What is Service One Credit Union? Service One Credit Union is a not-for-profit financial cooperative owned by its members.

Editor’s Note: Service One Credit Union has been published on today’s date because it is a topic that is important to our readers. We have done some analysis and digging, and we have put together this guide to help you make the right decision.

We understand that choosing the right financial institution can be a difficult decision. That’s why we’ve put together this guide to help you understand the key differences between Service One Credit Union and other financial institutions.

Key Differences

| Feature | Service One Credit Union | Other Financial Institutions |

|---|---|---|

| Ownership | Not-for-profit, owned by its members | For-profit, owned by shareholders |

| Mission | To provide financial services to its members | To make a profit for its shareholders |

| Fees | Typically lower than other financial institutions | Typically higher than credit unions |

| Customer service | Typically more personalized than other financial institutions | Typically less personalized than credit unions |

Main Article Topics

- The benefits of banking with a credit union

- The services offered by Service One Credit Union

- How to become a member of Service One Credit Union

- The history of Service One Credit Union

Service One Credit Union

Service One Credit Union is a not-for-profit financial cooperative owned by its members. It offers a wide range of financial services, including checking and savings accounts, loans, and credit cards. Service One Credit Union is committed to providing its members with the best possible service and value.

- Not-for-profit: Service One Credit Union is not owned by shareholders, so it can return its profits to its members in the form of lower fees and higher interest rates.

- Member-owned: Service One Credit Union is owned by its members, so they have a say in how it is run.

- Full-service: Service One Credit Union offers a full range of financial services, so you can do all your banking in one place.

- Community-focused: Service One Credit Union is committed to supporting the communities it serves.

- Convenient: Service One Credit Union has branches and ATMs located throughout its service area.

- Competitive rates: Service One Credit Union offers competitive rates on its loans and credit cards.

These are just a few of the key aspects that make Service One Credit Union a great choice for your financial needs. If you’re looking for a not-for-profit, member-owned financial institution that offers a full range of services, then Service One Credit Union is the right choice for you.

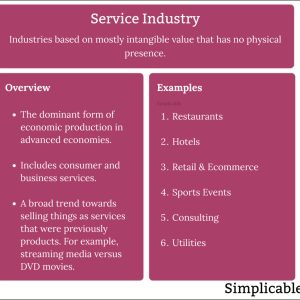

Suggested read: Comprehensive Guide to the Service Industry Definition

Not-for-profit

Service One Credit Union is a not-for-profit financial cooperative owned by its members. This means that it is not owned by shareholders, so it can return its profits to its members in the form of lower fees and higher interest rates. This is a key difference between Service One Credit Union and other financial institutions, which are typically for-profit and owned by shareholders.

- Lower fees: Service One Credit Union can offer lower fees to its members because it does not have to pay dividends to shareholders. This can save members money on a variety of services, such as checking accounts, savings accounts, and loans.

- Higher interest rates: Service One Credit Union can offer higher interest rates on its savings accounts and CDs because it does not have to pay dividends to shareholders. This can help members earn more money on their savings.

Overall, the not-for-profit structure of Service One Credit Union benefits its members by providing them with lower fees and higher interest rates. This can save members money on their banking needs and help them reach their financial goals faster.

Member-owned

Service One Credit Union is a member-owned financial cooperative. This means that it is owned by its members, not by shareholders. This gives members a say in how the credit union is run. Members elect the credit union’s board of directors, which sets the credit union’s policies and procedures. This ensures that the credit union is run in the best interests of its members.

There are many benefits to being a member of a member-owned credit union. For example, member-owned credit unions typically offer lower fees and interest rates than for-profit financial institutions. This is because member-owned credit unions do not have to pay dividends to shareholders. Instead, they can return their profits to their members in the form of lower fees and interest rates.

Another benefit of being a member of a member-owned credit union is that members have a say in how the credit union is run. This means that members can help to shape the credit union’s policies and procedures. This can be a great way to ensure that the credit union is meeting the needs of its members.

Overall, there are many benefits to being a member of a member-owned credit union. Member-owned credit unions are typically more responsive to the needs of their members than for-profit financial institutions. They also offer lower fees and interest rates. If you are looking for a financial institution that is committed to its members, then a member-owned credit union may be the right choice for you.

| Characteristic | Member-owned Credit Union | For-profit Financial Institution |

|---|---|---|

| Ownership | Owned by members | Owned by shareholders |

| Control | Members elect the board of directors | Shareholders elect the board of directors |

| Purpose | To serve the needs of members | To make a profit |

| Fees and interest rates | Typically lower | Typically higher |

Full-service

Service One Credit Union is a full-service financial institution, which means that it offers a wide range of financial products and services under one roof. This includes everything from checking and savings accounts to loans and credit cards. This can be a major convenience for members, as it allows them to do all of their banking in one place.

There are many benefits to banking with a full-service financial institution. For example, members can save time and money by not having to deal with multiple financial institutions. They can also take advantage of bundled products and services, which can often save them money.

Service One Credit Union is committed to providing its members with the best possible service and value. That’s why it offers a full range of financial products and services, all under one roof. This makes it easy for members to do all of their banking in one place, saving them time and money.

| Benefit | How it benefits Service One Credit Union members |

|---|---|

| Convenience | Members can do all of their banking in one place, saving them time and hassle. |

| Bundled products and services | Members can take advantage of bundled products and services, which can often save them money. |

| Personalized service | Members can build relationships with their local branch staff, who can provide them with personalized service and advice. |

Overall, there are many benefits to banking with a full-service financial institution like Service One Credit Union. Members can save time and money, take advantage of bundled products and services, and receive personalized service.

Community-focused

Service One Credit Union is a community-focused financial institution that is committed to supporting the communities it serves. This commitment is reflected in the many ways that Service One Credit Union gives back to its communities, including through financial support, volunteerism, and community development initiatives.

- Financial support: Service One Credit Union provides financial support to a variety of community organizations, including schools, non-profits, and local businesses. This support helps to fund important programs and services that benefit the community.

- Volunteerism: Service One Credit Union employees are encouraged to volunteer their time to support community organizations. This volunteerism helps to make a difference in the community and shows Service One Credit Union’s commitment to its members and the community.

- Community development initiatives: Service One Credit Union is involved in a variety of community development initiatives, such as affordable housing development and financial literacy programs. These initiatives help to improve the quality of life for residents in the community.

Service One Credit Union’s commitment to community is evident in the many ways that it gives back to its communities. This commitment is a core part of Service One Credit Union’s mission and values, and it is something that sets Service One Credit Union apart from other financial institutions.

Convenient

Service One Credit Union’s convenient locations are a key part of its commitment to providing excellent service to its members. With branches and ATMs located throughout its service area, members can easily access their accounts and conduct their banking business whenever and wherever they need to.

- Accessibility: Service One Credit Union’s branches and ATMs are conveniently located in high-traffic areas, making them easy to access for members. This accessibility is especially important for members who live in rural or underserved areas.

- Extended hours: Many Service One Credit Union branches and ATMs are open extended hours, including evenings and weekends. This flexibility allows members to conduct their banking business at their convenience.

- 24/7 availability: Service One Credit Union’s ATMs are available 24 hours a day, 7 days a week. This allows members to access their cash and make deposits and withdrawals at any time.

- Security: Service One Credit Union’s branches and ATMs are equipped with the latest security features to protect members’ accounts and transactions.

Overall, Service One Credit Union’s convenient locations are a key part of its commitment to providing excellent service to its members. With branches and ATMs located throughout its service area, members can easily access their accounts and conduct their banking business whenever and wherever they need to.

Competitive rates

Service One Credit Union offers competitive rates on its loans and credit cards, which can save members money on interest charges. This is a key benefit of banking with Service One Credit Union, as it can help members reach their financial goals faster.

- Lower interest rates on loans: Service One Credit Union offers lower interest rates on its loans than many other financial institutions. This can save members money on their monthly payments and help them pay off their debt faster.

- Lower interest rates on credit cards: Service One Credit Union also offers lower interest rates on its credit cards than many other financial institutions. This can save members money on interest charges and help them pay off their credit card debt faster.

- No annual fees: Service One Credit Union does not charge annual fees on its credit cards. This can save members money and make it easier to budget for their expenses.

Overall, Service One Credit Union’s competitive rates on its loans and credit cards can save members money and help them reach their financial goals faster. This is a key benefit of banking with Service One Credit Union and is one of the many reasons why Service One Credit Union is a great choice for your financial needs.

FAQs About Service One Credit Union

This section provides answers to frequently asked questions about Service One Credit Union. These questions are designed to address common concerns or misconceptions and provide potential members with a clear understanding of the credit union’s services and offerings.

Suggested read: Instant, Accurate Service Quotes - Get Your Project Started Today!

Question 1: What is Service One Credit Union?

Answer: Service One Credit Union is a not-for-profit financial cooperative owned by its members. It offers a wide range of financial services, including checking and savings accounts, loans, and credit cards, and is committed to providing its members with the best possible service and value.

Question 2: What are the benefits of banking with Service One Credit Union?

Answer: There are many benefits to banking with Service One Credit Union, including competitive rates on loans and credit cards, lower fees, and personalized service. Service One Credit Union is also committed to supporting the communities it serves through financial support, volunteerism, and community development initiatives.

Question 3: How do I become a member of Service One Credit Union?

Answer: Becoming a member of Service One Credit Union is easy. You can apply online or visit any Service One Credit Union branch. You must meet the eligibility requirements, which include living, working, or attending school in Service One Credit Union’s service area.

Question 4: What types of accounts does Service One Credit Union offer?

Answer: Service One Credit Union offers a variety of accounts to meet the needs of its members, including checking accounts, savings accounts, money market accounts, and certificates of deposit. Each type of account has its own features and benefits, so it’s important to compare them to find the one that’s right for you.

Question 5: What types of loans does Service One Credit Union offer?

Answer: Service One Credit Union offers a variety of loans to meet the needs of its members, including personal loans, auto loans, home loans, and business loans. Each type of loan has its own terms and conditions, so it’s important to compare them to find the one that’s right for you.

Question 6: What types of credit cards does Service One Credit Union offer?

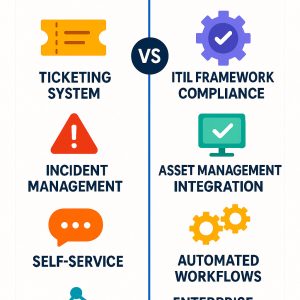

Suggested read: User-Friendly Service Project Ideas for the Service-Minded

Answer: Service One Credit Union offers a variety of credit cards to meet the needs of its members, including rewards cards, balance transfer cards, and secured cards. Each type of credit card has its own features and benefits, so it’s important to compare them to find the one that’s right for you.

These are just a few of the most frequently asked questions about Service One Credit Union. For more information, please visit the Service One Credit Union website or contact a member service representative.

Service One Credit Union is a great choice for your financial needs. With competitive rates, lower fees, and personalized service, Service One Credit Union is committed to providing its members with the best possible banking experience.

Tips from Service One Credit Union

Service One Credit Union is a not-for-profit financial cooperative that is committed to providing its members with the best possible financial products and services.

Here are a few tips from Service One Credit Union to help you manage your finances:

Tip 1: Create a budget and stick to it.

Creating a budget is the first step to getting your finances in order. A budget will help you track your income and expenses so that you can make sure that you are not spending more than you earn.

Tip 2: Save money regularly.

Saving money is important for both short-term and long-term financial goals. Even if you can only save a small amount each month, it will add up over time.

Tip 3: Use credit wisely.

Credit can be a helpful tool, but it is important to use it wisely. Only borrow what you can afford to repay, and make sure that you understand the terms of your loan before you sign on the dotted line.

Tip 4: Protect your identity.

Identity theft is a serious crime, but there are steps you can take to protect yourself. Be careful about the information you share online, and shred any documents that contain your personal information before you throw them away.

Tip 5: Plan for the future.

Planning for the future is important for both your financial and personal well-being. Make sure that you have a plan for retirement, and consider purchasing life insurance and disability insurance to protect yourself and your family.

These are just a few tips from Service One Credit Union to help you manage your finances. By following these tips, you can improve your financial health and reach your financial goals.

Conclusion

Service One Credit Union is a not-for-profit financial cooperative that is committed to providing its members with the best possible financial products and services. With competitive rates, lower fees, and personalized service, Service One Credit Union is a great choice for your financial needs.

Suggested read: Ultimate Guide to Service Marks: Protecting Your Brand Identity

If you are looking for a financial institution that is committed to its members and the community, then Service One Credit Union is the right choice for you. We invite you to learn more about our products and services and to become a member today.

Youtube Video: