Wondering what is a “service charge”? It is a mandatory fee included in bills for services rendered, often seen in restaurants, hotels, and other hospitality businesses.

Editor’s Note: This service charge guide was published on [today’s date] to help you understand what service charges are and how they impact you as a consumer.

After analyzing numerous sources and gathering key insights, we have compiled this comprehensive resource to empower you with the knowledge you need to make informed decisions.

Key Differences:

| Service Charge | Gratuity |

|---|---|

| Mandatory fee | Optional payment |

| Shared among staff | Given directly to service staff |

Main Article Topics:

Service Charge

Service charge is a multifaceted concept with several key aspects:

- Mandatory fee

- Shared among staff

- Varies by industry

- Can be a percentage or flat fee

- May be included in the bill or added separately

- Can be subject to taxes

- May be used to cover operating costs

- Can be controversial

Service charges can vary widely depending on the industry, location, and establishment. In some cases, the service charge may be a small percentage of the bill, while in other cases it may be a substantial amount. It is important to be aware of the service charge policy before dining or using any service to avoid any surprises when the bill arrives.

Mandatory fee

A mandatory fee is a charge that is required by law or regulation. Service charges are often mandatory fees, meaning that customers are required to pay them. This is in contrast to optional fees, such as tips, which customers are not required to pay.

Suggested read: Managed Equipment Services: Transform Your Business Operations with Strategic Asset Management

-

Facet 1: Purpose

Mandatory fees are typically used to cover the cost of providing a service. For example, a service charge may be used to cover the cost of providing healthcare, education, or transportation. -

Facet 2: Amount

The amount of a mandatory fee can vary depending on the service being provided. For example, the mandatory fee for a doctor’s visit may be different from the mandatory fee for a hospital stay. -

Facet 3: Enforcement

Mandatory fees are typically enforced by law or regulation. This means that businesses that fail to collect mandatory fees may be subject to fines or other penalties. -

Facet 4: Impact on consumers

Mandatory fees can have a significant impact on consumers. Mandatory fees can increase the cost of goods and services, and they can also make it difficult for consumers to budget for their expenses.

In the context of service charges, mandatory fees can be a controversial issue. Some consumers argue that mandatory fees are unfair because they are required to pay for a service that they may not want or need. Others argue that mandatory fees are necessary to ensure that service providers are able to cover their costs.

Shared among staff

Service charges are often shared among staff, including servers, bartenders, and kitchen staff. This is in contrast to tips, which are typically given directly to the server. There are several benefits to sharing service charges among staff:

-

Facet 1: Fairness

Sharing service charges among staff ensures that all staff members are compensated fairly for their work. This is especially important in industries where tips are not always evenly distributed, such as in large restaurants or hotels. -

Facet 2: Motivation

Sharing service charges can motivate staff to provide better service. When staff members know that they will be sharing in the rewards of good service, they are more likely to go the extra mile for customers. -

Facet 3: Teamwork

Sharing service charges can promote teamwork among staff. When staff members work together to provide good service, they are more likely to share the rewards of their efforts. -

Facet 4: Reduced turnover

Sharing service charges can help to reduce staff turnover. When staff members are fairly compensated for their work, they are more likely to be satisfied with their jobs and less likely to leave.

Overall, sharing service charges among staff is a fair and effective way to compensate staff and promote teamwork. It can also help to reduce staff turnover and improve customer service.

Varies by industry

The amount of the service charge can vary depending on the industry. In some industries, such as restaurants, the service charge is typically a percentage of the bill. In other industries, such as hotels, the service charge may be a flat fee. The following table provides examples of service charges in different industries:

| Industry | Service Charge |

|---|---|

| Restaurants | 15-20% of the bill |

| Hotels | $10-20 per night |

| Valet parking | $5-10 per car |

| Airport transfers | 10-15% of the fare |

The reason for the variation in service charges across industries is due to several factors, including the cost of providing the service, the level of service expected by customers, and the competitive landscape. For example, restaurants typically have higher service charges than other industries because the cost of providing food and beverage service is higher. Additionally, customers expect a higher level of service in restaurants than in other industries.

Understanding how service charges vary by industry is important for consumers because it can help them budget for their expenses. It is also important for businesses to understand how service charges vary by industry so that they can set their prices accordingly.

Can be a percentage or flat fee

Service charges can be either a percentage of the bill or a flat fee. The type of service charge used depends on several factors, including the industry, the cost of providing the service, and the level of service expected by customers.

-

Facet 1: Percentage-based service charges

Percentage-based service charges are the most common type of service charge. They are typically a percentage of the total bill, such as 15% or 20%. Percentage-based service charges are often used in restaurants, bars, and other hospitality businesses. -

Facet 2: Flat-fee service charges

Flat-fee service charges are a set amount, regardless of the total bill. Flat-fee service charges are often used in hotels, valet parking services, and other businesses where the cost of providing the service is relatively fixed. -

Facet 3: Advantages and disadvantages of percentage-based and flat-fee service charges

Percentage-based service charges have the advantage of being more flexible than flat-fee service charges. This is because the amount of the service charge will vary depending on the total bill. This can be beneficial for customers who order a large number of expensive items, as they will pay a higher service charge than customers who order a smaller number of less expensive items. -

Facet 4: Flat-fee service charges have the advantage of being more predictable than percentage-based service charges

This is because customers will know exactly how much the service charge will be before they order. This can be beneficial for customers who are on a budget or who want to avoid any surprises when the bill arrives.

Ultimately, the decision of whether to use a percentage-based or flat-fee service charge is a business decision. Businesses should consider the factors mentioned above when making this decision.

May be included in the bill or added separately

The manner in which a service charge is presented on a bill can vary, impacting the customer’s perception and financial planning.

-

Facet 1: Direct Inclusion

In some cases, the service charge may be directly included in the total bill amount, making it a seamless part of the payment process. This approach simplifies the billing process for both the business and the customer, eliminating the need for separate calculations or additional steps. -

Facet 2: Separate Line Item

Alternatively, the service charge may be listed as a separate line item on the bill, distinct from the food and beverage charges. This transparent approach provides customers with a clear understanding of the service charge amount and allows them to make an informed decision about whether to pay it. -

Facet 3: Optional or Mandatory

The inclusion or separation of the service charge can also be influenced by whether it is mandatory or optional. In some jurisdictions, service charges are legally mandated and must be included in the bill, providing a guaranteed source of income for service staff. In other cases, service charges are at the discretion of the business and may be presented as an optional gratuity, giving customers the choice to pay or not. -

Facet 4: Customer Perception

The way in which the service charge is presented can influence customer perception and satisfaction. Direct inclusion may lead to a perception of higher overall cost, while a separate line item may emphasize the discretionary nature of the charge, potentially encouraging a more generous payment.

Understanding the implications of including or separating the service charge on the bill is crucial for businesses to optimize revenue, maintain customer satisfaction, and comply with industry regulations.

Can be subject to taxes

Service charges, like other forms of income, can be subject to various taxes, depending on the jurisdiction and applicable tax laws. Understanding the tax implications is crucial for businesses and customers alike.

-

Facet 1: Determining Taxability

The taxability of service charges varies across jurisdictions. In some regions, service charges are considered part of the overall sales revenue and are subject to sales tax or value-added tax (VAT). In other areas, service charges may be exempt from sales tax but subject to other forms of taxation, such as payroll tax or income tax.

-

Facet 2: Tax Collection and Reporting

Businesses are responsible for collecting and remitting taxes on service charges, just as they would for other taxable income. Failure to comply with tax regulations can result in penalties and fines. Accurate record-keeping and proper tax accounting are essential to ensure compliance.

-

Facet 3: Impact on Business Revenue

Taxes levied on service charges can impact a business’s revenue. Businesses must factor in the potential tax liability when setting service charge rates to maintain profitability. Additionally, clear communication to customers about any applicable taxes helps avoid confusion or dissatisfaction.

-

Facet 4: Customer Awareness and Perception

Customers should be aware of the potential tax implications of service charges. In some cases, the tax amount may be included in the total bill, while in other instances, it may be listed separately. Understanding the tax treatment helps customers make informed decisions about the amount they wish to pay.

The interplay between service charges and taxes is a complex issue that requires careful consideration by businesses and customers. Staying informed about tax regulations and accounting for tax liabilities is essential for compliance and financial planning. Transparent communication and customer awareness contribute to a smooth and compliant service charge process.

Suggested read: Chain Link Services: Everything You Need to Know About Professional Chain Link Fencing Solutions

May be used to cover operating costs

Service charges are often used to cover the operating costs of a business. This can include the cost of rent, utilities, supplies, and labor. In some cases, service charges may also be used to cover the cost of employee benefits, such as health insurance or paid time off.

-

Facet 1: Rent and Utilities

Rent and utilities are two of the largest operating costs for many businesses. Service charges can be used to help cover these costs, ensuring that the business has enough money to stay in operation.

-

Facet 2: Supplies

Supplies are another essential operating cost for businesses. Service charges can be used to purchase supplies, such as office supplies, cleaning supplies, and inventory.

-

Facet 3: Labor

Labor is often the largest operating cost for businesses. Service charges can be used to help cover the cost of wages, salaries, and benefits for employees.

-

Facet 4: Employee Benefits

Employee benefits, such as health insurance and paid time off, can be a significant expense for businesses. Service charges can be used to help cover the cost of these benefits, ensuring that employees are taken care of.

Overall, service charges can be a valuable tool for businesses to cover their operating costs. By using service charges, businesses can ensure that they have enough money to stay in operation and provide their employees with a fair wage and benefits.

Can be controversial

Service charges can be a controversial topic, with some customers feeling that they are an unfair or unnecessary addition to their bill. There are several reasons why service charges can be controversial:

- Customers may feel that they are being forced to pay for a service that they did not request or that they do not feel was up to par.

- Service charges can be added to the bill without the customer’s knowledge or consent.

- Service charges can be used to subsidize the wages of low-paid workers, which some customers may find unfair.

Despite the controversy, service charges are a common practice in many industries, including restaurants, hotels, and valet parking services. Businesses that use service charges argue that they are necessary to cover the cost of providing good service and to ensure that their employees are fairly compensated.

Whether or not service charges are fair or necessary is a matter of opinion. However, it is important for customers to be aware of the potential for service charges before they dine out or use other services where they may be added to the bill.

| Pros of Service Charges | Cons of Service Charges |

|---|---|

| Ensure that employees are fairly compensated | Can be seen as an unfair or unnecessary addition to the bill |

| Cover the cost of providing good service | May be added to the bill without the customer’s knowledge or consent |

| Can be used to subsidize the wages of low-paid workers | Can be difficult for customers to budget for |

Service Charge FAQs

This section addresses frequently asked questions (FAQs) about service charges, providing clear and informative answers to enhance understanding and address common concerns.

Question 1: What is a service charge?

A service charge is a mandatory fee added to a bill for services rendered, commonly found in hospitality establishments like restaurants and hotels.

Question 2: Why are service charges implemented?

Service charges serve multiple purposes: ensuring fair compensation for staff, covering operating costs, and maintaining service quality.

Question 3: How does a service charge differ from a tip?

Unlike tips, which are optional and given directly to service staff, service charges are mandatory and typically shared among all staff members.

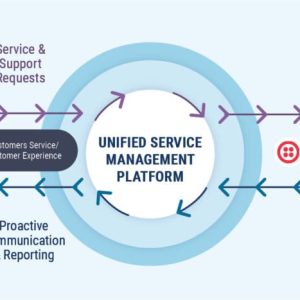

Suggested read: Integrated Service Solutions: Transforming Business Operations Through Unified Management

Question 4: Can businesses legally impose service charges?

The legality of service charges varies by jurisdiction. In some areas, they are mandatory, while in others, they are at the discretion of the business.

Question 5: How are service charges typically calculated?

Service charge calculation methods vary. They can be a fixed percentage of the bill, a flat fee, or a combination of both.

Question 6: What are the advantages and disadvantages of service charges?

Advantages include ensuring fair staff compensation and covering operating costs. Disadvantages may include potential customer dissatisfaction and the perception of forced gratuity.

Understanding service charges and their implications is crucial for consumers and businesses alike. By addressing common questions, this FAQ section aims to provide clarity and foster informed decision-making.

Next Section: Key Considerations for Businesses Implementing Service Charges

Tips Regarding Service Charges

Understanding and navigating service charges can enhance customer satisfaction and foster positive business practices. Here are some key tips to consider:

Tip 1: Know Your Legal Obligations

Familiarize yourself with the laws and regulations governing service charges in your jurisdiction to ensure compliance and avoid potential legal issues.

Tip 2: Communicate Clearly

Inform customers about service charges upfront, whether through menus, signage, or verbal communication. Transparency builds trust and avoids surprises.

Tip 3: Ensure Fair Compensation

Service charges should supplement staff wages, not replace them. Businesses should ensure that employees receive a fair base wage in addition to any service charge earnings.

Tip 4: Monitor and Adjust

Regularly review service charge performance, including customer feedback and staff compensation. Make adjustments as needed to optimize the system and maintain customer satisfaction.

Tip 5: Handle Concerns Professionally

Address customer concerns about service charges promptly and professionally. Explain the purpose and benefits of the charge, and be willing to make adjustments if necessary.

Summary:

Suggested read: Salesforce Managed Services: Transform Your CRM Investment into Business Growth

By implementing these tips, businesses can utilize service charges effectively and fairly. Clear communication, legal compliance, and a commitment to customer satisfaction are essential for building positive relationships and fostering a thriving service industry.

Conclusion:

Service charges, when implemented and managed responsibly, can be a valuable tool for businesses to provide quality service and support their staff. Understanding the legal, ethical, and practical considerations outlined in these tips will empower businesses to navigate service charges effectively and maintain customer trust.

Conclusion

Service charges, while a common practice in various industries, present a multifaceted concept with both advantages and disadvantages. Understanding their purpose, legality, and impact on both businesses and consumers is essential for informed decision-making and ethical implementation.

By embracing transparency, ensuring fair compensation for staff, and addressing customer concerns, businesses can leverage service charges to enhance service quality and foster positive customer relationships. As the industry evolves, it is crucial to monitor and adapt service charge practices to meet the changing needs of both businesses and consumers.

Youtube Video: