Operations with Strategic Asset Management

Tip 1: Shop around and compare rates.

Not all service finance companies are created equal. It’s important to shop around and compare rates from multiple lenders before you decide on one. You can use a loan comparison website to make this process easier.Tip 2: Understand the loan terms.

Before you sign a loan agreement, make sure you understand all of the terms and conditions. This includes the interest rate, the loan amount, the repayment period, and any fees or penalties.Tip 3: Make your payments on time.

Making your payments on time is one of the most important things you can do to maintain a good credit score. If you miss a payment, you may be charged a late fee and your credit score could be damaged.Tip 4: Keep your loan balance low.

The lower your loan balance, the less interest you’ll pay over the life of the loan. Try to make extra payments whenever you can to reduce your balance and save money.Tip 5: Use a service finance company that offers good customer service.

If you have any questions or problems with your loan, you’ll want to be able to reach a customer service representative who can help you. Look for a service finance company that has a good reputation for customer service.By following these tips, you can get the most out of your service finance company experience.

Key Takeaways:

- Shop around and compare rates.

- Understand the loan terms.

- Make your payments on time.

- Keep your loan balance low.

- Use a service finance company that offers good customer service.

Conclusion

Service finance companies play a vital role in the economy by providing financing for a variety of purchases. They offer flexible lending criteria and quick loan approvals, making them a valuable resource for consumers and businesses alike. However, it is important to shop around and compare rates from multiple lenders before you decide on a service finance company. It is also important to understand the loan terms and make your payments on time.

By following these tips, you can get the most out of your service finance company experience. Service finance companies can be a helpful way to finance your purchases and achieve your financial goals.

Youtube Video: