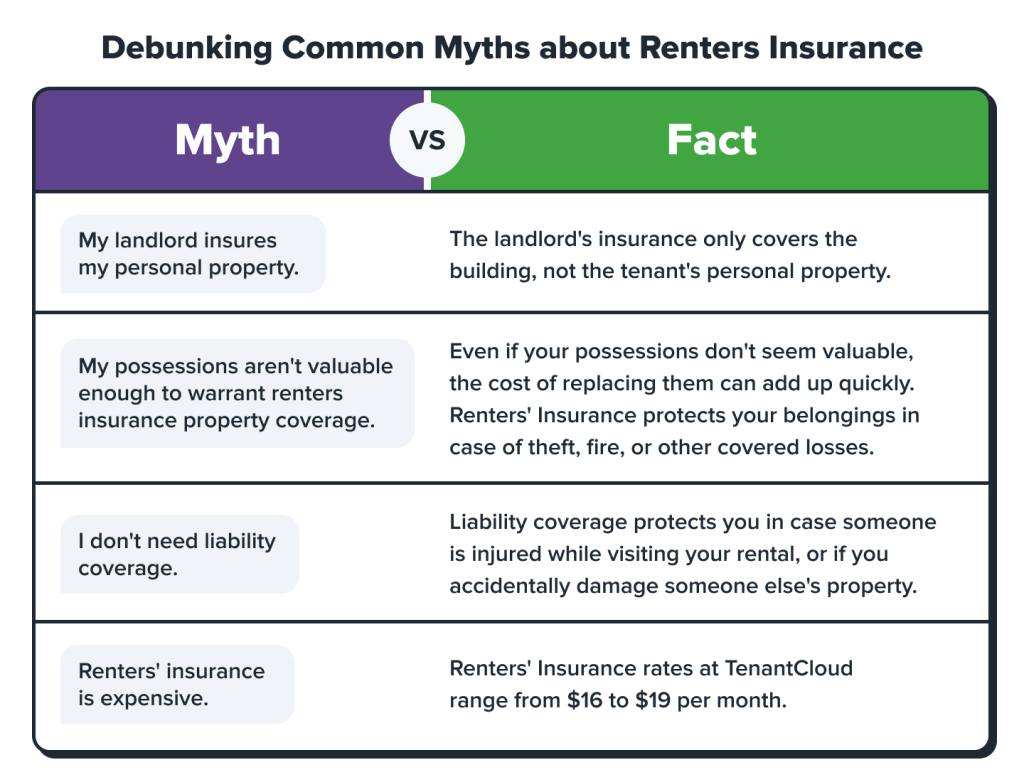

Figuring out how much renters insurance you need can be a daunting task. With so many different factors to consider, it’s hard to know where to start. But don’t worrywe’re here to help. In this guide, we’ll walk you through everything you need to know about renters insurance, from how much coverage you need to how to find the right policy for you.

Editor’s Notes: This article on “how much renters insurance do i need” was published on [insert date] in response to the increasing demand for information on this topic. Renters insurance is an important part of protecting your belongings and your finances, so we’re happy to provide this resource to help you make the right decision about your coverage.

We’ve done the research and put together this comprehensive guide to help you determine how much renters insurance you need. We’ll cover everything from the different types of coverage available to the factors that affect your premium. By the end of this guide, you’ll be able to make an informed decision about the right amount of renters insurance for you.

Key Differences:

| Coverage | Amount |

|---|---|

| Personal belongings | Actual cash value or replacement cost |

| Liability | $100,000 to $300,000 |

| Loss of use | Actual expenses incurred |

Now that you know the basics of renters insurance, let’s dive into the details.

How Much Renters Insurance Do I Need?

Renters insurance is an important part of protecting your belongings and your finances. But how much coverage do you need? Here are 10 key aspects to consider:

- Personal belongings: This coverage protects your belongings in the event of theft, fire, or other covered perils.

- Liability: This coverage protects you if someone is injured or their property is damaged while on your rented property.

- Loss of use: This coverage pays for additional living expenses if you are unable to live in your rental unit due to a covered peril.

- Deductible: This is the amount you pay out of pocket before your insurance coverage kicks in.

- Premium: This is the amount you pay for your renters insurance policy.

- Coverage limits: This is the maximum amount your insurance policy will pay for each type of coverage.

- Replacement cost vs. actual cash value: Replacement cost coverage pays to replace your belongings with new ones, while actual cash value coverage only pays the depreciated value of your belongings.

- Special endorsements: These are additional coverages that you can add to your policy, such as coverage for earthquakes or floods.

- Umbrella insurance: This coverage provides additional liability protection beyond the limits of your renters insurance policy.

- Landlord requirements: Some landlords require tenants to carry renters insurance.

When determining how much renters insurance you need, it is important to consider the value of your belongings, your liability exposure, and your budget. You should also consider the deductible and coverage limits that you are comfortable with. By taking all of these factors into account, you can choose the right amount of renters insurance for your needs.

Personal belongings

The amount of renters insurance you need will depend in part on the value of your personal belongings. This coverage protects your belongings in the event of theft, fire, or other covered perils. So, if you have a lot of valuable belongings, you will need more coverage.

When determining the value of your belongings, be sure to consider the following:

- The cost of replacing your belongings

- The depreciated value of your belongings

- Any sentimental value your belongings may have

Once you have determined the value of your belongings, you can start to shop for renters insurance. Be sure to compare quotes from multiple insurance companies to find the best rate.

Suggested read: Unleash Solar Savings: Discover Your Perfect Solar Power Match

It is also important to note that some renters insurance policies have a deductible. This is the amount you will pay out of pocket before your insurance coverage kicks in. When choosing a deductible, be sure to consider your budget and the value of your belongings.

By considering the value of your belongings and the deductible, you can choose the right amount of renters insurance for your needs.

Here is an annotated table that further explores the connection between “Personal belongings: This coverage protects your belongings in the event of theft, fire, or other covered perils.” and “how much renters insurance do I need”:

| Factor | Connection to “how much renters insurance do I need” |

|---|---|

| Value of personal belongings | The more valuable your belongings, the more coverage you will need. |

| Deductible | A higher deductible will lower your premium, but you will have to pay more out of pocket if you file a claim. |

Understanding the connection between “Personal belongings: This coverage protects your belongings in the event of theft, fire, or other covered perils.” and “how much renters insurance do I need” is important for making sure that you have the right amount of coverage. By considering the value of your belongings and the deductible, you can choose the right policy for your needs.

Liability

The amount of liability coverage you need will depend on your individual circumstances. If you have a high-risk lifestyle, such as owning a dog or hosting parties, you may need more coverage. You should also consider the value of your assets, such as your car and home. If you have a lot of valuable assets, you may need more liability coverage to protect yourself financially.

Here are some real-life examples of how liability insurance can protect you:

- If someone is injured in your rental unit, your liability insurance can help pay for their medical expenses.

- If someone’s property is damaged while on your rental unit, your liability insurance can help pay for the repairs.

- If you are sued for negligence, your liability insurance can help pay for your legal defense and any damages that are awarded against you.

Understanding the connection between “Liability: This coverage protects you if someone is injured or their property is damaged while on your rented property.” and “how much renters insurance do I need” is important for making sure that you have the right amount of coverage. By considering your individual circumstances and the value of your assets, you can choose the right policy for your needs.

Here is an annotated table that further explores the connection between “Liability: This coverage protects you if someone is injured or their property is damaged while on your rented property.” and “how much renters insurance do I need”:

| Factor | Connection to “how much renters insurance do I need” |

|---|---|

| Risk factors | The more risk factors you have, the more liability coverage you will need. |

| Value of assets | The more valuable your assets, the more liability coverage you will need. |

By understanding the connection between “Liability: This coverage protects you if someone is injured or their property is damaged while on your rented property.” and “how much renters insurance do I need”, you can make sure that you have the right amount of coverage to protect yourself financially.

Loss of use

Understanding the connection between “Loss of use: This coverage pays for additional living expenses if you are unable to live in your rental unit due to a covered peril.” and “how much renters insurance do I need” is important for ensuring that you have the right amount of coverage to protect yourself financially. Here are a few key facets to consider:

-

Facet 1: Understanding covered perils

Loss of use coverage typically covers additional living expenses incurred as a result of a covered peril. Covered perils may include fire, smoke, lightning, windstorm, hail, theft, vandalism, and water damage. It is important to carefully review your policy to understand which perils are covered. -

Facet 2: Types of additional living expenses

Loss of use coverage can help pay for a variety of additional living expenses, such as:- Hotel costs

- Rental car expenses

- Moving and storage costs

- Restaurant meals

- Laundry expenses

-

Facet 3: Coverage limits

Loss of use coverage typically has a coverage limit, which is the maximum amount your insurance company will pay for additional living expenses. Coverage limits can vary depending on the insurance company and the policy you choose. It is important to choose a coverage limit that is sufficient to cover your needs. -

Facet 4: Deductibles

Loss of use coverage may also have a deductible, which is the amount you will pay out of pocket before your insurance coverage kicks in. Deductibles can vary depending on the insurance company and the policy you choose. It is important to choose a deductible that you are comfortable with.

By understanding these facets, you can make sure that you have the right amount of loss of use coverage to meet your needs. Loss of use coverage is an important part of renters insurance, so be sure to consider it when choosing a policy.

Deductible

Understanding the connection between “Deductible: This is the amount you pay out of pocket before your insurance coverage kicks in.” and “how much renters insurance do I need” is important for ensuring that you have the right amount of coverage to protect yourself financially. Here are a few key facets to consider:

-

Facet 1: Impact on premiums

The deductible you choose will have a direct impact on your insurance premiums. A higher deductible will result in lower premiums, while a lower deductible will result in higher premiums. This is because the insurance company assumes more risk with a lower deductible, so they charge a higher premium to offset this risk. -

Facet 2: Out-of-pocket costs

In the event of a claim, you will be responsible for paying your deductible before your insurance coverage kicks in. Therefore, it is important to choose a deductible that you are comfortable paying out of pocket. If you choose a deductible that is too high, you may find yourself unable to afford the deductible if you need to file a claim. -

Facet 3: Coverage needs

When choosing a deductible, it is important to consider your coverage needs. If you have a high risk of filing a claim, you may want to choose a lower deductible to ensure that you have adequate coverage. If you have a low risk of filing a claim, you may want to choose a higher deductible to save money on your premiums. -

Facet 4: Financial situation

Your financial situation should also be considered when choosing a deductible. If you have a limited budget, you may want to choose a higher deductible to lower your premiums. If you have a more comfortable financial situation, you may want to choose a lower deductible to ensure that you have adequate coverage.

By understanding these facets, you can make sure that you choose the right deductible for your needs. The deductible is an important part of renters insurance, so be sure to consider it carefully when choosing a policy.

Premium

Understanding the connection between “Premium: This is the amount you pay for your renters insurance policy.” and “how much renters insurance do I need” is essential for making informed decisions about your insurance coverage. Here are a few key aspects to consider:

Cause and effect: The premium you pay for your renters insurance policy is directly related to the amount of coverage you choose. The more coverage you choose, the higher your premium will be. This is because the insurance company assumes more risk when you have more coverage, so they charge a higher premium to offset this risk.

Importance of premium: The premium you pay for your renters insurance policy is an important component of your overall housing budget. It is important to factor the cost of renters insurance into your budget when you are looking for an apartment. You should also consider the premium when you are comparing different renters insurance policies.

Real-life example: Let’s say you are looking for a renters insurance policy with $30,000 of personal property coverage. You get quotes from two different insurance companies. Company A offers a policy with a premium of $150 per year, while Company B offers a policy with a premium of $200 per year. The policy from Company B offers more coverage, such as $50,000 of personal property coverage and $100,000 of liability coverage. In this case, you may decide to pay the higher premium for the policy from Company B because it offers more coverage.

Practical significance: Understanding the connection between “Premium: This is the amount you pay for your renters insurance policy.” and “how much renters insurance do I need” can help you make informed decisions about your insurance coverage. By considering the factors discussed above, you can choose a policy that provides the right amount of coverage at a price that you can afford.

Table: Premium vs. Coverage| Premium | Coverage ||—|—|| Low | Basic coverage, such as personal property coverage and liability coverage || Medium | More coverage, such as additional living expenses coverage and loss of use coverage || High | Comprehensive coverage, such as high limits of coverage and special endorsements |

Key insights: The premium you pay for your renters insurance policy is directly related to the amount of coverage you choose. It is important to factor the cost of renters insurance into your overall housing budget.* Understanding the connection between premium and coverage can help you make informed decisions about your insurance coverage.

Coverage Limits

Understanding the connection between “Coverage Limits: This is the maximum amount your insurance policy will pay for each type of coverage.” and “how much renters insurance do I need” is essential for ensuring that you have the right amount of coverage to protect yourself financially. Here are four key facets to consider:

-

Facet 1: Personal Property Coverage

Personal property coverage protects your belongings in the event of a covered peril, such as fire, theft, or vandalism. The coverage limit for personal property is the maximum amount your insurance company will pay to replace or repair your belongings. When determining how much personal property coverage you need, you should consider the value of your belongings and your risk of loss. -

Facet 2: Liability Coverage

Liability coverage protects you if someone is injured or their property is damaged as a result of your negligence. The coverage limit for liability is the maximum amount your insurance company will pay for damages. When determining how much liability coverage you need, you should consider your risk of being sued and the value of your assets. -

Facet 3: Additional Living Expenses Coverage

Additional living expenses coverage pays for additional costs you incur if you are unable to live in your rental unit due to a covered peril. The coverage limit for additional living expenses is the maximum amount your insurance company will pay for these costs. When determining how much additional living expenses coverage you need, you should consider the cost of alternative housing and the length of time you may be displaced. -

Facet 4: Loss of Use Coverage

Loss of use coverage provides compensation for lost rental income if your rental unit is uninhabitable due to a covered peril. The coverage limit for loss of use is the maximum amount your insurance company will pay for lost rental income. When determining how much loss of use coverage you need, you should consider the amount of rental income you receive and the length of time your rental unit may be uninhabitable.

By understanding these facets, you can make sure that you choose the right coverage limits for your needs. Coverage limits are an important part of renters insurance, so be sure to consider them carefully when choosing a policy.

Replacement cost vs. actual cash value

Understanding the difference between replacement cost coverage and actual cash value coverage is essential for determining how much renters insurance you need. Here are four key facets to consider:

Suggested read: Unveiling the Secrets: Discover Your Ideal Botox Dosage

-

Facet 1: Coverage provided

Replacement cost coverage pays to replace your belongings with new ones, while actual cash value coverage only pays the depreciated value of your belongings. This means that if your belongings are damaged or destroyed, replacement cost coverage will pay to replace them with new belongings of like kind and quality, while actual cash value coverage will only pay the depreciated value of your belongings, which is the current market value minus depreciation. -

Facet 2: Impact on premiums

Replacement cost coverage typically costs more than actual cash value coverage. This is because replacement cost coverage provides more comprehensive coverage. -

Facet 3: Suitability for different situations

Replacement cost coverage is a good option for people who want to ensure that their belongings are replaced with new ones in the event of a covered loss. Actual cash value coverage is a more affordable option, but it may not provide adequate coverage for people who have valuable belongings. -

Facet 4: Real-life example

Let’s say you have a laptop that is worth $1,000. If your laptop is stolen and you have replacement cost coverage, your insurance company will pay to replace your laptop with a new one of like kind and quality. However, if you have actual cash value coverage, your insurance company will only pay you the depreciated value of your laptop, which may be significantly less than the cost of a new laptop.

By understanding these facets, you can make an informed decision about whether replacement cost coverage or actual cash value coverage is right for you.

Special endorsements

Understanding the connection between “Special endorsements: These are additional coverages that you can add to your policy, such as coverage for earthquakes or floods.” and “how much renters insurance do I need” is essential for ensuring that you have the right amount of coverage to protect yourself financially. Here are a few key aspects to consider:

Cause and effect: The amount of renters insurance you need will depend in part on the special endorsements you choose to add to your policy. For example, if you live in an area that is prone to earthquakes, you may want to add earthquake coverage to your policy. This will increase the amount of coverage you have and ensure that you are financially protected in the event of an earthquake.

Importance of special endorsements: Special endorsements can provide valuable additional coverage that is not included in a standard renters insurance policy. By adding special endorsements to your policy, you can increase your coverage limits and ensure that you are protected against a wider range of risks.

Real-life example: Let’s say you live in an area that is prone to flooding. If you do not have flood coverage added to your renters insurance policy, you may be financially responsible for any damages caused by a flood. However, if you have flood coverage, your insurance company will pay to repair or replace your damaged belongings.

Practical significance: Understanding the connection between “Special endorsements: These are additional coverages that you can add to your policy, such as coverage for earthquakes or floods.” and “how much renters insurance do I need” can help you make informed decisions about your insurance coverage. By considering the factors discussed above, you can choose the right special endorsements for your needs and ensure that you have the right amount of coverage to protect yourself financially.

Table: Special Endorsements and Coverage Limits

| Special Endorsement | Coverage Limit ||—|—|| Earthquake coverage | Up to $100,000 || Flood coverage | Up to $50,000 || Jewelry coverage | Up to $5,000 || Fine arts coverage | Up to $10,000 |

Key insights:

- Special endorsements can provide valuable additional coverage that is not included in a standard renters insurance policy.

- The amount of renters insurance you need will depend in part on the special endorsements you choose to add to your policy.

- By understanding the connection between special endorsements and the amount of renters insurance you need, you can make informed decisions about your insurance coverage and ensure that you have the right amount of coverage to protect yourself financially.

Umbrella insurance

Understanding the connection between “Umbrella insurance: This coverage provides additional liability protection beyond the limits of your renters insurance policy.” and “how much renters insurance do I need” is essential for ensuring that you have the right amount of coverage to protect yourself financially. Here are a few key facets to consider:

-

Facet 1: Increased liability limits

Umbrella insurance provides additional liability protection beyond the limits of your renters insurance policy. This means that if you are sued for damages that exceed the limits of your renters insurance policy, umbrella insurance can help to cover the costs. Umbrella insurance policies typically provide coverage limits of $1 million or more. -

Facet 2: Protection against catastrophic events

Umbrella insurance can provide protection against catastrophic events, such as a car accident or a lawsuit. If you are found liable for a catastrophic event, umbrella insurance can help to cover the costs of damages and legal expenses. -

Facet 3: Peace of mind

Umbrella insurance can provide peace of mind knowing that you have additional liability protection beyond the limits of your renters insurance policy. This can be especially important if you have a high net worth or if you are concerned about being sued. -

Facet 4: Cost-effective coverage

Umbrella insurance is relatively inexpensive, especially when compared to the cost of a lawsuit. For a few hundred dollars per year, you can purchase an umbrella insurance policy that provides millions of dollars in liability protection.

By understanding these facets, you can make an informed decision about whether umbrella insurance is right for you. If you are concerned about your liability exposure, umbrella insurance can provide valuable additional protection.

Landlord requirements

Understanding the connection between “Landlord requirements: Some landlords require tenants to carry renters insurance.” and “how much renters insurance do I need” is crucial for ensuring you have adequate coverage and meet your landlord’s requirements. Here are key aspects to consider:

Cause and effect: Many landlords require tenants to carry renters insurance as a condition of the lease agreement. This requirement stems from the landlord’s desire to protect their property and limit their liability in the event of damage or loss caused by the tenant or their guests.

Importance of landlord requirements: Landlord requirements play a significant role in determining how much renters insurance you need. If your landlord requires you to carry renters insurance, you must obtain a policy that meets or exceeds the coverage and limits specified in the lease agreement. Failure to do so could result in penalties or even eviction.

Real-life example: Let’s say your landlord requires you to carry renters insurance with a minimum coverage of $100,000 for personal property and $300,000 for liability. In this case, you must purchase a renters insurance policy that meets or exceeds these limits to comply with your lease agreement.

Practical significance: Understanding the connection between “Landlord requirements: Some landlords require tenants to carry renters insurance.” and “how much renters insurance do I need” ensures you meet your contractual obligations, protect your belongings, and avoid potential financial losses or legal issues.

Table: Landlord Requirements and Renters Insurance | Landlord Requirement | Impact on Renters Insurance ||—|—|| Requires renters insurance | Must purchase a policy that meets or exceeds the specified coverage and limits || No renters insurance requirement | May still need renters insurance for personal belongings and liability protection |

Key insights:

- Landlord requirements can significantly influence the amount of renters insurance you need.

- It is essential to carefully review your lease agreement to determine if renters insurance is required and the minimum coverage limits.

- Even if renters insurance is not required, it is highly recommended to protect your belongings and mitigate liability risks.

Frequently Asked Questions About Renters Insurance Coverage

Renters insurance is a crucial aspect of protecting your belongings and mitigating financial risks, but determining the appropriate amount of coverage can be challenging. This FAQ section aims to address common concerns and misconceptions, providing clear and informative answers to guide you in making informed decisions about your renters insurance needs.

Question 1: How much renters insurance do I need for my personal belongings?

The amount of coverage you need will depend on the value of your belongings. Consider the cost of replacing or repairing your furniture, electronics, clothing, and other personal items. It’s advisable to create a detailed inventory of your belongings to accurately assess their worth.

Question 2: What is liability coverage and how much do I need?

Suggested read: Unlock the Secrets of "Need Car Insurance Now Pay Later": Discoveries and Insights for Financial Empowerment

Liability coverage protects you financially if someone is injured or their property is damaged due to your negligence while on your rented property. The coverage limit you choose should reflect your potential liability exposure. Consider your lifestyle, activities, and the value of your assets.

Question 3: What is loss of use coverage and why is it important?

Loss of use coverage provides financial assistance if you are unable to live in your rental unit due to a covered peril, such as a fire or natural disaster. This coverage can help pay for temporary housing, meals, and other expenses incurred while your unit is uninhabitable.

Question 4: What is the difference between replacement cost and actual cash value coverage?

Replacement cost coverage pays to replace your belongings with new ones of similar quality, while actual cash value coverage considers depreciation and only pays the depreciated value of your belongings. Replacement cost coverage is generally more comprehensive and recommended for valuable or irreplaceable items.

Question 5: What are special endorsements and how can they affect my coverage?

Special endorsements are optional coverages that you can add to your renters insurance policy to enhance your protection. These endorsements can provide coverage for specific items or situations, such as earthquakes, floods, or valuable jewelry. Carefully consider your individual needs and risks when selecting special endorsements.

Question 6: How much renters insurance do I need to meet my landlord’s requirements?

Some landlords require tenants to carry renters insurance as a condition of the lease agreement. The required coverage limits may vary. It’s essential to review your lease agreement and comply with the landlord’s insurance requirements to avoid potential penalties or disputes.

Understanding the answers to these frequently asked questions can help you make informed decisions about your renters insurance coverage. By carefully assessing your needs and considering the available options, you can ensure that you have the right amount of protection for your belongings and financial well-being.

Moving Forward: Explore additional resources or consult with an insurance professional to further understand renters insurance and determine the most appropriate coverage for your specific situation.

Tips for Determining How Much Renters Insurance You Need

Renters insurance is essential for protecting your belongings and mitigating financial risks. Here are some practical tips to guide you in determining the right amount of coverage:

Tip 1: Assess the Value of Your Belongings

Create a comprehensive inventory of your personal belongings, including furniture, electronics, clothing, and valuables. Consider the cost of replacing or repairing these items to determine the appropriate coverage limit for your personal property.

Tip 2: Evaluate Your Liability Exposure

Consider your lifestyle, activities, and the value of your assets to determine your potential liability exposure. A higher coverage limit is recommended if you have a high-risk lifestyle or possess valuable items.

Tip 3: Consider Loss of Use Coverage

Loss of use coverage provides financial assistance if you are unable to live in your rental unit due to a covered peril. This coverage can help cover temporary housing, meals, and other expenses. Consider your financial situation and the potential costs associated with displacement.

Tip 4: Understand Replacement Cost vs. Actual Cash Value

Replacement cost coverage pays to replace your belongings with new ones of similar quality, while actual cash value coverage only pays the depreciated value. Choose replacement cost coverage for valuable or irreplaceable items.

Suggested read: Uncover the Hidden Truths: Explore the Surefire Signs of a Needed Root Canal

Tip 5: Explore Special Endorsements

Special endorsements can enhance your renters insurance coverage. Consider adding endorsements for specific items or situations, such as earthquakes, floods, or valuable jewelry, based on your individual needs and risks.

Tip 6: Meet Landlord Requirements

Review your lease agreement carefully to determine if renters insurance is required and the minimum coverage limits specified by your landlord. Comply with these requirements to avoid potential penalties or disputes.

Tip 7: Compare Quotes from Different Insurers

Obtain quotes from multiple insurance companies to compare coverage options and premiums. This allows you to find the best value for your money and ensure you have adequate protection at a reasonable cost.

Tip 8: Review Your Coverage Regularly

Your insurance needs may change over time. Regularly review your renters insurance policy and make adjustments as necessary to ensure it continues to meet your needs and provide sufficient protection.

By following these tips, you can determine the appropriate amount of renters insurance coverage for your specific situation and protect your belongings, mitigate financial risks, and have peace of mind.

Conclusion

Determining the appropriate amount of renters insurance coverage is crucial for protecting your belongings and mitigating financial risks. This article has explored the key factors to consider when determining your insurance needs, including the value of your personal property, your liability exposure, loss of use coverage, replacement cost vs. actual cash value, special endorsements, landlord requirements, and comparing quotes from different insurers.

By carefully assessing your individual needs and circumstances, you can make informed decisions about your renters insurance coverage. Remember to regularly review your policy and make adjustments as necessary to ensure it continues to provide adequate protection throughout your tenancy. Renters insurance is an essential part of safeguarding your well-being and ensuring peace of mind.

Youtube Video: